Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- Larger and decrease timeframe charts had been bearish.

- Community progress and velocity declined.

At press time, Ripple [XRP] depreciated about 7% since Wednesday (8 March) and was on the verge of breaching one other key Fib retracement stage.

On the similar time, Bitcoin [BTC] dropped beneath the $20K psychological stage forward of the U.S. Jobs Report on 10 March.

Learn Ripple [XRP] Worth Prediction 2023-24

A powerful jobs report might tip the Fed to undertake increased charges and improve promoting strain, whereas a weak report might result in a possible dovish strategy in March’s FOMC assembly.

Can the 23.6% Fib stage maintain?

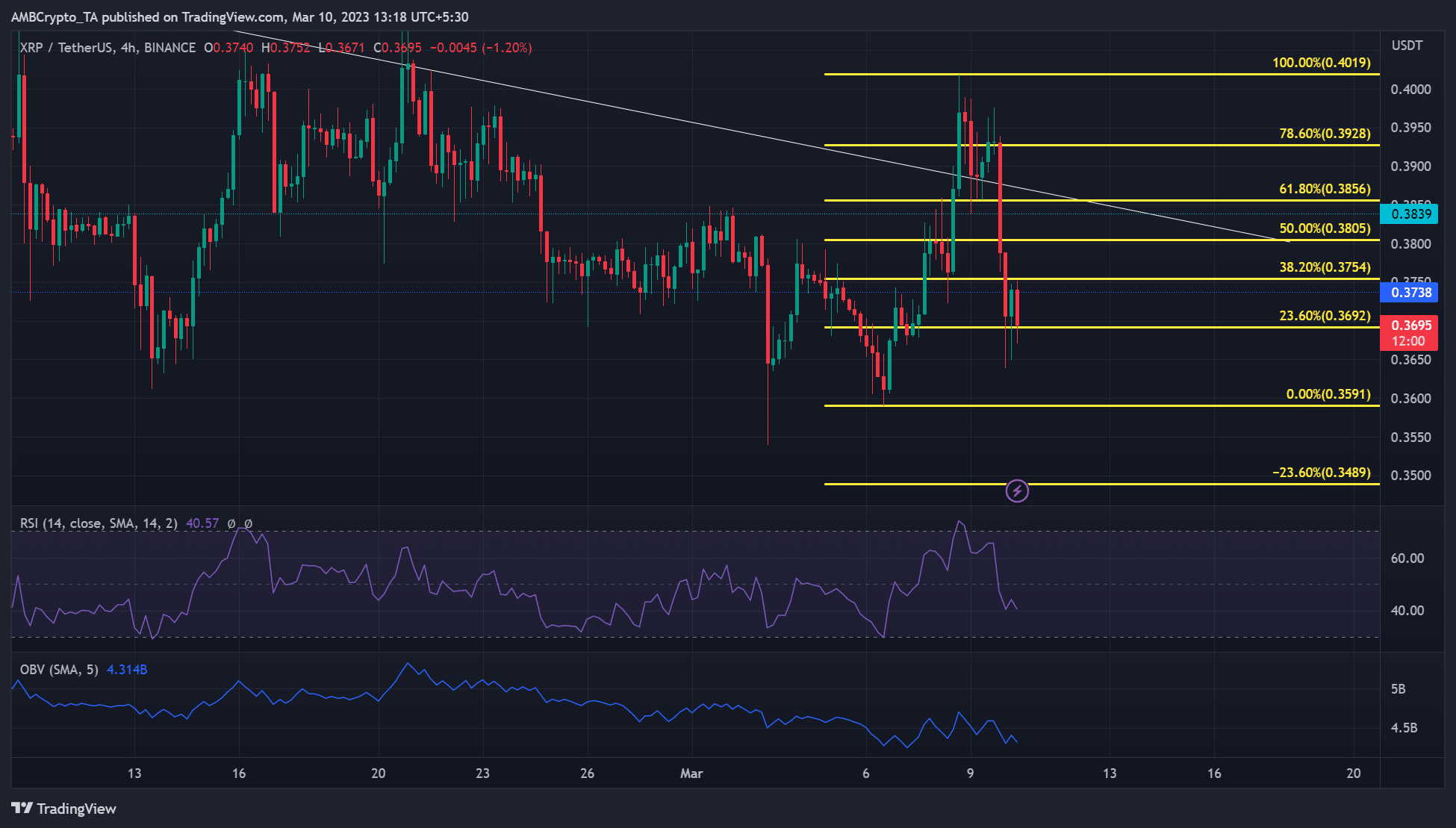

Supply: XRP/USDT on TradingView

XRP has been toiling beneath the descending line (white) prior to now few weeks. A false breakout above it occurred on 8 March earlier than dealing with worth rejection at $0.4019.

Though a pullback retest on the descending line provided a restoration, it was stopped by the 78.6% Fib stage ($0.3928) and set XRP for an prolonged correction. On the time of writing, the value oscillated between 23.6% and 38.2% Fib ranges however was on the verge of breaching the decrease boundary.

XRP might retest $0.3591 if short-term bears clear the hurdle at $0.3650. Due to this fact, these ranges might be shorting alternatives if the value shut beneath the 23.6% Fib stage ($0.3692).

Additionally, the value might bounce to 38.2% Fib stage ($0.3754) and face rejection, providing one other shorting alternative with targets at $0.3692.

Nevertheless, a transfer above 38.2% Fib stage ($0.3754) will invalidate the thesis. The upswing might set near-term bulls to focus on the 50% Fib stage ($0.3805) and different higher resistances for beneficial properties.

The RSI and OBV registered downticks, indicating the restricted shopping for strain which might supply bears extra leverage within the short-term.

