Binance’s Navigating the Inscription Panorama report discusses three protocols that may additional develop Bitcoin’s (BTC) footprints into non-fungible token (NFT), decentralized finance (DeFi), and tooling sectors.

In 2023, the Bitcoin ecosystem noticed transformative progress through the rise of inscriptions and BRC-20 tokens, which redefined the community’s capabilities. These developments fueled a market resurgence and ignited a speculative frenzy harking back to meme cash, considerably impacting transaction actions and charges on the Bitcoin community.

3 Protocols Can Rework the Bitcoin Community

Bitcoin inscriptions, although nonetheless rising, have expanded into varied sectors, together with DeFi, NFTs and tooling. In keeping with Binance, that is evident in a number of modern initiatives which have come to the fore.

bitSmiley, for example, represents a pivotal growth in Bitcoin’s DeFi infrastructure, combining stablecoin, lending, and derivatives right into a cohesive protocol. The launch of bitUSD, a BTC-backed stablecoin, underlines a major stride in direction of integrating standard monetary devices throughout the Bitcoin ecosystem.

Alternatively, Liquidium is a brand new peer-to-peer lending protocol. It permits loans utilizing Bitcoin belongings like inscriptions and BRC-20s as collateral. This reveals the rising demand for the Bitcoin community in DeFi. It additionally highlights the financial potential of inscriptions.

“Very similar to the operational mannequin of different peer-to-peer lending platforms, Liquidium permits debtors to collateralize their ordinals in accordance with the phrases they discover acceptable, whereas lenders present BTC loans that align their risk-reward preferences,” Binance defined.

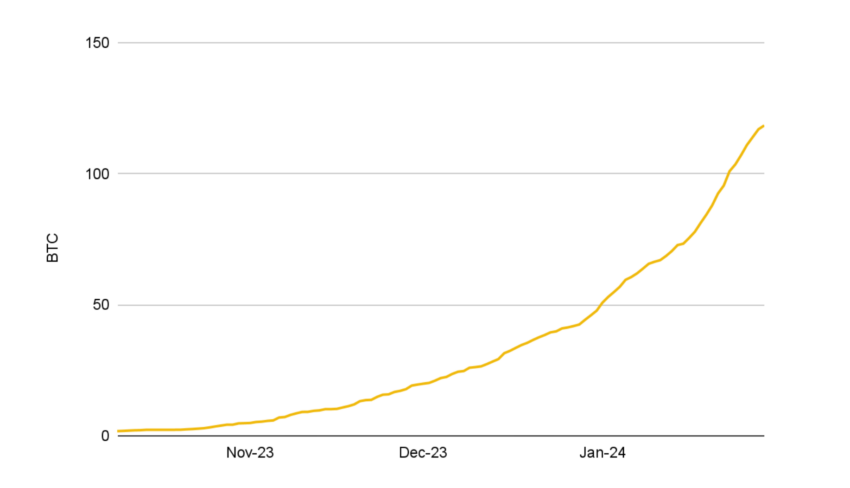

Moreover, Binance revealed that Liquidium has facilitated transactions exceeding 118 BTC. Since its inception, it has processed over 2,700 loans which are both accomplished or at present energetic.

Learn extra: What Are BRC-20 Tokens? The whole lot You Want To Know

Liquidium Bitcoin Loans Quantity. Supply: Binance

Lastly, Portal stands out as a cross-chain liquidity answer, specializing in decentralized trade and pockets providers. By facilitating BRC-20 swaps to different chains, Portal underscores the potential for Bitcoin’s integration into the broader blockchain ecosystem, enhancing its utility and accessibility.

The influence of inscriptions and BRC-20s extends past Bitcoin, with a number of EVM-compatible chains adopting comparable protocols. Regardless of the inherent capabilities of those chains for dealing with fungible and non-fungible tokens, inscriptions have witnessed appreciable transaction exercise pushed partly by speculative pursuits.

Learn extra: Bitcoin NFTs: The whole lot You Want To Know About Ordinals

Nonetheless, critics and proponents of inscriptions and BRC-20s supply divergent viewpoints, with the previous stating the community congestion and elevated charges, whereas the latter sees them as a golden alternative for Bitcoin’s evolution, particularly in enhancing the ecosystem’s scalability and safety.