NFT

NFTs belonging to the bankrupt crypto hedge fund Three Arrows Capital (3AC) have been offered by Sotheby’s in New York.

In an public sale on Friday, the primary lot of 3AC NFTs offered for a complete of over 2,482,850 USD. The funds can be used to assist repay the corporate’s collectors.

Cryptopunks and BAYC NFTs Amongst Three Arrows Assortment

Previous to submitting for chapter in July 2022, 3AC had amassed a powerful assortment of NFTs.

In February, the bancrupt fund’s liquidator, Teneo, revealed a full listing of the non-fungible tokens that it intends to promote. Gadgets the fund held embody uncommon digital artworks by Joshua Bagley, Dmitri Cherniak, and Tyler Hobbs. It additionally owned a number of Cryptopunks, a Cryptokitty, and a Bored Ape Yacht Membership (BAYC) NFT.

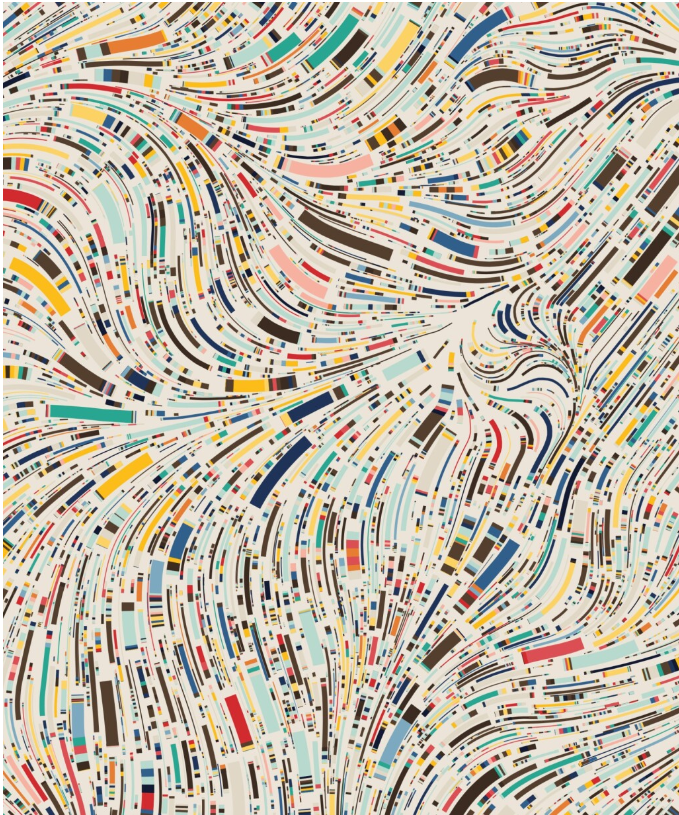

In Friday’s public sale, Sotheby’s curated a group of artworks from Hobbs’ Fidenza undertaking, Cherniak’s Ringers assortment, and Larva Labs’s pioneering NFTs, together with Autoglyph #187 and Cryptopunk #1326. Total, seven generative artworks have been included within the lot.

In a catalog for the “GRAILS” assortment, Sotheby’s acknowledged that it represents “an enchanting exploration of the intersection of artwork and know-how, and gives a singular perspective on the potential of algorithmic artwork to push the boundaries of creativity within the digital age.”

The very best-priced NFT from the primary set up of the Grails assortment was Fidenza #725. The piece offered for $1,016,000 USD, effectively above its estimate of $120,000-$180,000.

Tyler Hobs’ Fidenza #725 (Supply: Sotheby’s)

Going ahead, Sotheby’s will proceed to assist Teneo offload 3AC’s NFT belongings.

Because the public sale home states on its web site, the gathering can be launched in chapters throughout numerous gross sales codecs starting from non-public gross sales to auctions. These will happen throughout a number of places globally.

Sotheby’s Doubles Down on NFT Gross sales

Whereas rival advantageous artwork public sale home Christie’s might have crushed it off the mark with its seminal NFT public sale of Beeple’s The First 5000 Days, Sotheby’s hasn’t precisely been resting on its laurels.

Following on from its first NFT sale in April 2021, Sotheby’s has turn out to be more and more concerned on this planet’s high-end NFT market. And the auctioneer was a pure alternative for the 3AC liquidators.

Earlier this month, Sotheby’s introduced its intention to develop its personal devoted NFT market.

In a transfer that sees the almost 280-year-old establishment step into direct competitors with native digital platforms like OpenSea, the brand new market will allow peer-to-peer NFT gross sales, executed on Ethereum and Polygon.

What’s extra, Sotheby’s will use good contracts to make sure artists generate resale royalties for each secondary sale.

Starry Night time Portfolio Stays Off Market For Now

Along with the digital artworks within the GRAIL assortment, Three Arrows additionally held NFTs through Starry Night time Capital.

Launched in mid-2021 through the peak of the early NFT growth, Starry Night time was a devoted NFT fund. It labored labored with the collector and influencer Vincent Van Dough to snap up prized items. By one estimate, the fund had spent over 21 million USD within the quick time it was lively.

Nonetheless, as 3ACs insolvency proceedings unfold, liquidating the Starry Night time portfolio has confirmed complicated. To this point, solely NFTs held straight by the Singaporean hedge fund have been cleared on the market.

In accordance with the blockchain analytics agency Nansen.ai, NFTs collected by Starry Night time have been moved to a Gnosis Protected tackle in November 2022. This means that they’re being stored safe pending a court docket order that can enable Teneo to promote them.

Moreover, the liquidator has acknowledged that the way forward for the Starry Night time assortment is topic to a excessive court docket utility within the British Virgin Islands.