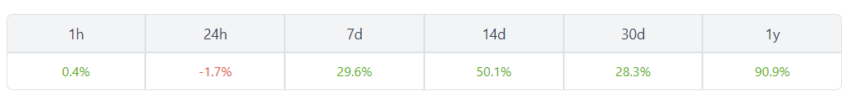

The cryptocurrency Stacks (STX) has not too long ago skilled a outstanding turnaround, with its value bouncing again after reaching a multi-month low of $0.4412. Traders have seized the chance to “purchase the dip,” leading to a steady upward development for STX over the previous few days. In consequence, STX is now buying and selling at $0.7916, marking a big 29% improve from its lowest degree this month.

Potential Catalysts For STX

Two major causes drive the surge in Stacks’ value. Firstly, the choice by Blackrock to file for a Bitcoin exchange-traded fund (ETF) with the US Securities and Trade Fee has sparked optimistic sentiment. Nonetheless, uncertainties stay relating to the acceptance of the iShares Bitcoin Trust, as Coinbase is slated to function the custodian of the cash. Moreover, the continuing battle between Coinbase and the SEC provides to the regulatory uncertainty surrounding the scenario.

Associated Readings: Bitcoin Simply Gained Over 18% In Seven Days: What’s Occurred When This Has Occurred In The Previous?

Moreover, the SEC’s lawsuit in opposition to main exchanges Binance and Coinbase is predicted to profit Bitcoin, as each regulatory businesses acknowledge Bitcoin as a commodity fairly than a safety. Consequently, many traders in various cryptocurrencies could shift their focus to the perceived security of Bitcoin. Stacks, which is carefully tied to Bitcoin’s ecosystem and allows the event of decentralized purposes (dApps), stands to profit from this altering investor sentiment.

The increasing Stacks ecosystem is one other important issue contributing to the rise in STX value. Bitflow Finance, a decentralized finance (DeFi) protocol, not too long ago launched an sBTC/sBTC stableswap pool, enabling seamless token swaps. This improvement enhances the utility and adoption of Stacks, finally bolstering its optimistic value efficiency.

What’s Subsequent For Stacks?

From a technical evaluation standpoint, Stacks displays promising alerts. The each day chart reveals the formation of a bullish falling wedge sample, indicating a possible development reversal. STX has additionally surpassed the 25-day exponential transferring common and is at the moment testing the 50-day MA.

Furthermore, the breakthrough of the important thing resistance degree at $0.5281, the bottom level in March, additional reinforces the bullish sentiment. As consumers set their sights on the subsequent resistance level at $0.90, a possible 9% improve from the present degree, Stacks continues to draw consideration.

Associated Readings: Masks Basis Strikes 2.5 Million Tokens To Exchanges, Big Dip Incoming?

The Stacks value is $0.79 at press time, reflecting a change of -2.10% over the previous 24 hours. The current value motion has left Stacks’ market capitalization at $1,101,401,654.52. Notably, Stacks has demonstrated a formidable 277.22% change for the reason that starting of the 12 months, indicating its robust development potential.

STX serves because the native token of the Stacks blockchain, which operates as a layer 2 blockchain community leveraging the safety of the Bitcoin blockchain for transaction settlement. With its distinctive positioning and strong ecosystem, Stacks continues to seize the eye of traders and builders alike.

Featured picture from iStock.com and charts from Tradingview and Coingecko.com