Funding Charge and community exercise declined

Supply: Santiment

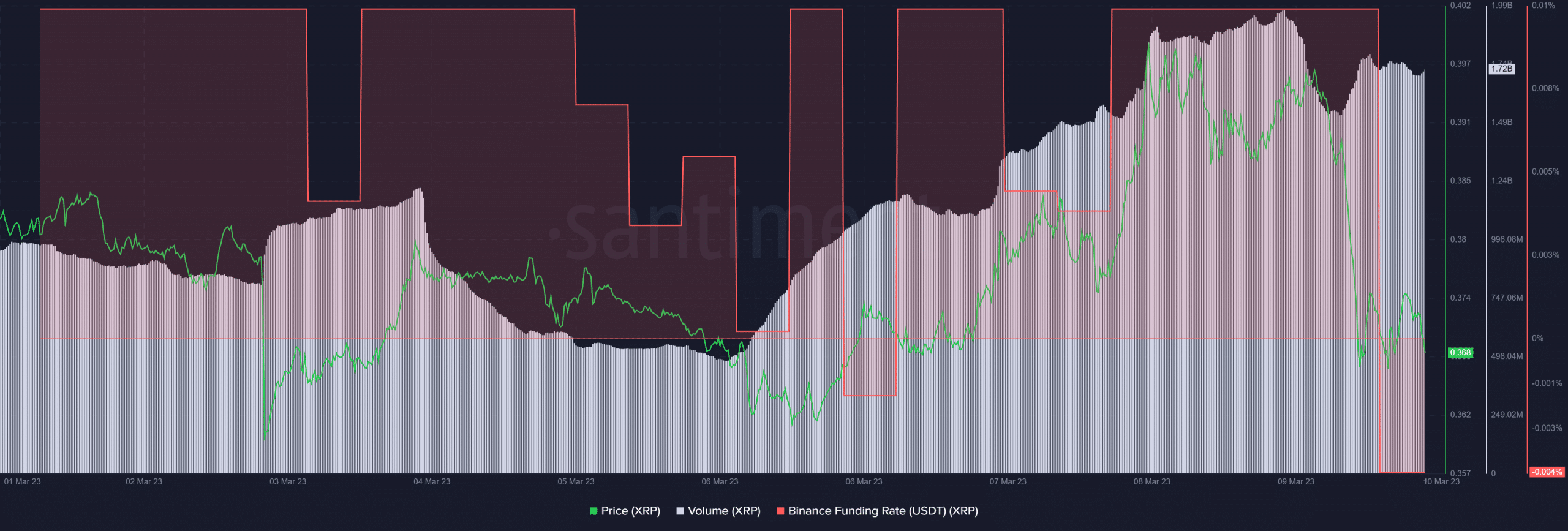

In line with Santiment, Funding Charge flipped to unfavourable on the time of writing, exhibiting bearish sentiment within the derivatives market. Equally, buying and selling volumes dropped barely and will supply bears extra affect available in the market.

Is your portfolio inexperienced? Examine the XRP Revenue Calculator

