NFT

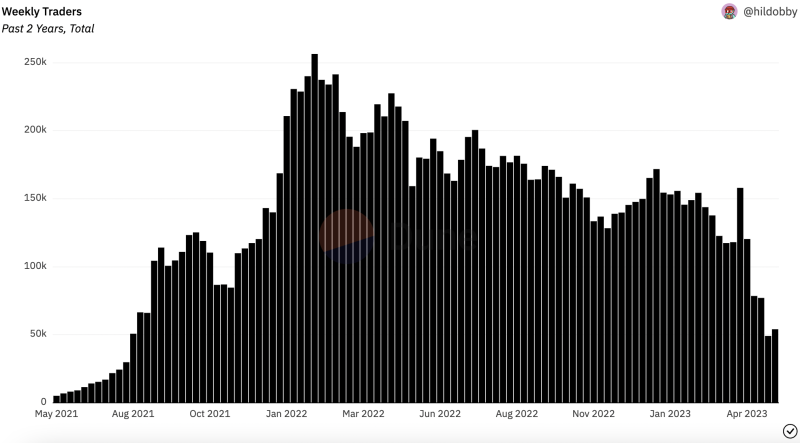

The variety of NFT merchants energetic on a weekly foundation has sunk to its lowest stage since August 2021, based on The Block Analysis.

Liquidity farming pushed by market Blur’s formidable incentive program aimed toward wooing merchants away from OpenSea, the long-time main platform in NFT buying and selling, has spurred an erosion in pricing. The decrease pricing coupled with common market volatility has then had the knock-on impact of lowering the variety of merchants, mentioned The Block Analysis Analyst Brad Kay.

“This erosion of the ground value, paired with heightened market volatility, has dampened the standard urgency to purchase, the ‘worry of lacking out,’ amongst common merchants,” he mentioned. “This volatility, in flip, has had a discouraging impact on common merchants, resulting in a lower in total buying and selling exercise.”

Final week, the variety of energetic merchants shopping for and promoting Ethereum NFTs slid to about 49,000, based on information from Dune analytics. The full variety of merchants has not been that low since August 2021, the information exhibits.

Weekly variety of energetic NFT merchants: Dune

NFTs are typically traded on Solana and Bitcoin blockchains, however the quantity is negligible when in comparison with Ethereum, the chain utilized by top-tier collections like CryptoPunks, Bored Ape Yacht Membership and Azuki.

The affect of Blur’s technique of providing profitable incentives to merchants with a purpose to overtake OpenSea as the highest market by buying and selling quantity has been unprecedented, mentioned Kay.

“Pushed by Blur Market’s aggressive airdrop and bidding incentives, liquidity farming has surged,” he mentioned. “Whereas this has stimulated short-term liquidity, it is also instigated a downward stress available on the market ground. Farmers, pursuing Blur’s rewards, settle for short-term buying and selling losses, consequently pushing costs decrease.”

“Liquidity farmers” are basically merchants aiming to make the most of Blur’s incentives by “artificially inflating the worth or quantity of an NFT earlier than quickly promoting it off,” mentioned Kay, including that this discourages “real” buying and selling whereas concurrently threatening liquidity.