Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- FIL hiked massively up to now few weeks.

- The momentum slowed amidst macroeconomic uncertainty.

Filecoin [FIL] has seen double-digit appreciation up to now few weeks. Prior to now seven and 30 days, the token rallied by 50%. The most important driving issue for the latest uptrend was a deliberate enlargement to incorporate a Filecoin digital machine (FEVM).

Nevertheless, FIL tanked by over 10% up to now 24 hours, in response to CoinMarketCap. The correction adopted a pointy rejection of Bitcoin [BTC] on the $25K value stage amidst market uncertainty and a doable hawkish stance by the Fed if inflation persists.

Is your portfolio inexperienced? Take a look at the FIL Revenue Calculator

The Private Shopper Expenditure (PCE), to be launched on Friday, is an important device Fed makes use of to trace inflation and will decide its coverage stance in March FOMC’s assembly.

Merely put, Friday’s occasion will affect FIL’s value motion in March and general Q1 2023 efficiency.

FIL’s short-term restoration at stake

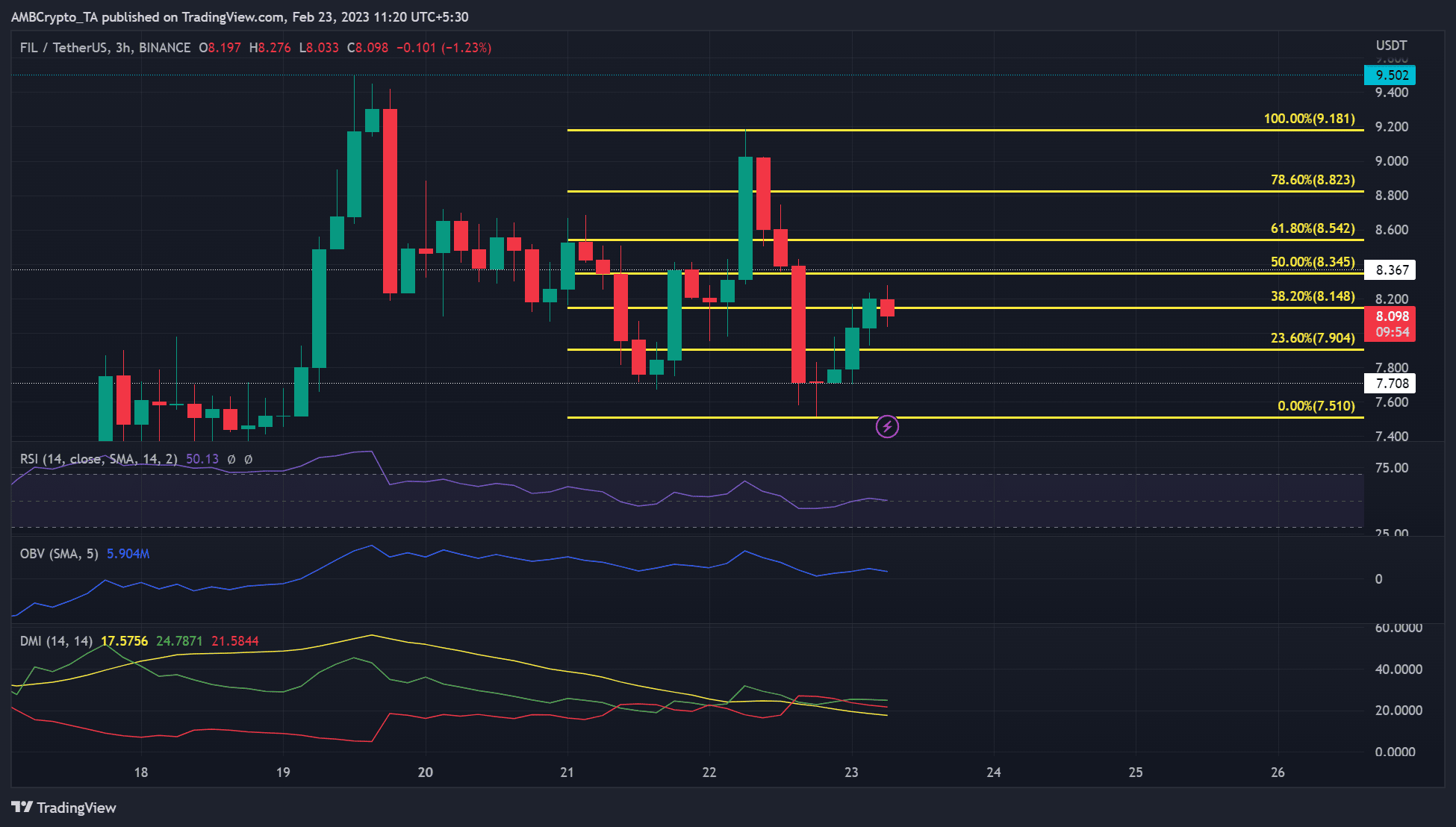

Supply: FIL/USDT on TradingView

Notably, FIL tanked by 17% after a value rejection at $9.181. However $7.708 help was regular and allowed bulls to launch a restoration however confronted an impediment by the point of writing.

