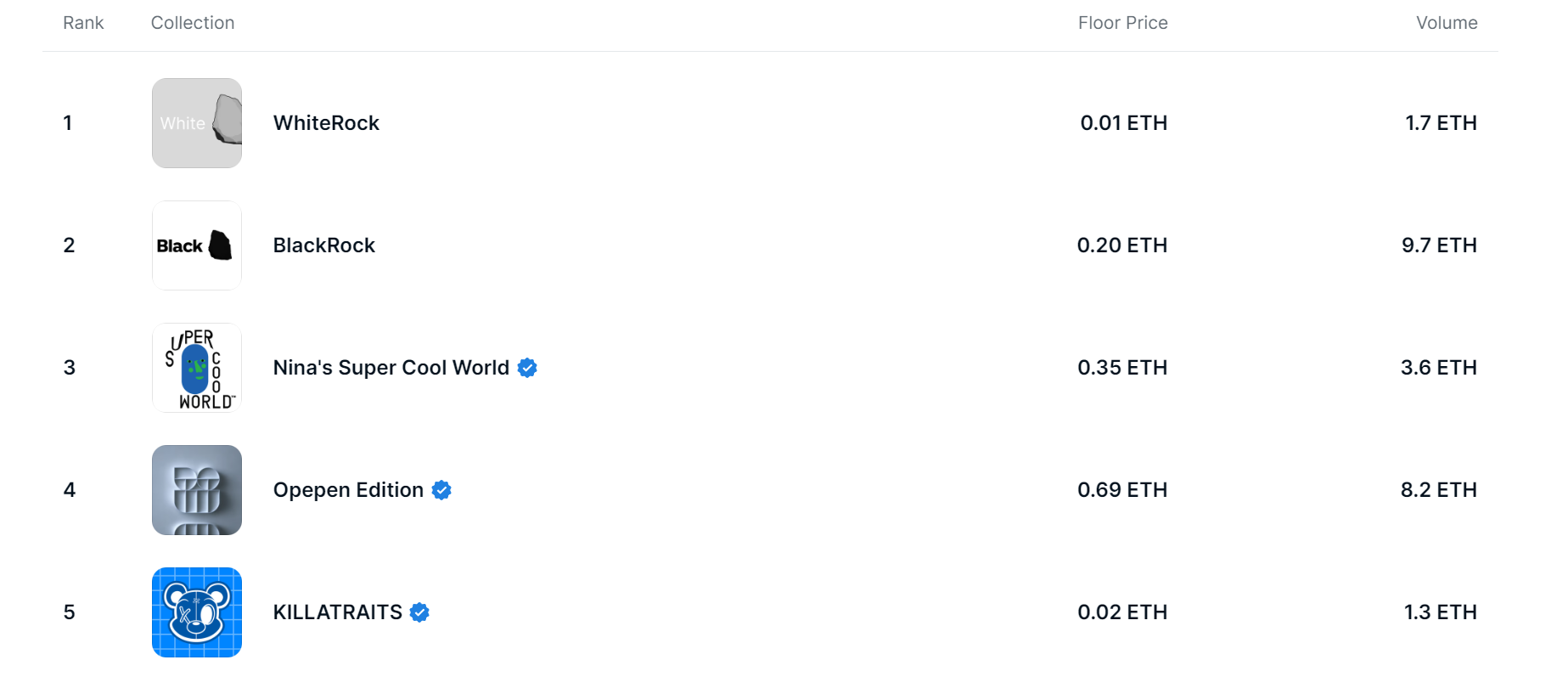

In line with knowledge on Opensea, WhiteRock is the #1 assortment, main BlackRock, however BlackRock presently has a flooring value 10 occasions larger (0.2 ETH in comparison with 0.01 ETH) and nearly 6 occasions the amount. (9.7 ETH vs. 1.7 ETH).

Rating of trending NFT collections. Supply: Opensea

This increase is essentially attributed to monetary companies large BlackRock’s submitting for a spot Bitcoin ETF with the U.S. Securities and Change Fee (SEC) on June 15.

The Securities and Change Fee (SEC) has rejected any software to ascertain a spot Bitcoin ETF. Nonetheless, within the case of Blackrock, this time, the SEC approval fee for a Bitcoin ETF software is comparatively excessive due to its cautious preparation. Blackrock’s ETF software may function a key occasion in crypto 2023 and probably past.

This occasion not solely helps to maintain the “rock” themes trending on NFT collections, but it surely additionally supplies an excessive amount of optimism for firms that additionally provide wealth administration companies within the historically dynamic market to enter the promising Bitcoin market.

In lower than per week, a collection of enormous funds similar to Constancy, Citadel, Charles Schwab, Deutsche Financial institution, MasterCard, WisdomTree,… have all utilized to open a spot Bitcoin ETF with the SEC and have prompted BTC value to extend repeatedly since $26,000 to $30,200 in simply 2 days, BTC value is up greater than 20% this week.

7 days BTC value chart. Supply: CoinMarketCap

DISCLAIMER: The Data on this web site is supplied as basic market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.