- Bitcoin’s common every day transaction rely surged to 522,000 in September.

- The reserve danger indicator instructed that BTC’s worth was at a market backside.

Traders continued to maintain an in depth watch on Bitcoin’s [BTC] worth, which remained above the $26,000 mark at press time. Furthermore, on 28 September, Messari posted an evaluation that highlighted the king coin’s efficiency on a number of fronts over the previous few weeks.

Take a look at our newest Bitcoin Transient masking all issues BTC, together with the newest out of Runes, Grayscale, and MicroStrategy. https://t.co/GucLHkmpPg

— Messari (@MessariCrypto) September 28, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

SEC and Bitcoin

Messari’s report started with highlights of the ETF and SEC episodes. For the uninitiated, a federal decide ordered the SEC to evaluation Grayscale’s request for a spot Bitcoin ETF on 29 August. This incident precipitated BTC’s worth to maneuver up as prospects of a Bitcoin spot ETF heightened.

The worth improve was, nonetheless, fleeting, as the worth fell again to earlier ranges in simply two days.

Whereas this occurred, MicroStrategy, which is among the largest BTC holders, elevated its accumulation. Based on an SEC submitting submitted on 25 September, MicroStrategy stockpiled almost 5,445 Bitcoin for $147 million, rising the corporate’s whole BTC holding to 158,245 BTC.

Bitcoin’s community exercise is commendable

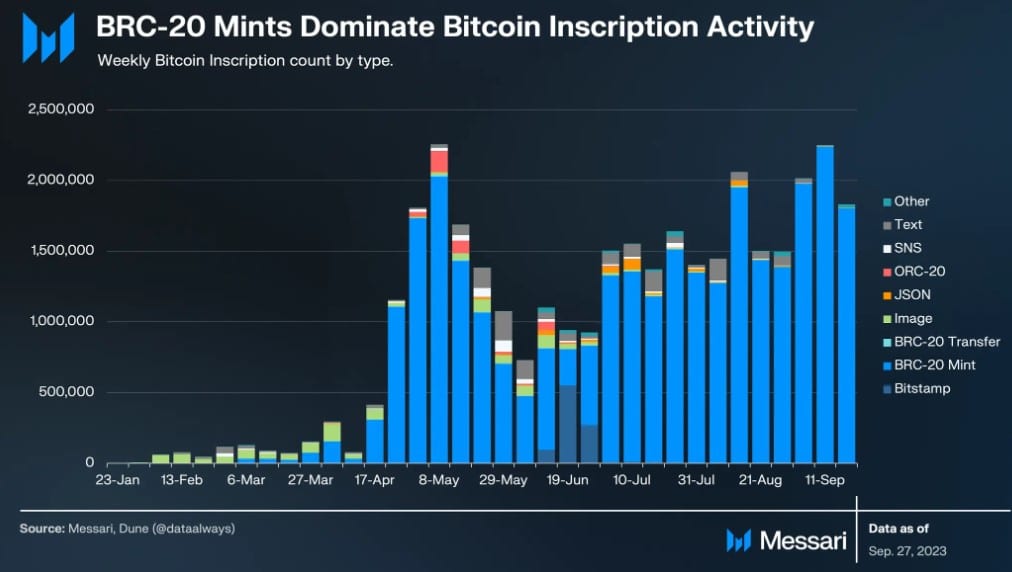

Aside from the aforementioned updates, Messari’s report additionally highlighted Bitcoin’s community exercise. For example, BTC Ordinals, which gained a lot recognition proper after its inception, continued to indicate sturdy upward momentum.

Within the final month, there have been 7.7 million Inscriptions on Bitcoin, which is a 20% improve from the earlier month. In reality, Inscriptions additionally accounted for greater than 20% of the full transaction charges for bitcoin in September, which appeared encouraging.

Supply: Messari

Messari’s evaluation revealed that between 2021 and 2022, Bitcoin transaction counts remained comparatively stagnant. Nevertheless, this modified with the emergence of Inscriptions in early 2023.

In September, the common every day transaction rely surged to 522,000, which was a 12% improve in comparison with the earlier month.

Moreover, Bitcoin’s energetic addresses skilled a breakthrough in September, surpassing the 1 million threshold. As per the report, the every day common rely of energetic addresses reached 1.04 million, which was a 9% improve in comparison with August.

Supply: Messari

Ought to traders have excessive hopes for BTC?

Although a number of metrics registered upticks during the last month, the king of cryptos’ worth motion remained comparatively much less risky. As per CoinMarketCap, BTC’s worth solely elevated by 1% within the final seven days.

On the time of writing, it was buying and selling at $26,963.98 with a market capitalization of over $525 billion.

Messari’s evaluation additionally included a have a look at BTC’s reserve danger. The reserve danger indicator measures the boldness of long-term holders relative to the worth of BTC.

At press time, the reserve danger lingered in proximity to vital historic ranges, which have beforehand aligned with market bottoms.

Supply: Glassnode

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Moreover, LunarCrush’s data revealed that bullish sentiment round BTC additionally elevated by greater than 6% within the final seven days.

Subsequently, contemplating the above-mentioned metrics and BTC’s worth almost touching the $27,000 mark, traders may witness a bull rally within the days to observe.