Bored Ape Yacht Membership has been on an emotional rollercoaster during the last a number of days. A number of traders offered their prized blue-chip NFTs, triggering a wave of Concern, Uncertainty, and Doubt (FUD).

BAYC has had a troublesome time lately because the bear market has lastly taken its toll. Due to the stoop, a number of holders have offered their NFTs, decreasing the NFT’s whole worth.

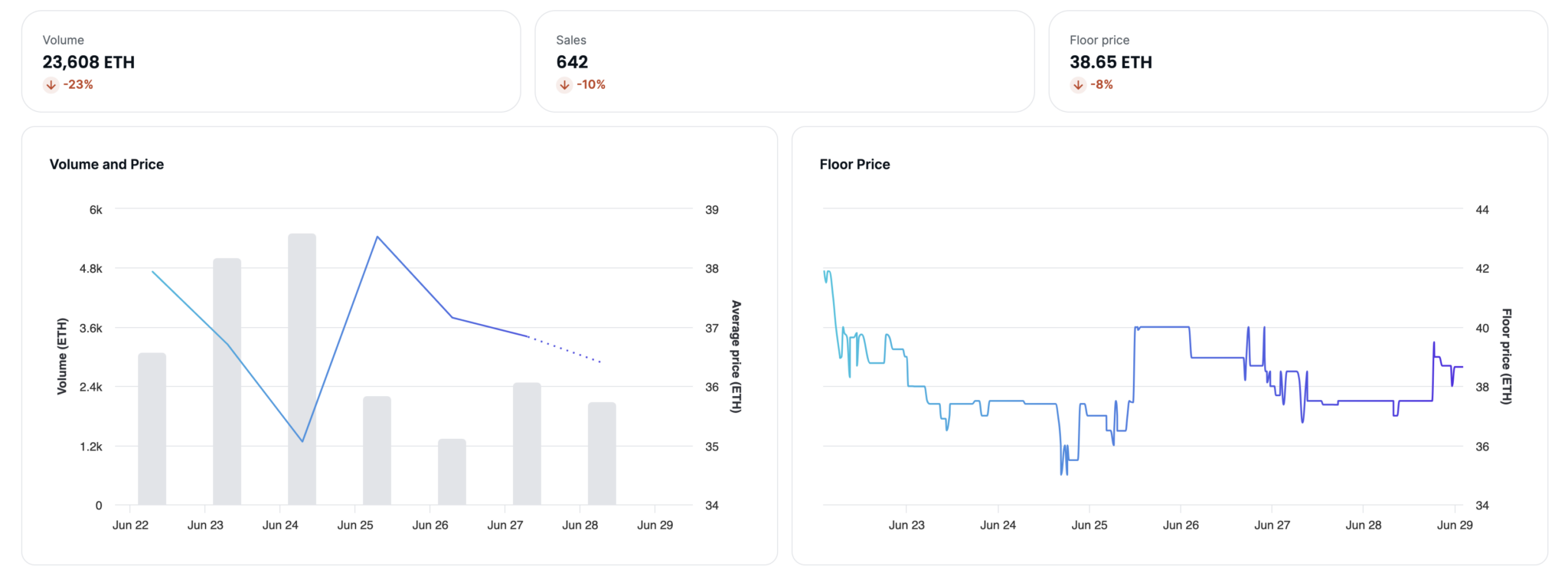

The Bored Ape Yacht Membership has seen steeper losses in current weeks, with the ground value plummeting over 19% within the earlier 30 days when measured in ETH. A Bored Ape prices 36.5 ETH.

The BAYC assortment’s fortunes have modified attributable to a mess of elementary points. Basic market pessimism, the obvious finish of usefulness, whale sell-offs, and diminished media consideration are amongst them. However, many within the know imagine that current motion within the Blur ecosystem has had the best general affect.

Well-known NFT collector Jeffrey Huang, often known as Machi Large Brother, sparked a frenzy over BAYC NFTs. Huang’s succession of gross sales and subsequent acquisitions from the gathering precipitated important instability within the NFT’s value.

Huang offered roughly 50 Apes, in accordance with statistics from Blur, a well known NFT market. He accomplished a single transaction final Saturday, promoting 19 Apes for 651 ETH, which equated to virtually $1.2 million on the time of the sale.

ApeCoin (APE), marketed because the core of the world’s most beneficial NFT ecosystem, reached an all-time low of $1.936 on June 19, down greater than 90% from its all-time excessive, earlier than recovering.

APE value chart. Supply: TradingView

Learning BAYC’s OpenSea statistics revealed an intriguing sample. From Might by way of roughly June 18, the NFT maintained a constant ground value, averaging round 45 ETH. At this writing, the ground value was hanging round 38.6 ETH, indicating {that a} restoration was underway.

Supply: OpenSea

This improvement revealed a positive relationship between growing social interplay and value makes an attempt to appropriate larger, signaling a doable worth restoration.

Nevertheless, in accordance with the present evaluation based mostly in the marketplace scenario, this restoration stage continues to be not price it for speculators to think about short-term holding, a rally to the 40 ETH value stage might be held by gamers ready for a bullish sign whereas the present value stage nonetheless doesn’t fulfill the above necessities.

DISCLAIMER: The data on this web site is offered as common market commentary and doesn’t represent funding recommendation. We encourage you to do your personal analysis earlier than investing.