Bitcoin Money (BCH) has skilled a outstanding upswing, with its worth hovering by 55% previously week. This surge will be attributed to 2 key elements: BlackRock’s latest software for a Bitcoin spot ETF with the US Securities and Trade Fee and the launch of EDX Markets.

BlackRock’s transfer to hunt SEC approval for a Bitcoin spot ETF has sparked a wave of comparable purposes, producing a bullish sentiment within the cryptocurrency market. This sentiment has had a very constructive impression on Bitcoin and associated tasks, together with Bitcoin Money.

Nonetheless, the introduction of EDX Markets, a platform catering to institutional buyers, seems to be the first catalyst behind Bitcoin Money’s latest worth surge. EDX Markets, backed by business giants Constancy, Schwab, and Citadel Securities, carries important weight regardless of not being registered with the SEC.

Jamil Nazarali, CEO of EDX Markets, expressed confidence within the compliance of the 4 listed crypto tokens (Bitcoin, Ether, Bitcoin Money, and Litecoin) with the SEC. The platform’s selective itemizing of cryptocurrencies, which incorporates Bitcoin, Ether, Litecoin, and Bitcoin Money, has been interpreted as a vote of confidence, particularly in Bitcoin Money.

The itemizing of BCH on the EDX Markets change is a sign of the token’s regulatory clearance. This interpretation beneficial properties significance because the SEC scrutinizes different blockchain tasks.

Associated studying: Right here’s What Brought about Bitcoin’s Flash Crash To $29,000

Bitcoin Money Uptrend Fueled By Quantity Spike On Upbit

A significant factor that would have influenced the latest uptrend in Bitcoin Money (BCH) is the brief squeeze and an sudden surge in buying and selling quantity on the South Korean change, Upbit. A brief squeeze happens when the worth of an asset rises, main merchants who had wager in opposition to the asset’s worth to cowl their positions at a loss or face pressured liquidation.

The volatility in BCH’s worth resulted in roughly $19 million in liquidations throughout the previous 24 hours, with brief orders accounting for 77% of the overall quantity. These liquidation ranges signify the best recorded in June 2023, in line with knowledge from Coinglass.

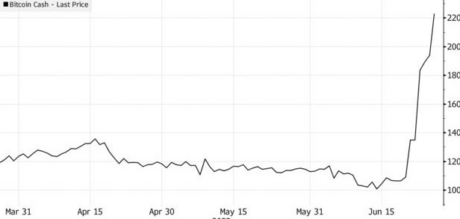

BCH’s worth remained closely suppressed all year long, fluctuating between $100 and $150. Nonetheless, its worth skilled a big vertical rise after being listed on EDX Markets. At present, BCH is buying and selling at $308.72, reaching ranges final seen 14 months in the past in Might 2022.

In line with crypto analysis outlet The Tie, BCH buying and selling volumes on Binance have reached ranges not witnessed in two years. This means a resurgence of BCH’s buying and selling curiosity following its EDX Markets itemizing. This renewed curiosity highlights a constructive shift within the buying and selling dynamics surrounding Bitcoin Money.

BCH is buying and selling at $280.7 at press time, with a 5% decline previously 24 hours.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails danger. Once you make investments, your capital is topic to danger).

Featured picture from iStock and charts from Tradingview, Bloomberg, and Coinglass