- New Arkansas invoice seeks to guard miner pursuits particularly from authorities overreach.

- BTC miners incentived to promote a few of their holdings because the market slows down.

Not so way back, U.S regulators tried make it appear to be they have been embracing Bitcoin [BTC] and altcoins. Just for them to change up and ban banking entry to the crypto market. A traditional case of actions talking louder than phrases.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Bitcoin has thus far demonstrated resilience in opposition to FUD assaults. As evident by its potential to outlive and thrive for greater than a decade whereas gaining extra recognition.

That is largely due to Bitcoin’s decentralized nature. However what if governments tried to assault or benefit from the Bicoin mining system, the underlying mechanism behind Bitcoin decentralization?

Lawmakers in Arkansas, U.S appear to be siding with Bitcoin and have an interest legal guidelines that may defend Bitcoin from authorities overreach. The US Arkansas Data Centers Act of 2023 goals to implement measures that may defend Bitcoin miners from unfair taxes and laws.

The US Arkansas Information Facilities Act of 2023 seeks to determine tips for Bitcoin miners and defend them from discriminatory laws and taxes, guaranteeing that corporations have the identical rights as information facilities. “Discrimination in opposition to digital asset mining enterprise [is]…

— Wu Blockchain (@WuBlockchain) April 10, 2023

Based mostly on Arkansas’ official publication relating to the brand new act, Bitcoin mining services might be handled as information facilities. So, why is that this new Arkansas Act vital for the crypto trade?

Effectively, it’s because governments would possibly deploy unfair techniques corresponding to heavy taxation to cripple the trade. Unfavorable laws would possibly discourage crypto mining actions.

Is Bitcoin vulnerable to unfair taxation and regulation?

In a hypothetical situation, if a authorities was to behave aggressively in opposition to Bitcoin in an effort to forestall mining, it would discourage mining. The potential final result can be a slight dip within the hash price, or a migration of miners to different favorable jurisdictions.

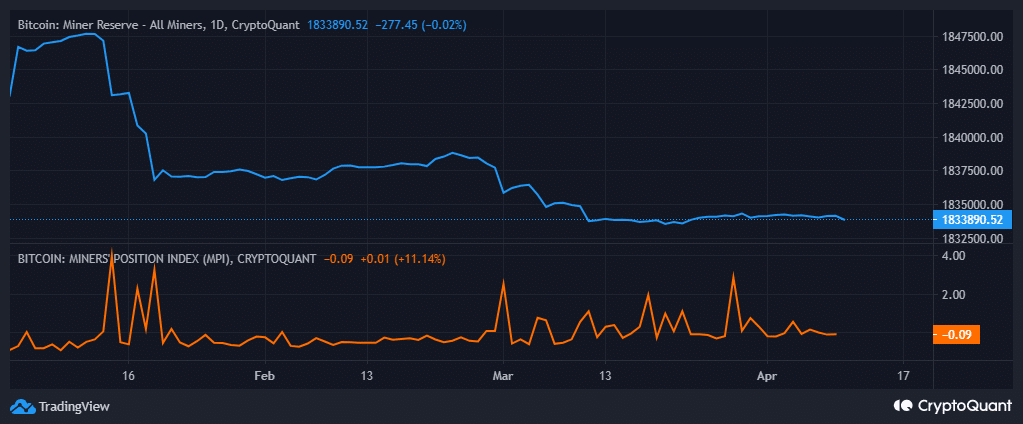

If something, one might argue that unfair tax and regulatory measures in opposition to BTC mining would take away alternatives for the affected jurisdiction. The impression of such measures would doubtless even have a notable impression on Bitcoin miner reserves. The latter, at press time, stood at its YTD lows.

Supply: CryptoQuant

What number of are 1,10,100 BTCs value at the moment

Moreover, Bitcoin miner reserves remained low reflecting a insecurity within the bulls dominating. The Bitcoin miner place index additionally depicted a low worth, confirming that miners have been nonetheless contributing to promote stress.

A have a look at miner flows revealed a surge in miner outflows within the final 24 hours as miner inflows dropped.

Supply: TradingView

The above final result is probably going as a result of the market has slowed down, resulting in a drop in transactions, therefore a drop in miner income. As such, miners should promote a few of their BTC holdings to cowl their mining prices.