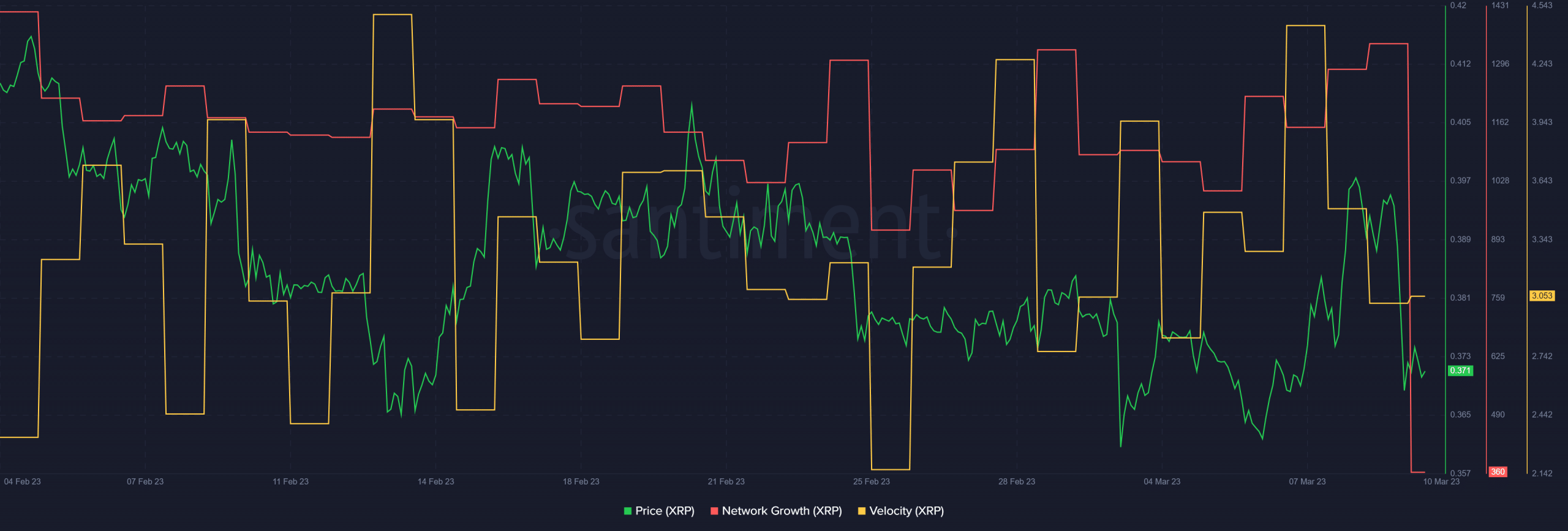

However, XRP’s velocity dipped, indicating that fewer tokens had been exchanged prior to now few days/hours. As well as, the community progress additionally declined sharply on the time of writing, proof of a decline within the traction of the challenge.

Supply: Santiment

![Ripple [XRP]: Short-term bears can gain more leverage only if…](https://nomadabhitravel.com/wp-content/uploads/2023/03/pasted-image-0-55-1536x874.png)