Well-liked Bitcoin analyst Willy Woo says BTC faces a big impediment that might foil the king cryptocurrency’s potential for future development.

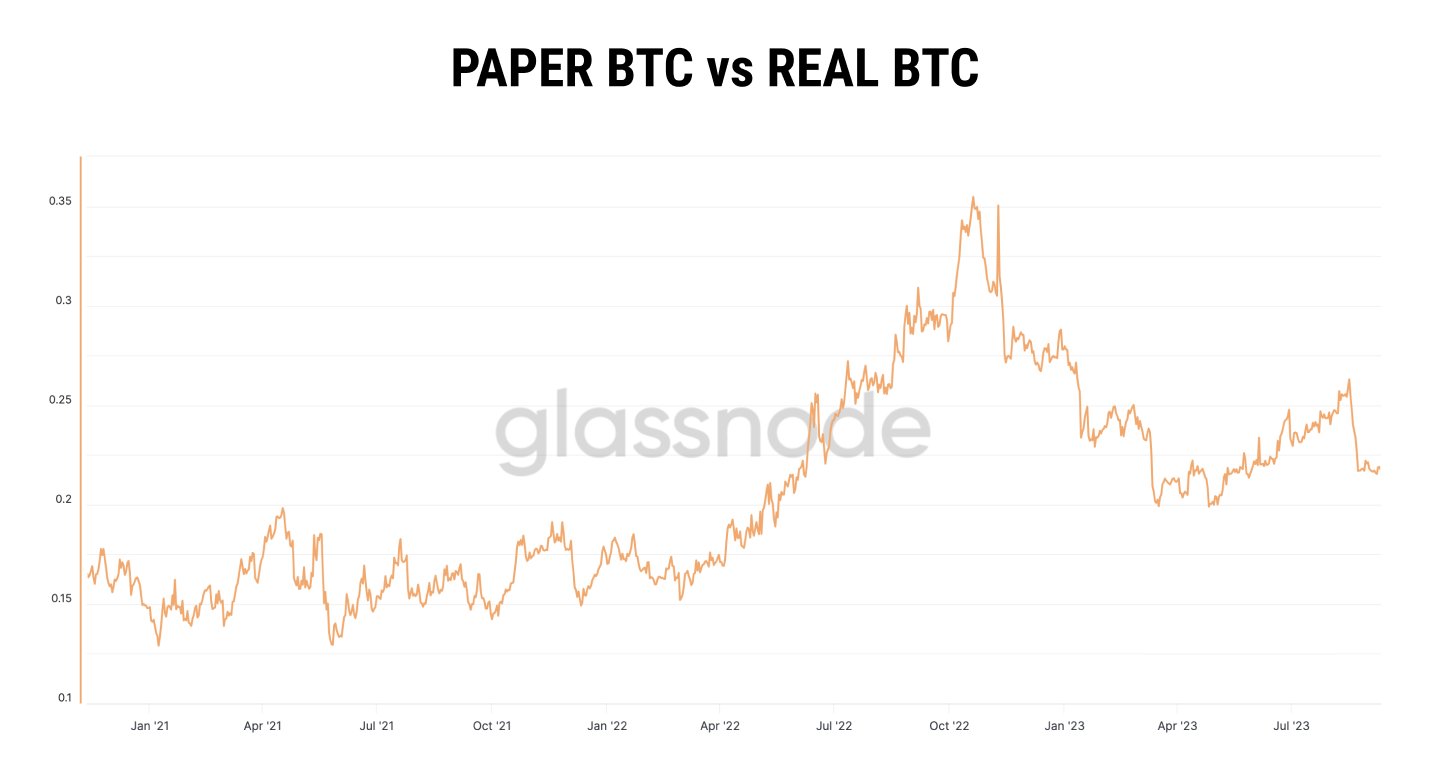

Woo shares a chart along with his 1 million followers on the social media platform X exhibiting the ratio between “paper” Bitcoin, or derivatives that signify BTC, and precise liquid cash.

“This can be a slide from my TOKEN2049 discuss. It’s the ratio of ‘paper BTC’ (mixed futures open worth) that’s traded vs. the true BTC that’s extremely liquid and traded. We at the moment are in a regime of 20-30% extra BTC being traded. This counteracts a bullish provide shock.”

In keeping with Woo, the rise of Bitcoin derivatives is taking liquidity away from BTC, enabling value manipulation and weaker rallies.

The analyst says that since US {dollars} (USD) are far more plentiful and available to buyers than BTC, the futures and derivatives markets permit massive gamers to take huge chunks of capital and use it to use inorganic promote stress on Bitcoin. Woo says the prominence of such markets is the “enemy” of Bitcoin and the explanation why BTC has had much less dramatic rallies in recent times in comparison with its early days.

“Long run, it permits establishments who should not have BTC to promote it with out restrictions so long as they’ve a lot of USD. See how the exponential reflexive bull runs ended as soon as futures markets got here on-line.”

Says Woo in a separate post,

“All it is advisable examine is the day by day volumes being traded on futures. It dwarfs the liquidity on spot markets. So long as that is the case, spot markets orbit the gravity of futures markets, not the opposite approach round.

Therefore you see the agenda laid out to delay a spot exchange-traded fund (ETF). For seven years, spot liquidity has been held again whereas futures markets have flourished, vastly outgrowing the spot market.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney