- Lido’s preliminary buyers have began promoting their holdings en masse

- The protocol continues to report constructive efficiency

Lido has been dominating the LSD (Liquid Staking By-product) area for the reason that starting of the yr. Nevertheless, regardless of its rising TVL and the protocol’s constructive efficiency, many buyers and validators have currently began to liquidate the belongings that had been assigned to them.

Learn LDO’s Value Prediction 2023-2024

Whales make an exit

The identical was evidenced by knowledge shared by widespread analyst – tumileth. In line with the identical, early buyers in Lido comparable to ParaFi Capital and Wormhole Finance offered 100% of the LDO that was allotted to them. Moreover, different establishments comparable to 3AC and Alameda Analysis had been additionally noticed to be promoting a major majority of their holdings.

Nevertheless, one of many largest sell-offs of the LDO token was performed by Terraform Labs. Terraform Labs had initially invested $2 million in LDO and had been allotted 20 million LDO tokens in return.

At press time, they managed to realize roughly $40 million by promoting all their holdings.

Terraform Labs (tagged by Nansen) offered all 20M $LDO at this time at a mean promote value of $2.07.

15.3M $LDO ($32M at the moment) offered on DEX at a mean value of $2.1

4.7M $LDO ($9.4M at the moment) was transferred to #Binance on Might 9, when the value was $2. pic.twitter.com/EYkCxnF4VU

— Lookonchain (@lookonchain) March 12, 2023

Massive addresses lowering their LDO holdings induced the share of LDO held by them to drop. Regardless of the adverse influence of those sell-offs on LDO’s value within the short-term, it could find yourself making the LDO community extra decentralized.

One doable explanation for the excessive sell-offs is that establishments like Alameda and 3AC went via difficult durations. Ergo, they wanted to promote belongings to keep up liquidity.

Different elements comparable to declining community progress and quantity might have additionally impacted the establishment’s decision-making course of.

Supply: Santiment

Nevertheless, not all establishments had been promoting their positions. In reality, funds comparable to Paradigm and DCG remained undeterred and have continued to carry on to their LDO.

Enterprise as standard for the protocol

Though a major majority of the holders offered their holdings, the Lido protocol has continued to see some enchancment in a number of sectors.

Real looking or not, right here’s LDO’s market cap in BTC’s phrases

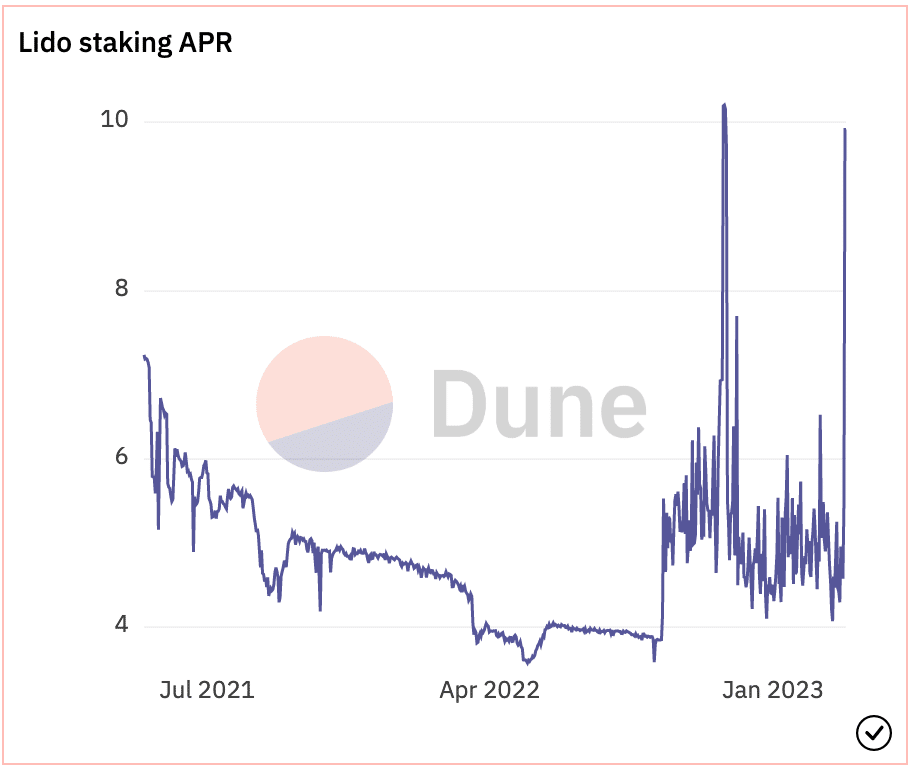

As an illustration, the general APR offered by Lido skyrocketed over the previous few days. The excessive APR additionally attracted a brand new set of distinctive customers to the protocol.

