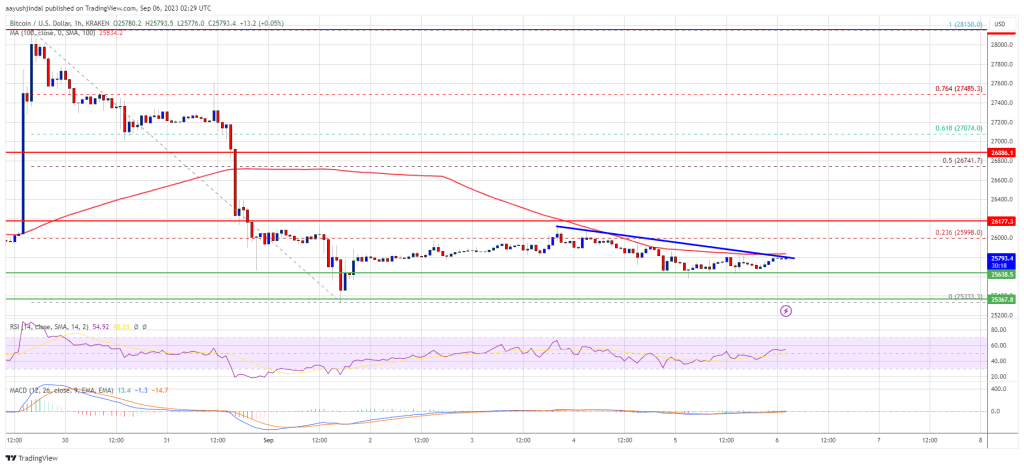

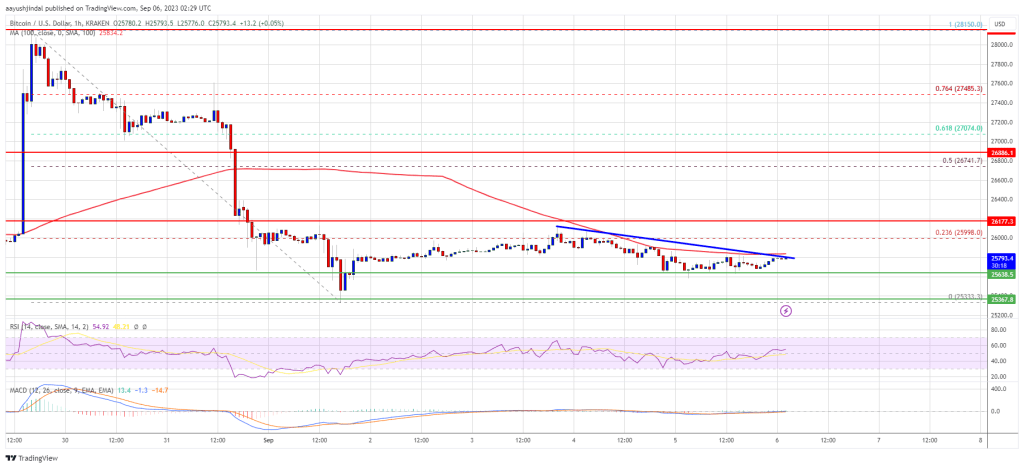

Bitcoin value is consolidating above $25,650 and $25,500. BTC may begin a good enhance if the bulls handle to push it above the $26,200 resistance.

- Bitcoin is buying and selling in a spread above the $25,650 help zone.

- The value is buying and selling under $26,000 and the 100 hourly Easy shifting common.

- There’s a short-term bearish pattern line forming with resistance close to $25,800 on the hourly chart of the BTC/USD pair (knowledge feed from Kraken).

- The pair may take a serious hit if it continues to wrestle under the $26,200 resistance zone.

Bitcoin Worth Begins Consolidation

Bitcoin value remained in a spread and settled nicely under the $26,200 resistance zone. It looks like BTC bulls are at present defending a draw back break under the $25,650 and $25,500 help ranges.

It’s clearly consolidating above the $25,650 stage. Nevertheless, it’s also under $26,000 and the 100 hourly Easy shifting common. Apart from, there’s a short-term bearish pattern line forming with resistance close to $25,800 on the hourly chart of the BTC/USD pair.

Rapid resistance on the upside is close to the $25,800 stage and the pattern line. The primary main resistance is close to the $26,000 stage or the 23.6% Fib retracement stage of the primary decline from the $28,150 swing excessive to the $25,330 low.

The following main resistance is now close to the $26,200 stage. A correct shut above the $26,200 stage may begin a good restoration wave towards $26,750. It’s near the 50% Fib retracement stage of the primary decline from the $28,150 swing excessive to the $25,330 low.

Supply: BTCUSD on TradingView.com

The following main resistance is close to $27,000, above which the bulls may achieve energy. Within the said case, the worth may take a look at the $28,000 stage.

One other Drop In BTC?

If Bitcoin fails to clear the $26,200 resistance, it may proceed to maneuver down. Rapid help on the draw back is close to the $25,650 stage.

The following main help is close to the $25,350 stage. A draw back break and shut under the $25,350 stage may ship the worth additional decrease. Within the said case, the worth may drop towards $24,800 and even $24,500.

Technical indicators:

Hourly MACD – The MACD is now shedding tempo within the bearish zone.

Hourly RSI (Relative Energy Index) – The RSI for BTC/USD is now above the 50 stage.

Main Assist Ranges – $25,650, adopted by $25,350.

Main Resistance Ranges – $25,800, $26,000, and $26,200.