Billionaire Chamath Palihapitiya is issuing a warning to traders, saying that the basics of the US inventory market are beginning to look shaky.

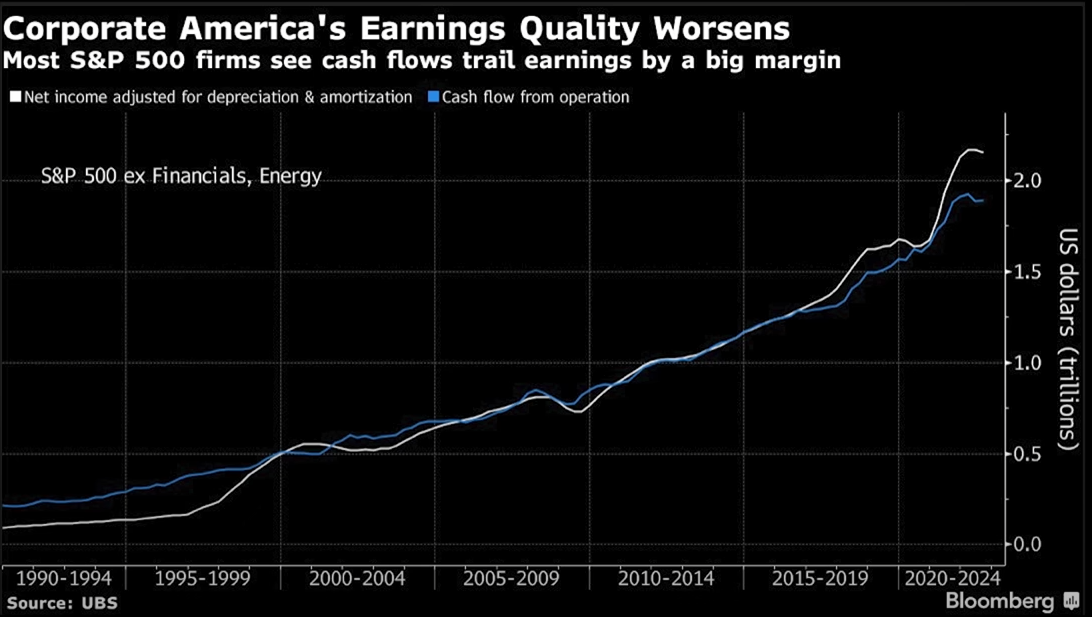

In a brand new All-In Podcast episode, Palihapitiya, who nailed the market meltdown final yr, shares a chart from Bloomberg that exhibits the huge disparity between earnings and money flows amongst S&P 500 corporations.

In accordance with the Social Capital CEO, the hole between the 2 basic metrics is at its widest level in about three a long time.

“In the event you give attention to the interval of 2020 to 2024, what you see is the white line, which is internet revenue adjusted for depreciation and amortization, and the blue line is money flows from operation. So what does that imply? This the very best 500 corporations on the planet.

The white line is what you inform Wall Road when it comes to what you make on paper. The blue line is what truly seems within the checking account. So why might there be a spot between what you inform any person you made… versus what’s within the financial institution? Nicely the reason being as a result of there’s all types of accounting tips that you should use…

Proper now, we now have the worst earnings state of affairs, so the worst hole between what we’re telling folks versus what is definitely within the checking account that we’ve had for 30 years since 1990. So it simply brings into focus the truth that we could also be in the previous couple of innings of attempting to verify this all seems okay.”

In accordance with the billionaire enterprise capitalist, the weak money flows of S&P 500 corporations might counsel {that a} inventory market meltdown is on the horizon.

“One faction of the investing world who thinks that this earnings recession is definitely at hand could be sort of proper after which what they might say is that after all of us understand that these earnings are pretend and also you reset down 15%, that’s whenever you get to the mid-3,000 [points] within the S&P 500…

I don’t know if that’s true or not however there’s an increasing number of proof that may help that the best way that they see the world could possibly be credible.”

At time of writing, the S&P 500 is buying and selling for 4045.65 factors.

I

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/Vadim Sadovski