Bloomberg Intelligence’s senior macro strategist Mike McGlone is warning that Bitcoin (BTC) could run into robust headwinds this yr.

McGlone tells his 58,800 Twitter followers {that a} US financial recession is probably going coming quickly and it may drag down threat property like Bitcoin and different cryptos.

“Notably Destructive Liquidity vs. Bouncing Bitcoin – Recessions usually portend struggling threat property and decrease rates of interest as central banks add liquidity. Cryptos are tops in threat, with Bitcoin the smallest fear. It’s unlikely the US will keep away from financial contraction by year-end, in keeping with Bloomberg Economics, however futures present the Fed extra inclined to maintain mountain climbing.

Respecting the principles of liquidity, which was notably unfavourable on the finish of 1H (first half of the yr), our bias is the long-anticipated recession will add typical headwinds, significantly to cryptos and shares that bounced.”

McGlone additionally says Bitcoin could carry out equally to how gold carried out through the Nice Recession of 2008 when it declined 30% earlier than taking off on a rally.

“The graphic exhibits Bitcoin’s upward trajectory going through a primary – the NY Fed’s likelihood of recession from the yield curve at its best since 1982. That gold dropped about 30% from its peak in 2008 earlier than rallying could have implications for its digital descendent in 2H (second half of the yr).”

Nonetheless, McGlone says that if Bitcoin may decorrelate from the Nasdaq 100 (NDX) it may result in broader adoption that may assist the king crypto carry out stronger throughout a recession.

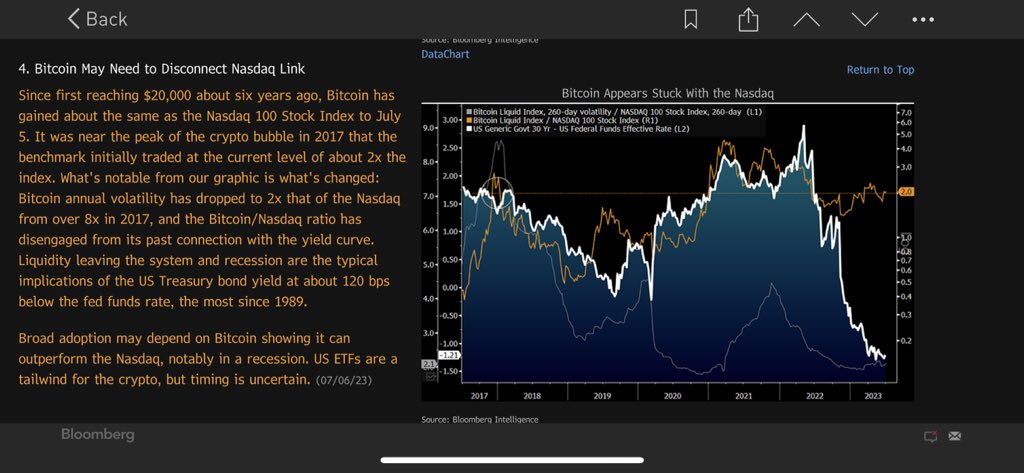

“Bitcoin Might Have to Disconnect Nasdaq Hyperlink – Since first reaching $20,000 about six years in the past, Bitcoin has gained about the identical because the Nasdaq 100 Inventory Index to July 10. It was close to the height of the crypto bubble in 2017 that the benchmark initially traded on the present stage of about 2x the index. What’s notable from our graphic is what’s modified:

Bitcoin annual volatility has dropped to 2x that of the Nasdaq from over 8x in 2017, and the Bitcoin/Nasdaq ratio has disengaged from its previous reference to the yield curve. Liquidity is leaving the system and recession are typical implications of the US Treasury bond yield at about 120 bps under the Fed funds price, essentially the most since 1989. Broad adoption could rely on Bitcoin exhibiting it could outperform the Nasdaq, notably in a recession.”

McGlone additionally highlights how approval of Bitcoin spot exchange-traded funds (ETF) may present BTC with a big tailwind throughout a recession, however it’s unclear when the U.S. Securities and Trade Fee (SEC) will decide on the pending purposes.

“US ETFs are a tailwind for the crypto, however timing is unsure.”

Bitcoin is buying and selling for $30,369 at time of writing, down 0.7% over the past 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses it’s possible you’ll incur are your duty. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Alexander56891/Sensvector