The chief funding officer on the largest crypto index fund supervisor within the US could be very optimistic about what a spot Bitcoin (BTC) exchange-traded fund (ETF) approval might do for the king crypto’s value.

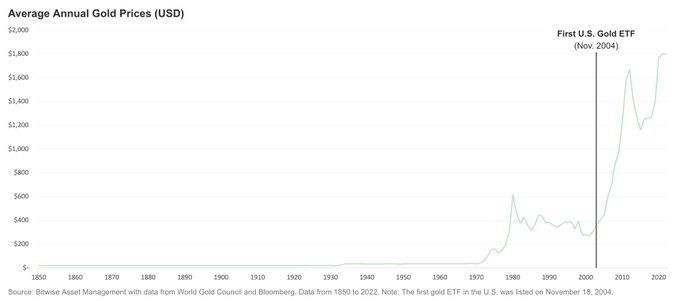

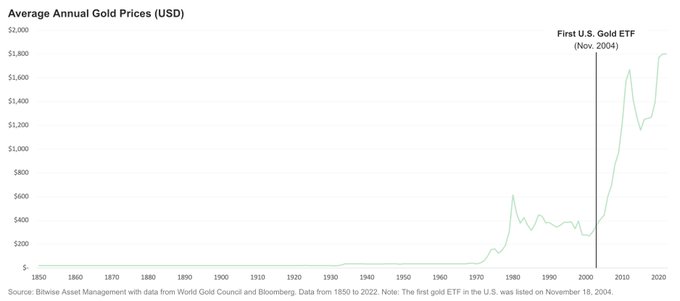

Matt Hougan, CIO of Bitwise, draws a comparability to what occurred to gold’s value after the dear metallic secured its first ETF within the US in 2004, suggesting one thing comparable might occur to BTC.

“Individuals ask me: What occurred when the primary gold ETF launched within the US?”

Bitwise is certainly one of quite a few corporations that has submitted a spot Bitcoin ETF software to the U.S. Securities and Change Fee (SEC).

In a latest interview with Pondering Crypto, Hougan said that Bitwise is targeted on educating conventional finance stakeholders about Bitcoin.

“The factor to consider with the Bitcoin ETF – why it issues – is it unlocks this different phase of the market that basically has no allocation to crypto, which is the monetary advisor market. Now this is a vital market – it’s at the very least twice, and possibly 4 instances as huge, as self-directed retail traders. So the individuals who personal crypto now are principally self-directed retail traders. The monetary advisor market controls between 2x and 4x as many property.

And so what we’re doing day by day, with a 20-plus particular person gross sales workforce, is having conferences with these advisors, speaking to them about what Bitcoin is, speaking to them about the place it suits of their portfolio, and laying the groundwork for when that ETF launches, for them to undertake it readily. We’re seeing actual traction. There are quite a lot of advisors who need to allocate forward of the Bitcoin ETF.”

I

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney