- Curve Finance’s new stablecoin, crvUSD, confirmed promise.

- Curve’s TVL declined, however a slight uptick in token development supplied optimism.

As new decentralized exchanges (DEXs) proceed to emerge, Curve Finance [CRV] has skilled a big decline in its market dominance. Nevertheless, with the introduction of its stablecoin, crvUSD, Curve Finance could regain its footing within the aggressive DEX area.

Lifelike or not, right here’s CRV’s market cap in BTC’s phrases

Some stability for Curve?

Parsec Finance’s information reveals that inside simply 24 hours, the marketplace for crvUSD has attracted 3,000 wstETH (equal to $6.5 million) as collateral.

$4.3 million value of crvUSD has already been generated towards this collateral, showcasing a surge in curiosity for this stablecoin.

In lower than 24hrs crvUSD’s new market already has 3k wstETH ($6.5m) in collateral and $4.3m crvUSD minted towards it pic.twitter.com/ykonxiIjgb

— parsec (@parsec_finance) June 8, 2023

The elevated consideration on crvUSD may be attributed to the approval of a brand new proposal on the Curve protocol. This permits customers to make the most of their stETH holdings as collateral, with Curve mechanically minting crvUSD in return.

The worth of the minted crvUSD is set by a portion of the stETH’s worth. To take care of the supposed $1 peg of crvUSD, customers should pay a 6% borrowing charge and face automated liquidation if the worth of the equipped collateral decreases.

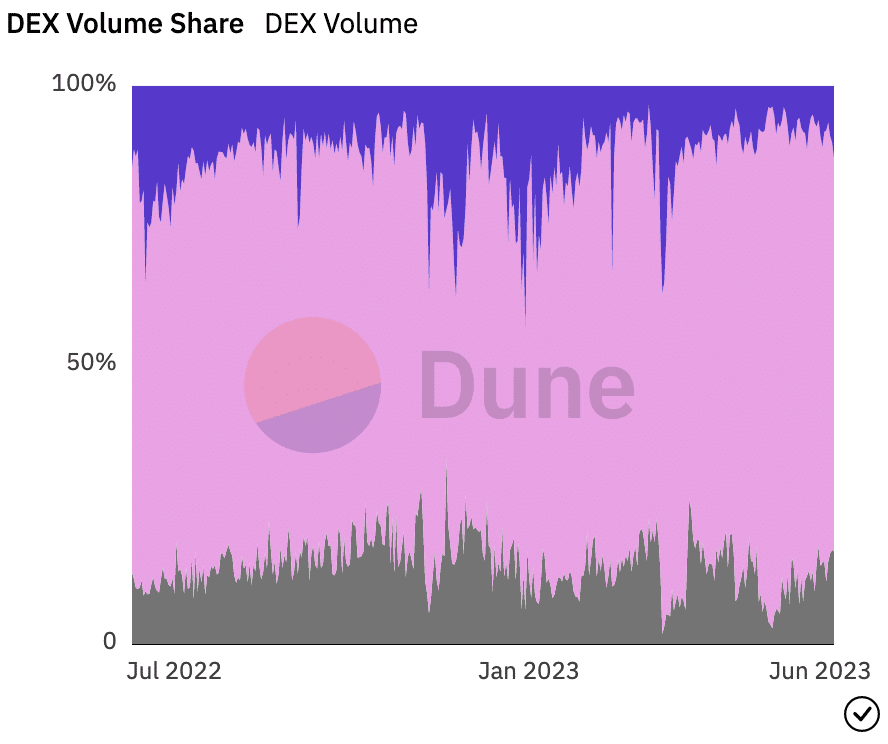

These developments maintain the potential to reinforce Curve’s dominance inside the DEX sector. At press time, Curve had captured 10.1% of all quantity on DEXs, whereas Uniswap maintains a market share of 74.1%.

Regardless of Curve’s recognition and the success of its stablecoin, its Whole Worth Locked (TVL) has skilled a decline, dropping by 2.3% inside the previous 24 hours. At press time, the cumulative TVL on the protocol amounted to $4.1 billion.

Nonetheless, Curve outperformed each Uniswap [UNI] and SushiSwap [SUSHI] by way of TVL, as indicated by Token Terminal. Uniswap’s TVL stood at $3.9 billion on the time of writing, whereas SushiSwap’s TVL amounted to $368.8 million.

Supply: Dune Analytics

Authorized troubles

Curve’s dominance in TVL might face challenges because of ongoing lawsuits involving its founder. At press time, a legal dispute was underway in San Francisco, with three outstanding crypto enterprise capital companies accusing Curve founder Michael Egorov of misleading practices and misappropriation of commerce secrets and techniques, leading to monetary damages.

These prices have the potential to influence sentiment surrounding Curve, resulting in a decline in exercise and subsequent TVL.

Is your portfolio inexperienced? Try the UNI Revenue Calculator

Concerning tokens, the market capitalization of SUSHI, UNI, and CRV has skilled vital declines over the previous month. Nevertheless, there was a slight uptick in community development noticed in current days.

This means a rising curiosity in these tokens amongst new addresses, suggesting a possible turnaround for these tokens sooner or later.

Supply: Santiment