FIL may drop to the 23.60% Fib stage of $7.904, $7.708, or $7.510, particularly if BTC falls beneath $24.20K. Brief-term bears can use these ranges as short-selling targets. A cease loss will be positioned above the 50% Fib stage of $8.345.

How a lot are 1,10,100 FILs price right this moment?

Then again, near-term bulls may goal the overhead resistance stage of $9.181 if FIL closes above the 50% Fib stage. However they have to take care of the hurdles at 61.8% and 78.6% Fib ranges. The upswing could possibly be accelerated if BTC retests the $25K stage. However the upswing will invalidate the above bearish bias.

In the meantime, the RSI and OBV declined considerably up to now few days, exhibiting that FIL’s momentum slowed. As well as, the DMI (Directional Motion Index) confirmed -DI (pink line) elevated in the identical interval, confirming the weakening construction.

FIL’s improvement exercise and demand declined; weighted sentiment improved

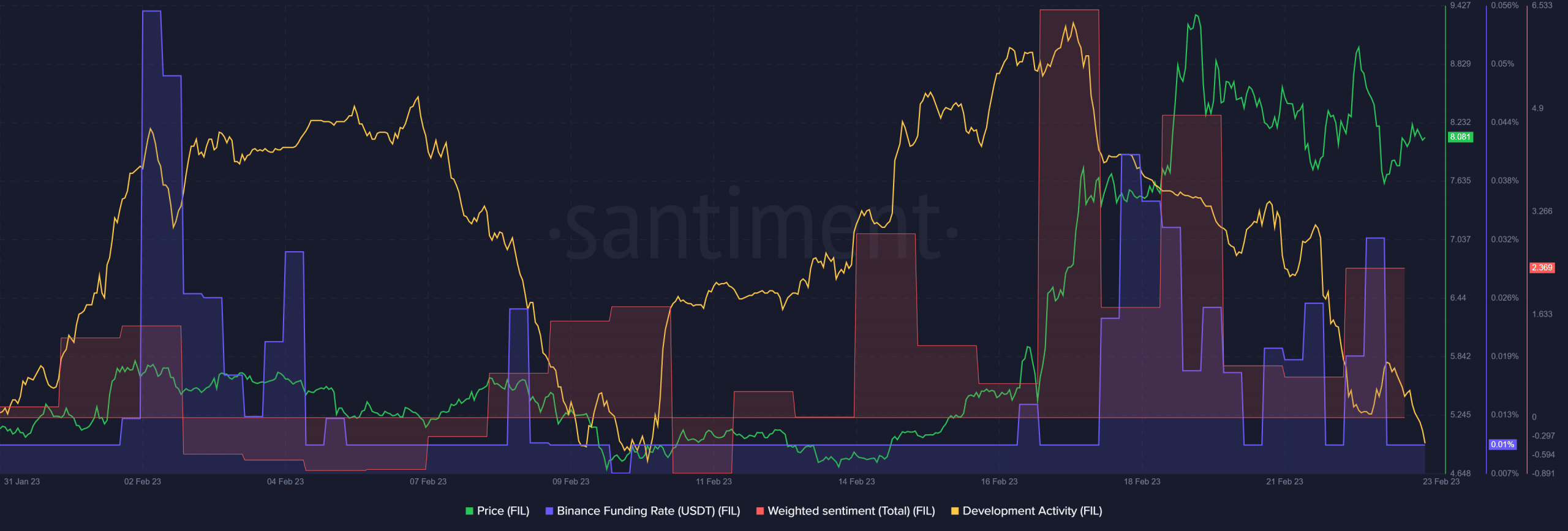

Supply: Santiment

In accordance with Santiment, FIL’s improvement exercise declined from 16 February. Equally, the weighted sentiment fell as demand fluctuated, as proven by the Funding Fee.

However the Funding Fee remained optimistic, and sentiment improved, denoting the gentle bullish sentiment at press time. Any additional enhance in demand and optimistic sentiment may push FIL in the direction of the 50% Fib stage. However buyers ought to observe BTC value motion earlier than making strikes.