In reality, based on Messari’s knowledge, the variety of distinctive customers on the Lido protocol hiked by 0.28% over the past 24 hours.

Supply: Dune Analytics

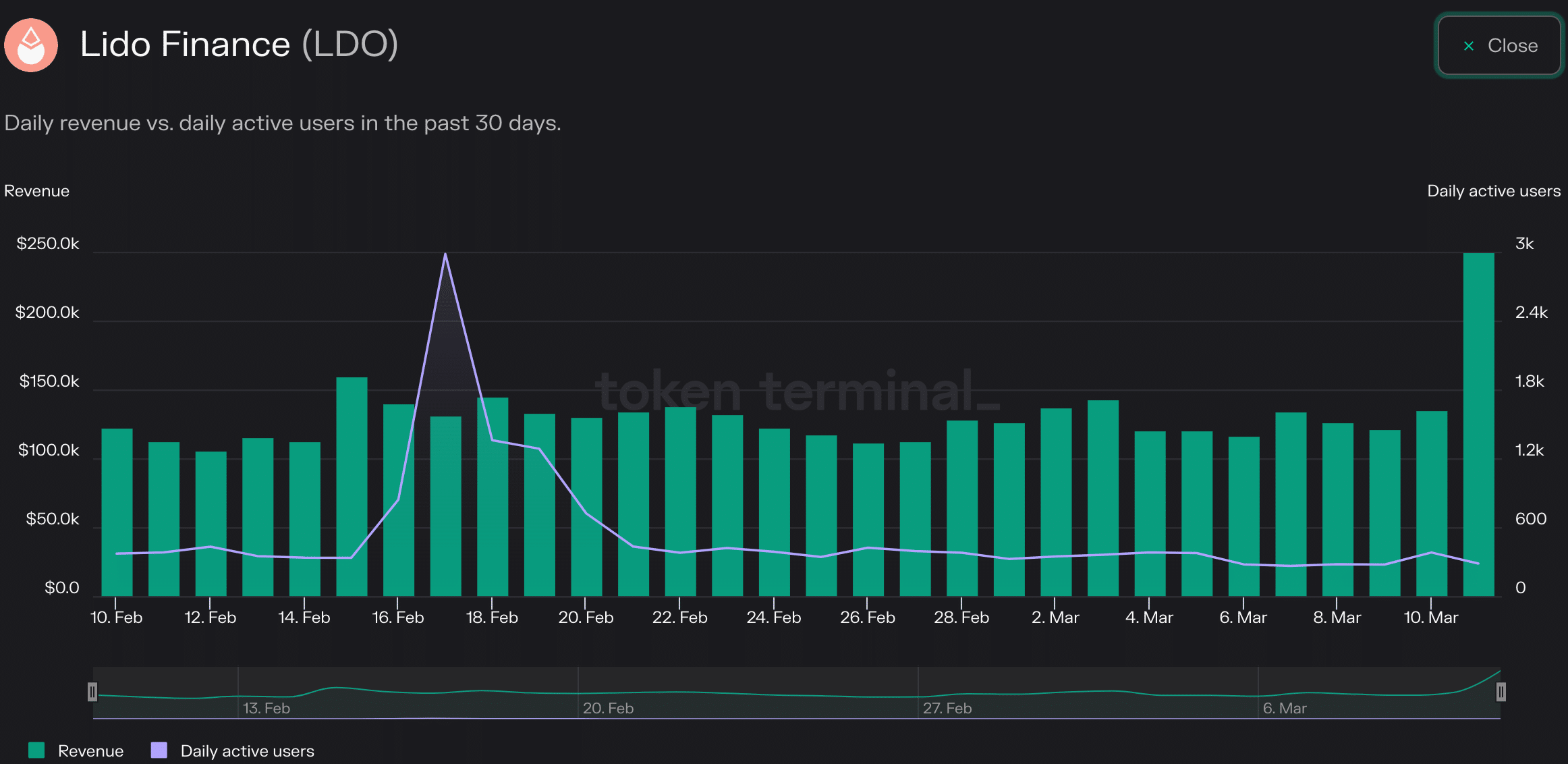

The aforementioned commentary could be coupled with the truth that the income generated by the protocol appreciated by 85% within the final 24 hours.

In reality, the protocol managed to generate this sort of income regardless of a decline in each day lively customers on the protocol. This implied that the spike in income was as a result of transactions of some key addresses.

Supply: token terminal