Bloomberg Intelligence’s senior macro strategist Mike McGlone says that the second half of the yr may very well be bearish for Bitcoin (BTC) and the remainder of the crypto markets.

McGlone says that threat property, equivalent to shares and crypto, might get low-cost within the coming months as he believes that an financial recession is on the horizon.

In keeping with the macro strategist, the Federal Reserve remains to be on the trail of accelerating rates of interest, which he notes might negatively impression the efficiency of Bitcoin and different crypto property.

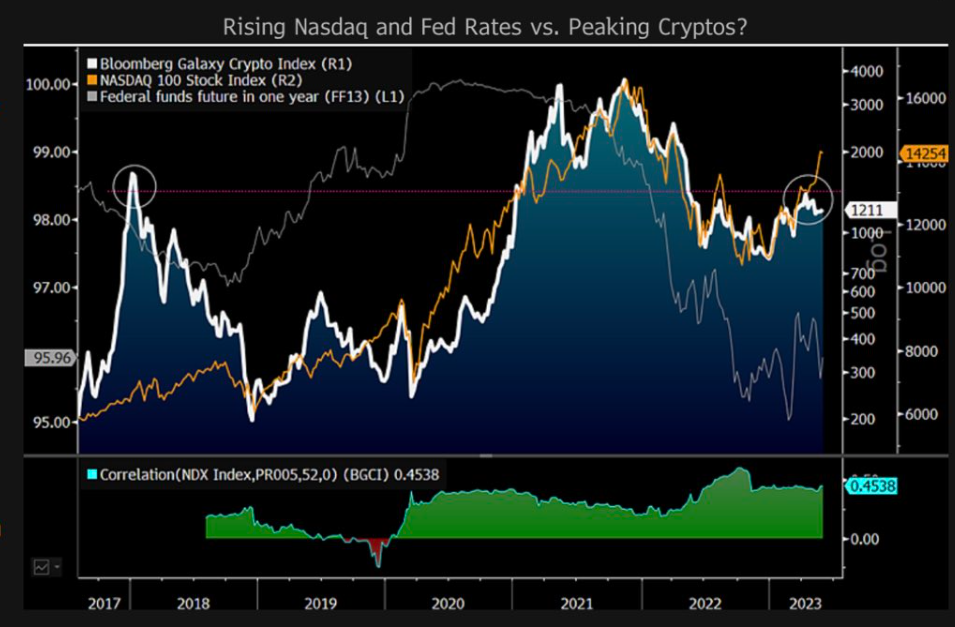

“Danger property can get low-cost in recessions. The cat-and-mouse recreation between the rallying inventory market and watchful central banks may very well be an impediment for threat property. Cryptos are among the many riskiest, and the lack of the Bloomberg Galaxy Crypto Index (BGCI) to maintain above its 2018 excessive in 2023 could also be for a great cause: the Fed remains to be tightening.”

The BGCI tracks the efficiency of the biggest crypto property traded in USD.

McGlone additionally says that the Bloomberg Economics staff is predicting an “ugly” second half for cryptos and equities

“Our graphic exhibits a uncommon divergence, with the Nasdaq 100 Inventory Index breaking larger and the BGCI falling in (Q2).

Federal funds futures in a single yr (FF13) are a liquidity gauge, including rising rate-hike expectations to a climbing inventory market might put a ceiling on crypto costs.

The BGCI has rallied in 2023 by about 50% to June 1 and the Nasdaq 30%, which can shift the bias towards what’s typical in recessions: threat property can get low-cost.”

Do not Miss a Beat – Subscribe to get crypto e mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Featured Picture: Shutterstock/Tithi Luadthong