Final week marked a noteworthy surge for Solana in inflows, main the pack in altcoin funding pursuits and outshining Bitcoin. Solana’s current efficiency significantly positioned it within the highlight because it amassed roughly $24 million, the altcoin registered its largest influx since March 2022, in keeping with a current report from Coinshares.

A Nearer Look: Dissecting The Solana Influx Surge

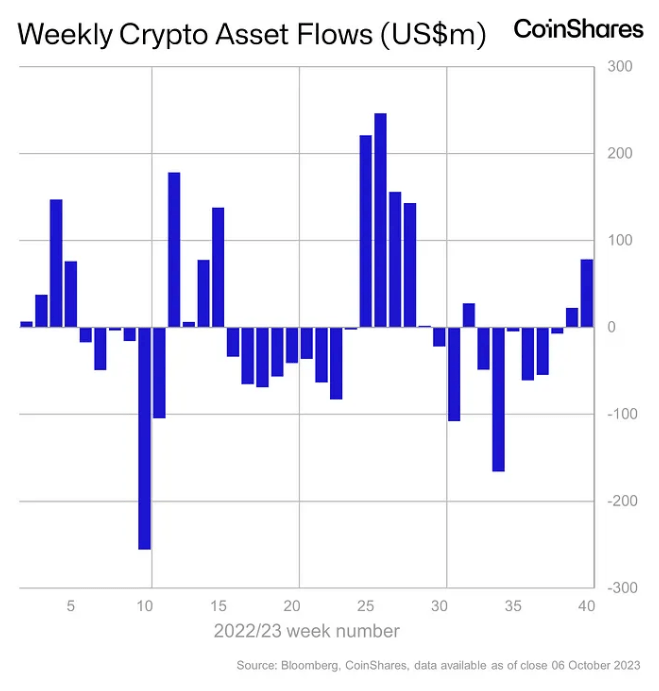

Diving into the numbers, the broader digital-asset funding area noticed internet inflows for the second consecutive week, accumulating a major $78 million, showcasing a bullish sentiment harking back to July’s efficiency.

Whereas Bitcoin, the quintessential crypto large, continued to dominate, Solana grabbed headlines. As highlighted by James Butterfill, Head of Analysis, Solana’s re-emergence as a sought-after altcoin signifies its rising enchantment amongst digital traders, particularly in mild of current Ethereum futures ETF product launches.

In response to the report, with a noteworthy observe file for 2023, Solana funds reported inflows for 28 weeks, with a mere 4 weeks registering outflows.

At all times a serious participant, Bitcoin recorded inflows of $43 million. The report disclosed {that a} sure subset of traders, doubtlessly driving on Bitcoin’s current worth momentum, initiated positions in short-bitcoin merchandise, resulting in an influx of $1.2 million throughout the week.

Diverging Funding Patterns: Europe Leads Whereas ETH ETFs Underwhelm

Geographically, Europe continued its digital asset supremacy, accounting for 90% of the overall inflows. Quite the opposite, the mixed inflows from the US and Canada totaled a mere $9 million. In response to Butterfill, this noticeable regional disparity in funding sentiments underscores evolving market dynamics and investor preferences.

Including to the digital fervor, buying and selling volumes for exchange-traded merchandise surged by 37%, settling at $1.13 billion for the week. Trusted exchanges coping with Bitcoin additionally witnessed a 16% leap in buying and selling quantity.

Nevertheless, it wasn’t all sunshine and rainbows. The current US launch of six Ethereum futures ETFs raked under $10 million. Whereas seemingly substantial, Butterfill termed the response as showcasing a “tepid urge for food,” significantly when juxtaposed towards the $1 billion amassed by Bitcoin futures ETFs of their inaugural week again in 2021.

Nevertheless, Butterfill attributed this distinction extra to the contrasting market environments and the “poor investor urge for food” for digital property slightly than a direct reflection of the asset’s potential.

Moreover, whatever the recorded constructive inflows from Solana final week, the altcoin is at present dealing with a massacre together with Bitcoin. Notably, Solana has declined by practically 10% up to now week and 4.5% up to now 24 hours, with a market worth of $22.30 on the time of writing.

In distinction, Bitcoin has additionally shed its portion of losses, down by 2.9% up to now 7 days and 1.4% up to now day, with a buying and selling worth at present at $27,518.

Featured picture from Unsplash, Chart from TradingView