- Final week’s inflows into digital asset funding merchandise totalled $326M

- Bitcoin accounted for 90% of all inflows recorded

Digital asset funding merchandise recorded inflows of $326 million final week. This represented the biggest single week of inflows since July 2022, CoinShares present in a brand new report.

Because the report highlighted, the important thing catalyst behind the document influx was the optimism surrounding the potential approval of a spot-based Bitcoin ETF by the US Securities and Trade Fee (SEC).

The bullish sentiments that enveloped the complete market in October prompted crypto funds to solely document inflows through the four-week interval.

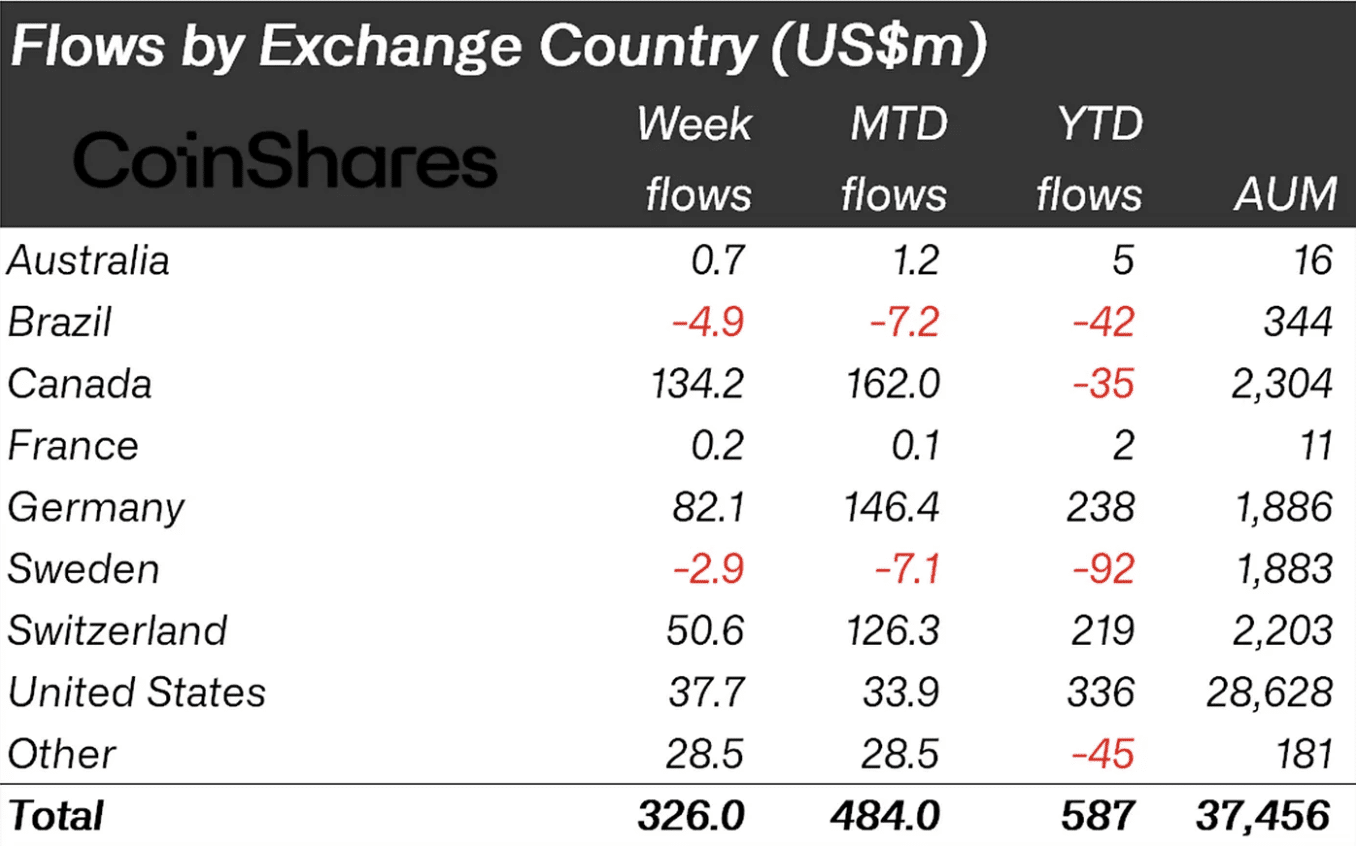

This introduced the month-to-date flows “near half a billion {dollars}”. Likewise, the entire property below administration for these digital asset merchandise reached $37.8 billion, marking the very best determine since Could 2022.

On a regional stage, the vast majority of final week’s flows into crypto funds got here from Canada, Germany, and Switzerland. Buyers in these international locations accounted for inflows of $134 million, $82 million, and $50 million, respectively.

America accounted for under 12% of all inflows recorded throughout the identical interval. In accordance with CoinShares, this advised that U.S. buyers could also be holding off, presumably in anticipation of the ETF approval.

Notably, Asia recorded its highest weekly inflows at $28 million.

Bitcoin leads, others observe

With $296 million added to Bitcoin-backed funding merchandise, the main coin accounted for 90% of the entire inflows recorded final week. This introduced its month-to-date inflows to $407 million, a 263% uptick from the previous week’s influx of $112 million.

Concerning its year-to-date (YTD) flows, final week’s fund movement pushed the coin’s internet inflows above $600 million. In accordance with CoinShares, BTC’s YTD internet inflows totaled $613 million final week. Within the week earlier than, this was lower than $350 million.

Apparently, regardless of BTC’s optimistic worth efficiency up to now few weeks, some buyers added funds to short-bitcoin positions.

CoinShares discovered,

“Latest worth rise additionally prompted inflows of US$15m into short-Bitcoin funding merchandise,”

Solana stays king within the alt-verse

Within the previous week, the $15.5 million recorded as inflows into Solana-backed merchandise made it the altcoin with essentially the most optimistic fund flows that week.

Repeating the identical feat final week, the coin noticed inflows of $24 million. This introduced the coin’s month-to-date inflows to $66 million and its YTD internet flows to round $100 million.

In accordance with CoinShares:

“The enhancing optimism additionally prompted vital inflows of US$24m into Solana, whereas another altcoins noticed inflows this optimism didn’t embrace Ethereum, which noticed one other US$6m of outflows.”