The Bitcoin panorama is not any stranger to debates and predictions. Two dominant theories are presently on the forefront: the 4-12 months Cycle and the Elliot Impulse Wave. Nevertheless, a complete analysis by the esteemed crypto analyst CryptoCon, suggests an interesting intersection of those two theories.

The Dueling Bitcoin Value Prediction Theories

On the coronary heart of the controversy are two camps. The primary, the 4-12 months Cycle proponents, consider in Bitcoin’s 4-year journey from cycle tops to bottoms, with a predicted zenith in 2025. The second camp, the Elliot Impulse Wave advocates, are forecasting a robust parabolic prime both this 12 months or by early 2024.

CryptoCon’s meticulous evaluation, which encompasses TA, on-chain knowledge, market psychology, and extra, gives a contemporary perspective. “I consider it might be attainable to see one of the best of each worlds for every group of thinkers,” he posited.

A good portion of the 4-12 months Cycle idea hinges on the halving’s impression on Bitcoin’s worth. “When the Bitcoin provide is decreased roughly each 4 years, this could set off a provide lower which causes worth to rise,” CryptoCon elucidated. Nevertheless, he additionally raised a counterpoint, noting the diminishing affect of miner provide output on Bitcoin’s worth, particularly given its present market measurement.

Historic Parallels, Alerts And Indicators

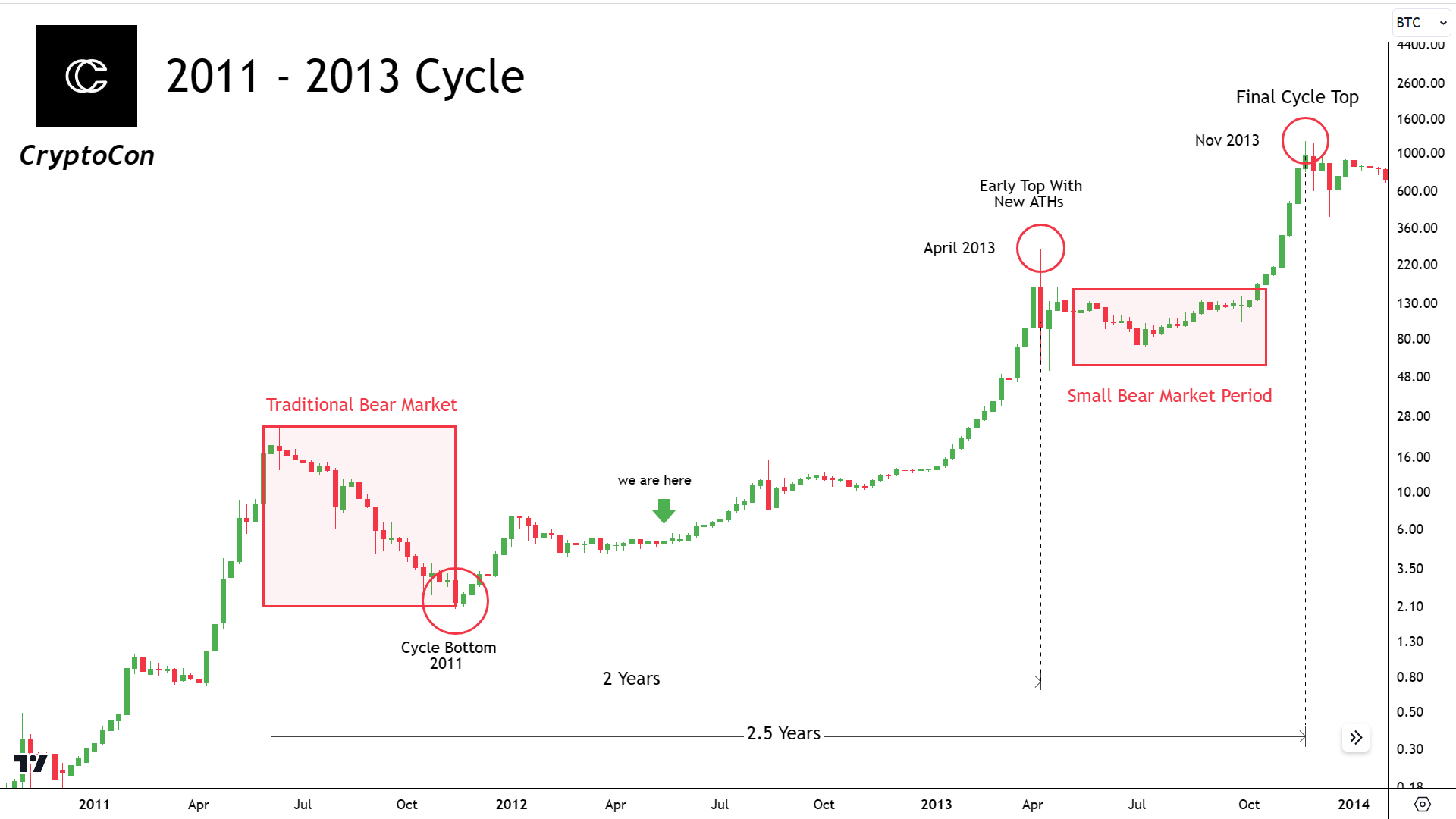

CryptoCon drew consideration to the 2011-2013 cycle, a interval that didn’t adhere to conventional patterns. This cycle skilled each an early and a later prime. Might this be a precedent for the present cycle? “Each of those teams of individuals appear to neglect one explicit cycle that seemingly defied the entire guidelines. 2011 – 2013,” he recalled.

