In a flip of occasions inside the non-fungible token (NFT) market, Bitcoin (BTC) has achieved a major milestone by surpassing Ethereum (ETH) in 24-hour NFT gross sales quantity. This marks the primary time that Bitcoin has outperformed Ethereum on this side.

BTC’s NFT Breakthrough

Bitcoin’s current achievement of surpassing Ethereum in 24-hour NFT gross sales quantity indicators a altering pattern and rising curiosity within the NFT market.

Whereas Ethereum has lengthy been acknowledged because the dominant blockchain for NFTs, Bitcoin’s entrance into the area demonstrates its rising relevance and enchantment to NFT fans and collectors.

The knowledge highlights that Bitcoin accounted for $17,291,694 in NFT gross sales, with 575 patrons collaborating. Then again, Ethereum recorded $26,689,252 in complete gross sales, with 11,225 patrons.

Regardless of Ethereum sustaining the next complete gross sales determine, the comparatively decrease wash share of Bitcoin suggests a probably more healthy and extra natural market exercise.

Nevertheless, with regards to volatility, knowledge from Deribit, the main crypto derivatives change, exhibits that the unfold between ETH and BTC volatility, generally known as the ETH DVOL vs. BTC DVOL unfold, has narrowed considerably since October twenty third from -11.6 to simply -0.6. This shift signifies a change in investor sentiment and elevated consideration in the direction of Ethereum and altcoins.

In gentle of this improvement, Ethereum has outperformed Bitcoin over the previous fourteen days. ETH has seen important value motion, gaining over 2% within the final 24 hours, 6% within the final seven days, and 4% within the final fourteen days, bringing its present value to $1,899.

In the meantime, Bitcoin has exhibited a slowdown in its upward momentum and is presently consolidating above $35,400. It has seen a 2% enhance prior to now 24 hours, 3% prior to now seven days, and 1% within the fourteen-day timeframe.

Nevertheless, you will need to notice that BTC has gained greater than 82% year-to-date, whereas ETH has solely elevated by 30% throughout the identical interval, in accordance with CoinGecko knowledge.

Nasdaq 100 Correlation With Bitcoin Plummets

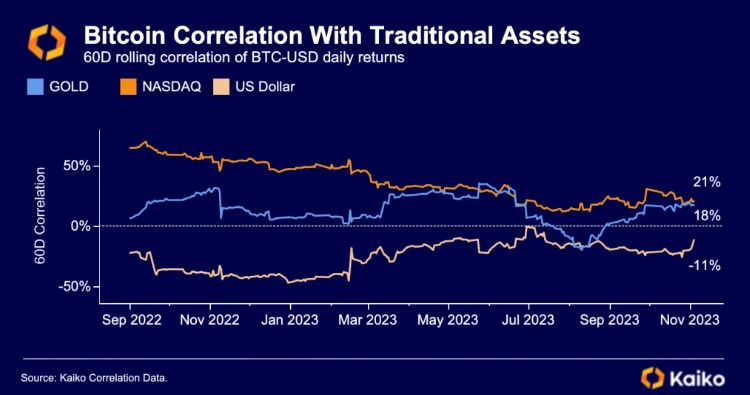

In line with current Kaiko knowledge, BTC has witnessed a major decline in its correlation with conventional belongings all year long. One notable improvement is the diminishing correlation between Bitcoin and the Nasdaq 100 index.

Over the previous yr, Bitcoin’s 60-day correlation with the Nasdaq 100 has considerably declined, plunging from over 70% in September 2022 to roughly 19% as of final week.

Bitcoin’s damaging correlation with the US greenback, which ranged from 40% to 50%, has additionally weakened. At the moment, the correlation is round 11%, signifying a lowered tendency for Bitcoin’s worth to maneuver in the wrong way of the US greenback.

Whereas Bitcoin’s correlation with gold has seen some upward momentum since August, the typical correlation all year long has remained comparatively low at 12%.

This means that the connection between Bitcoin and gold has been modest concerning value actions and signifies a possible divergence in funding traits between the 2 belongings.