In just some days, the quantity of worth despatched into the Blast deposit contract on Ethereum has elevated by an order of magnitude to $390 million.

A sensible contract, marketed as a “bridge” for a yet-to-be-developed optimistic rollup, has acquired about $340 million in ether and $50 million in stablecoins since launching Monday.

The contract, is managed by a Secure 5-key multisig the place 3 keys are required to execute transactions. Nonetheless, one of many 5 keys has no transaction historical past, and the opposite 4 present preliminary ether deposits from the identical Ethereum account.

There is no such thing as a method for an out of doors observer to know whether or not the 5 keys have been generated by 5 impartial entities or individuals.

Improvement of the venture, backed by VC companies Paradigm and Commonplace Crypto, together with a slew of influential crypto personalities and merchants, is being spearheaded by Blur co-founder, Tieshun Roquerre who goes by the pseudonym “Pacman.”

The previous Thiel Fellow and MIT dropout beforehand informed Blockworks that “every signer is a novel contributor to Blast,” and that the venture makes use of “the identical safety mannequin” as different L2s specifying Optimism, Polygon, and Arbitrum.

Nonetheless, every of those networks, whereas not absolutely trustless, has extra safety parts moreover a multisig. For example, Arbitrum has a publicly elected “safety council” with 12 members, solely two of that are on the Offchain Labs improvement group.

Blockworks contacted Paradigm and Commonplace Crypto and Pacman for clarification.

Deposited ether can’t be withdrawn till February 2024, when the event group should modify the deposit contract, presumably alongside the launch of an precise rollup.

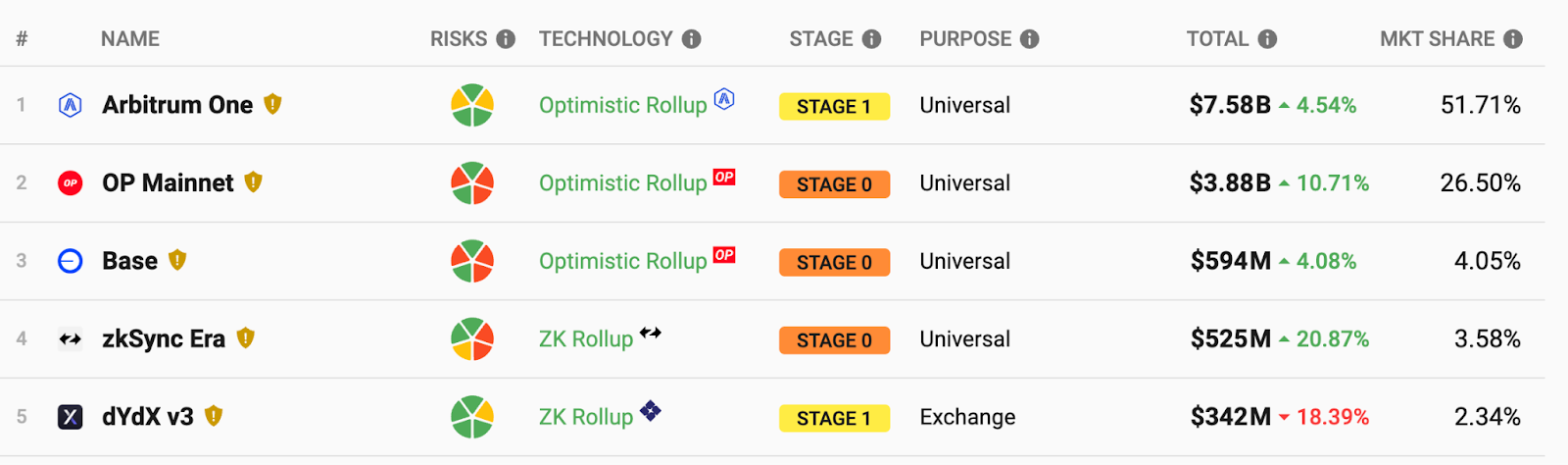

Ethereum layer-2 tracker L2BEAT lists the venture in it’s “Upcoming” part, however have been it energetic as we speak it could rank between zkSync Period, which launched mainnet in October 2022, and dYdX V3 the StarkEx rollup that has been energetic since April 2021.

Energetic Ethereum L2s; Supply; L2BEAT

One depositor tossed 10,000 ETH, price $21 million on the time, into the contract in a single transaction.

“Collective mind of Crypto Twitter” weighs in

Many crypto observers have expressed shock at Blast’s fast progress within the face of unsure dangers.

Blast has touted on its X account that ether staking represents “risk-free return,” a view which Lido DAO members, together with Blast traders, have expressed lacks nuance.

necessary to make clear that this assertion is fake.

whereas i’m of the opinion that staking must be made as near risk-free as doable, we’re not there as we speak. there are governance, contract, and operator dangers concerned.

anybody utilizing Blast must hold these in thoughts https://t.co/8z9dVJhr6J

— sacha💧 (@sachayve) November 21, 2023

Orlando Cosme, founding legal professional of OC Advisory, criticized the venture, calling it an “onchain hedge fund” that’s “proving regulators’ level.”

Blast is proving regulators’ level.

An onchain hedge fund managed by a 3/5 anon multisig isn’t defi. It’s “belief me bro.”

And centuries of “belief me bro” is why monetary regs exist.

Crypto’s worth add—and why crypto wants diff regs—is belief discount.

We will do higher.

— orlando.btc (@Orlando_btc) November 23, 2023

A straw ballot carried out by Tangent Ventures founder Jason Choi, looking for to faucet “the collective mind of CT,” has garnered over 2,500 respondents. The unscientific opinion ballot places the chances of an exploit of the deposited crypto property between now and February at 64%.

Will Blast bridge be exploited earlier than February?

— Jason Choi (@mrjasonchoi) November 24, 2023

Offchain Labs’ Chief Technique Officer, A.J. Warner, famous Thursday in an X put up that the Arbitrum improvement agency had thought of the same design however opted to not pursue it.

Btw, this doesn’t imply staking bridged funds is per se a foul thought. There are methods to handle/disclose dangers and so forth. in concept. It’s simply apparent that the way in which Blast is doing it isn’t how we might strategy it.

— A.J. Warner (💙,🧡) (@ajwarner90) November 23, 2023

Only a few of the listed traders have publicly addressed criticisms of the venture to this point, although some declare to have privately communicated considerations.

Dovey Wan, a Blast investor and Founding father of Primitive.Ventures, promoted the venture’s success attracting capital as having “pre-bull vitality,” and “sturdy pumpanomics,” whereas hand waving considerations over the safety of funds, by acknowledging “it’s only a multisig managed by 5 [profile pics] on-line.”

Wan urged crypto customers to “bridge for tradition bridge for enjoyable bridge for what you may afford to lose all of it,” alongside the vacuous caveat that the promotion was “no FA DYOR” — not monetary recommendation, do your personal analysis.