Two compelling indicators have been central to his evaluation: the DXY Correlation Coefficient and the Vigor Sign. Traditionally, these have been precursors to a worth parabola. “The parabola sign has triggered. This has been the beginning of each worth parabola by definition,” he emphasised, underscoring their reliability. Traditionally, when Bitcoin has proven a low correlation with the US greenback, vital worth actions have been noticed.

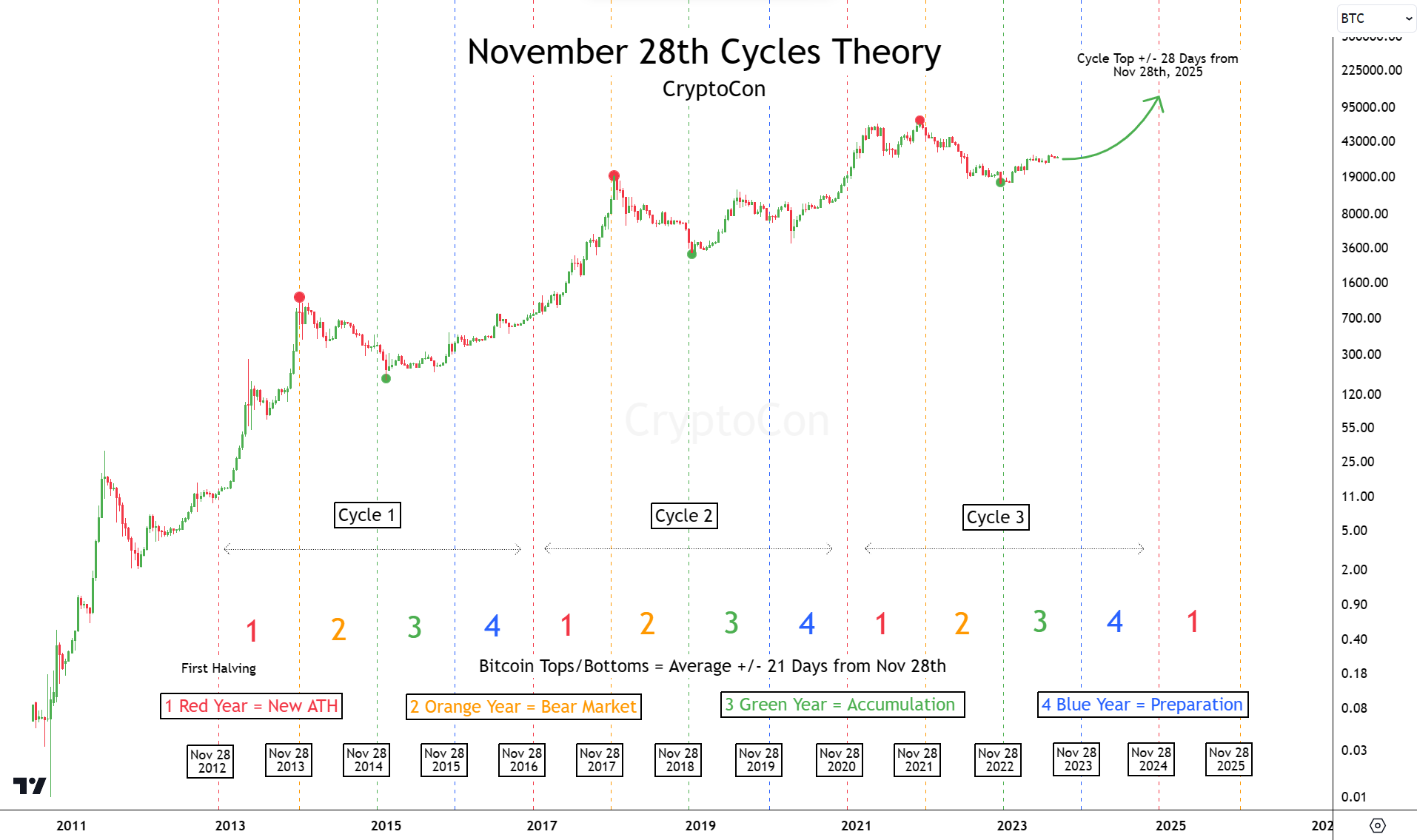

The November twenty eighth Cycles Principle, rooted within the date of Bitcoin’s first halving, has additionally been a constant predictor of Bitcoin’s worth actions for a decade. It segments the Bitcoin worth journey into 4 distinct phases: Inexperienced, Blue, Crimson, and Orange years (see chart under), every with its personal attribute worth habits. “With its stage of accuracy, there’s no purpose to count on it to fail this cycle. Telling us the true cycle prime will come late 2025,” CryptoCon confidently said.

CryptoCon’s Pattern Sample Value Mannequin, which makes use of patterns in angles levels from cycle highs and lows to foretell future ones, initiatives a worth of $130,000 by the tip of the November twenty eighth Cycle’s Principle timeframe. He was fast to warning in opposition to over-reliance on fundamentals, stating, “Though many would say there is no such thing as a restrict to cost with fundamentals, I feel that is a fully ridiculous argument.”

Converging BTC Predictions

Synthesizing all this knowledge, CryptoCon envisions a state of affairs the place each the 4-12 months Cycle and the Elliot Impulse Wave theories may harmoniously coexist. He anticipates an early prime round April 2024, probably reaching $90,000, adopted by a mid-cycle bear market. The ultimate prime, he predicts, may contact $130k by late 2025.

CryptoCon’s evaluation, whereas detailed and complete, additionally comes with a dose of humility. “That is what I consider is feasible. Absolute? Hardly,” he remarked. Because the Bitcoin group continues its fervent discussions, one factor stays clear: Solely time will really reveal the course Bitcoin’s worth will take.

At press time, the BTC worth stood at $29,466.

Featured picture from iStock, chart from TradingView.com