On-chain knowledge exhibits the Bitcoin Binary Coin Days Destroyed (CDD) has stayed low not too long ago. Right here’s what this says concerning the present market.

Bitcoin Binary CDD Has Remained At Very Low Ranges Lately

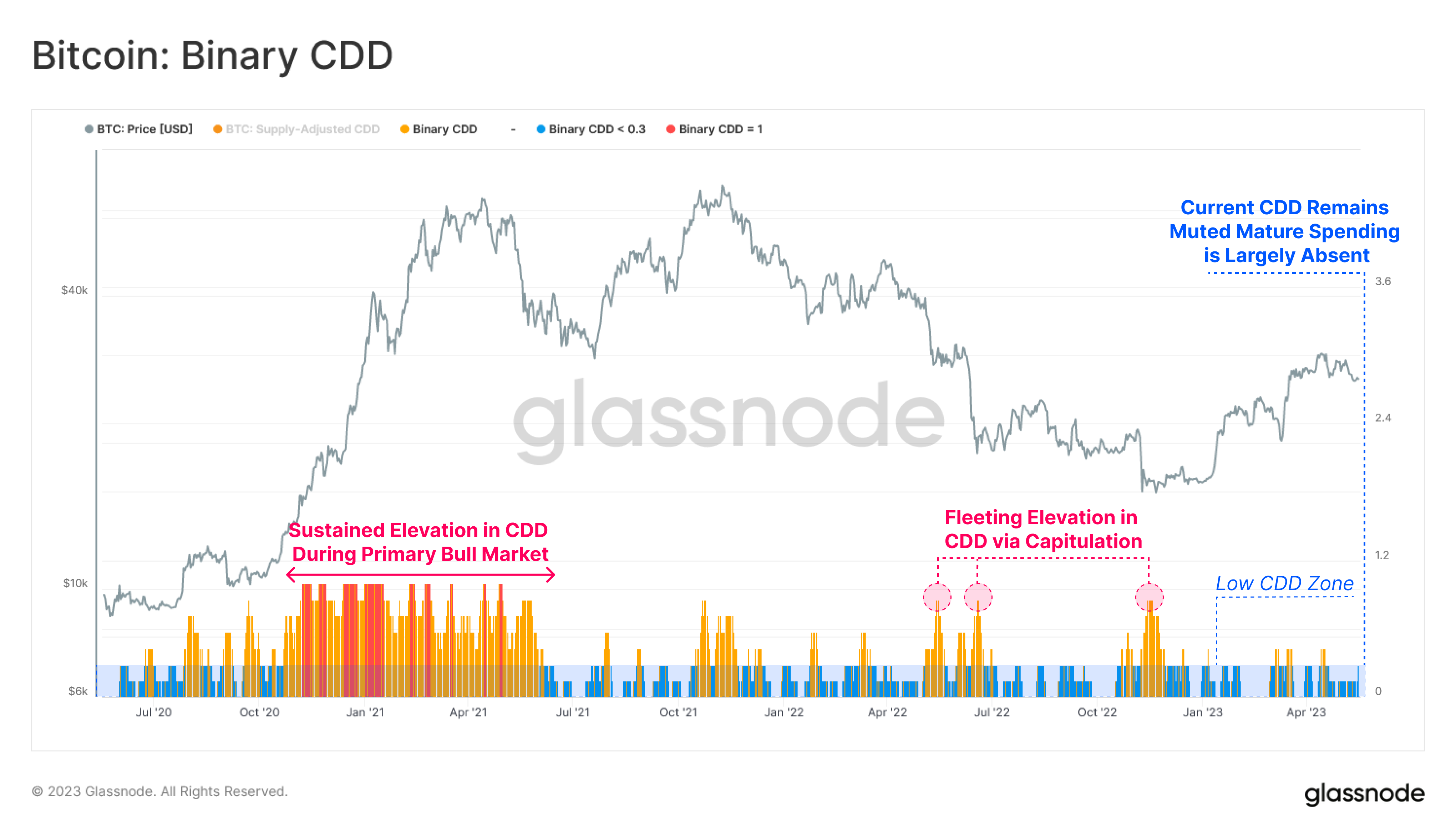

In response to knowledge from the on-chain analytics agency Glassnode, this indicator attained excessive values through the 2021 bull run. To grasp the CDD metric, the idea of “coin days” must be checked out first.

Every time 1 BTC stays stationary on the blockchain for 1 day, it accumulates 1 “coin day.” If a coin that has remained unmoved on the community for some time, which means that it has gathered a sure variety of coin days, is now all of a sudden transferred, its coin days counter would naturally reset again to zero.

The coin days it had beforehand been carrying are stated to be “destroyed.” The CDD indicator measures the overall variety of coin days being reset all through the community on any given day.

When this indicator has a excessive worth, it implies that numerous coin days are being reset available in the market at present. Usually, this sort of development is an indication of motion from the “long-term holders” (LTHs).

This group consists of traders which were holding their BTC since at the least 155 days in the past, so these holders are likely to accumulate massive numbers of coin days. Due to this purpose, every time they make transfers, the CDD registers a spike.

Within the context of the present dialogue, the CDD itself isn’t of curiosity, however a modified model of it referred to as the Binary CDD is. This indicator principally tells us how the CDD at present compares with the historic common worth of the metric.

As is already apparent from its title, this indicator can solely attain two values: 0 and 1. It has a worth of 0 if the CDD is beneath the historic common, whereas it’s 1 when the metric is above it.

Now, here’s a chart that exhibits the development within the 7-day common Bitcoin Binary CDD over the previous couple of years:

The worth of the metric appears to have been low in latest days | Supply: Glassnode on Twitter

As proven within the above graph, the 7-day common Bitcoin Binary CDD has had a fairly low worth for some time now. This means that there hasn’t been any vital destruction of coin days available in the market not too long ago.

Naturally, which means that the LTHs haven’t been making any strikes out of the bizarre, regardless of the value observing a notable improve throughout the previous couple of months.

The LTHs are typically essentially the most resolute bunch available in the market, so transfers from them can have vital implications for the sector since they’re an indication that even these holders might have been compelled to promote.

The Bitcoin bull run through the first half of 2021 noticed the 7-day common Binary CDD keep close to 1, implying that the LTHs had been promoting in full power. As this hasn’t been the case within the rally up to now, it seems that the present earnings aren’t sufficient to maneuver these diamond arms, and they’re doubtless anticipating higher alternatives afterward.

These traders persevering with to carry such a bullish conviction could be constructive for the value in the long run.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,300, down 1% within the final week.

The asset continues to consolidate | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Glassnode.com