On August 14, Kevin Kelly, Co-founder of outstanding crypto analysis agency Delphi Digital provided some attention-grabbing insights on Bitcoin and the crypto market generally. Based on Kelly, the crypto market strikes in constant cycles, and we’re at present within the preliminary phases of a brand new cycle based mostly on market proof.

Utilizing the premier cryptocurrency as a benchmark, Kelly states a crypto cycle normally begins with Bitcoin attaining a brand new all-time excessive (ATH) worth, adopted by an 80% loss within the subsequent 12 months. Thereafter, BTC would expertise a market restoration over two years earlier than embarking on a bullish run to realize a brand new ATH.

The Interaction Between The Crypto Cycle And Macroeconomic Alerts

Primarily based on Kelly’s evaluation, a typical crypto cycle happens inside 4 years, and its occasions are triggered by some components within the larger macro enterprise cycle.

Associated Studying: Bitcoin Worth Comparatively Muted – What Might Set off A Sharp Decline?

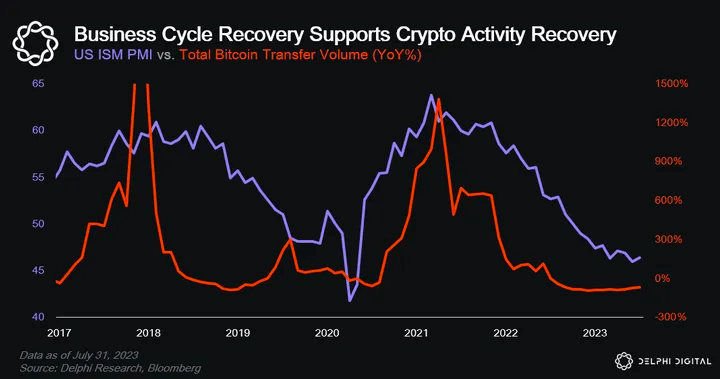

The analyst famous that, for instance, Bitcoin normally attains new value peaks on the identical interval because the Institute of Provide Administration (ISM) Index – an financial indicator that tracks the manufacturing sector’s well being in the US.

He mentioned:

BTC value peaks happen across the identical time the ISM exhibits indicators of topping out. Lively addresses, complete transaction volumes, complete charges – all of them peaked alongside tops within the ISM too. Because the enterprise cycle exhibits indicators of restoration, so too does community exercise ranges…

Attributable to this similarity in market motion, Kevin notes that turning moments in a typical enterprise cycle have confirmed to be a good interval to extend one’s publicity to threat belongings resembling Bitcoin.

Supply: Delphi Digital

Bitcoin Poised To Attain New ATH By This fall 2024, Kelly Says

Curiously, Kevin Kelly acknowledged in his evaluation that the ISM is at present heading towards the tip of a two-year downtrend, indicating that BTC’s costs could quickly begin surging within the coming months.

To again his long-term bullish value prediction, Kelly highlights a number of different components, together with the Bitcoin Halving occasion developing in April 2024.

The Delphi Digital Co-founder acknowledged that the final two Bitcoin halvings had occurred 18 months after BTC’s value tanked and seven months earlier than rallying to a brand new ATH.

Associated Studying: Bernstein Predicts Spot ETFs Might Declare 10% Of Bitcoin’s Market If Greenlit

Primarily based on this historic knowledge, BTC might properly attain a brand new ATH by This fall 2024. Nonetheless, as with all predictions, Kelly acknowledged which might be sure threat components concerned.

Firstly, he predicted that the BTC market is prone to quickly witness a modest promoting stress or value consolidation, particularly following the market’s robust restoration within the final 9 months.

As well as, he additionally highlighted the potential of the enterprise cycle presenting a false bearish finish – as seen in March 2020 – or not reaching its bearish finish as quickly as predicted.

Based on knowledge from CoinMarketCap, Bitcoin is buying and selling round $29,333.89, with a 0.12% decline on the final day. Nonetheless, the token’s day by day buying and selling quantity is up by 26.38% and is valued at $12.2 billion

BTC buying and selling at $29,322 on the day by day chart | Supply: BTCUSD chart on Tradingview.com

Featured picture from LinkedIn, chart from Tradingview