Bitcoin has now damaged the $31,000 mark with its newest rally. In line with on-chain information, the extent may very well be the following main milestone for BTC.

Bitcoin Realized Value Of 2021 Holders Is $35,000 At The Second

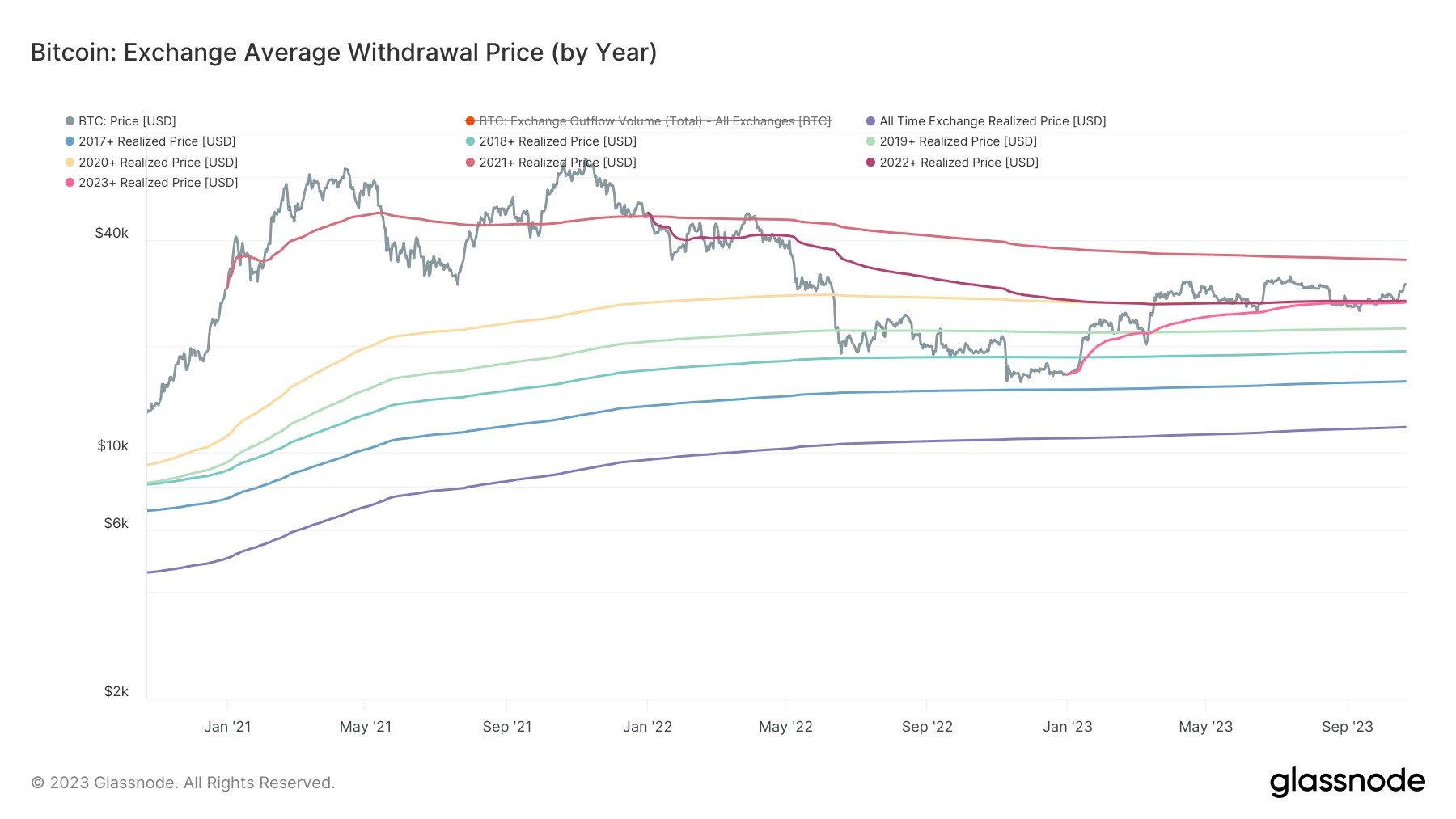

In a brand new post on X, analyst James V. Straten has mentioned the revenue/loss state of affairs of the totally different yearly Bitcoin purchaser cohorts. The indicator of curiosity right here is the “realized worth,” which retains observe of the typical worth at which buyers within the BTC market purchased their cash.

When the asset’s spot worth is beneath this metric, the typical holder within the sector is at a loss proper now. However, it being above the indicator suggests the dominance of income among the many buyers.

Right here, Straten hasn’t shared the chart for the peculiar realized worth for the whole circulating provide however quite just a few variations of the metric that solely think about patrons for the reason that begin of a selected 12 months. The chart beneath reveals the development within the Bitcoin realized worth for every year since 2017.

The info for the totally different realized worth ranges | Supply: @jimmyvs24 on X

As is seen within the graph, the Bitcoin realized worth for all years besides 2021 is beneath the present spot worth of the cryptocurrency. This means that the totally different yearly cohorts of the asset are holding their cash at some web unrealized revenue.

The newest teams to enter right into a state of revenue have been the 2022+ and 2023+ ones. The 2021+ group has a realized worth of about $35,000 for the time being, which remains to be a major distance away, however as Straten has famous, the hole between the spot worth and the metric is now the narrowest for the reason that two diverged again firstly of the bear market.

Apparently, through the peak in 2021, this group’s value foundation was round $48,000. The analyst suggests their realized worth, since lowering considerably, signifies some spectacular Greenback-Price Averaging (DCA) out there.

In on-chain evaluation, main value foundation ranges have all the time performed an vital position, because the BTC spot worth has typically noticed assist or resistance on retests of them.

The chart reveals that the Bitcoin worth had discovered assist on the 2023+ realized worth again in June. The current seemingly countless consolidation that BTC noticed earlier than the newest rally occurred across the 2022+ and 2023+ metrics after they’d overlapped.

Given the historic examples, the 2021+ might understand worth will trigger the worth to react one way or the other when it will definitely reaches there. Thus, the $35,000 stage can be a major milestone for the asset, as efficiently claiming it may suggest clear waters forward for the cryptocurrency.

On the identical time, nonetheless, the possibilities of contributors buckling and harvesting their good points are growing with all these teams coming into income. Such profit-taking can result in a pullback within the worth, at the least within the quick time period.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $31,200, up 11% prior to now week.

Seems to be like BTC has loved some sharp upwards momentum in the previous few days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com