Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- ADA cleared half of the positive factors made on the mid-February rally.

- Weekly value volatility and open curiosity flashed weak indicators of a pivot.

Over the previous few days, bears have remained accountable for the market, resulting in an prolonged correction for Cardano [ADA]. Ethereum’s [ETH] blockchain rival has already cleared 10% of its 20% positive factors from the mid-February hike. As of press time, ADA was buying and selling at $0.3792 and had hit a key help stage.

Is your portfolio inexperienced? Take a look at the Cardano Revenue Calculator

Can the $0.3790 help maintain?

Supply: ADA/USDT on TradingView

After the FOMC assembly in mid-February, ADA rose from $0.3452 to $0.4216, a 20% appreciation. Nevertheless, it has since shaped a descending channel and fallen to $0.3744, a ten% drop after dealing with value rejection at $0.4216.

If bulls defend the $0.3790 help, near-term targets might embody the 50% Fib stage of $0.3834 or the 61.8% Fib stage of $0.3924. Nevertheless, key resistance ranges additionally lie at $0.3985 and $0.4052.

Alternatively, sellers might search market entry if ADA closes under the $0.3790 help. This might supply shorting alternatives on the 38.2% Fib stage of $0.3744 or $0.3712 (the descending channel’s decrease boundary). The downtrend may very well be accelerated if BTC drops under $23.76k.

How a lot are 1,10,100 ADAs value as we speak?

Weekly volatility and open rates of interest confirmed indicators of a pivot

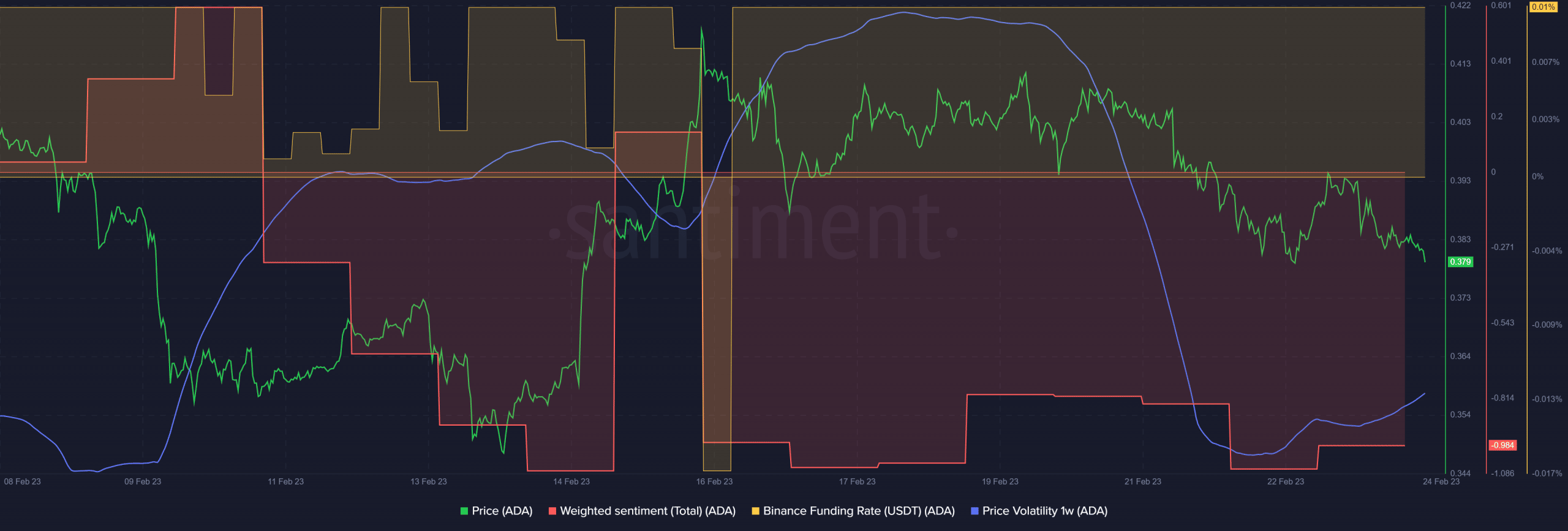

Supply: Santiment

Based on Santiment, ADA’s weekly value volatility hit backside and rose gently on the time of writing. Moreover, the Funding Fee remained constructive, suggesting that demand for ADA has remained steady regardless of the current value decline. This might point out a possible value reversal and short-term restoration if the bulls defend the $0.3790 help.

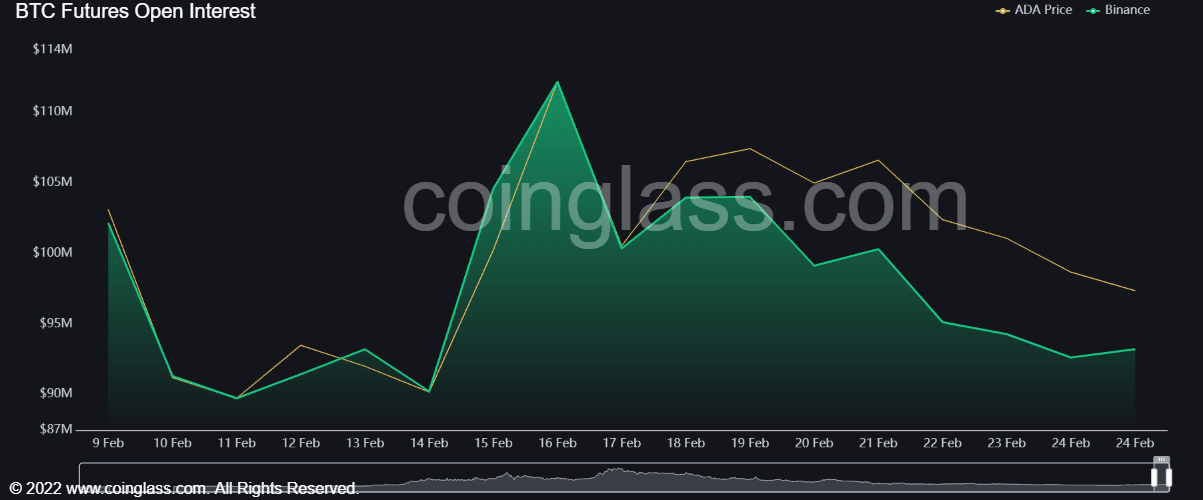

Furthermore, ADA’s open rate of interest confirmed an uptick at press time after a current drop, additional reinforcing the pivoting thesis. Nonetheless, the sentiment has improved however stays adverse, indicating warning for each bulls and bears.

Supply: Coinglass

![Cardano [ADA] slides down descending channel: Can bulls defend $0.3790?](https://nomadabhitravel.com/wp-content/uploads/2023/02/pasted-image-0-23-1-1536x874.png)