- APE price greater than $2.3 million was just lately transferred to Binance.

- Market indicators and metrics steered elevated promoting stress for the alt.

ApeCoin [APE] just lately rejected a proposal that offered the concept of the Eternally Apes workforce producing 1000 ApeCoin capsules, together with 4 stickers, one patch, and one poster.

This proposal was geared toward rising token accumulation and lowering unauthorized gross sales by way of unofficial channels. Nonetheless, nearly all of the ApeCoin group voted in opposition to the AIP, therefore the rejection.

Curiously, whereas this proposal was geared toward rising APE accumulation, the other was occurring available in the market.

Learn ApeCoin’s [APE] Worth Prediction 2023-24

Is promoting stress inevitable?

Lookonchain just lately posted a tweet, which talked about that an tackle “0x4BE5” transferred 463,137 APE price over $2.3 billion to Binance.

Handle “0x4BE5” transferred 463,137 $APE($2.36M) to #Binance 20 minutes in the past.

The tackle acquired 512,062 $APE on Dec 6, 2022, Jan 10 and Jan 20, 2023, the common receiving value is $4.74.

And nonetheless has 131,222 $APE staked.https://t.co/YnLJCVzotd pic.twitter.com/bGDKxA7Ram

— Lookonchain (@lookonchain) February 25, 2023

The addresses that transferred APE had acquired the token within the latest previous. This newest APE switch underlines the potential of incoming promoting stress, which may push APE’s value down within the coming days.

At press time, APE had declined by practically 1% within the final 24 hours. It was trading at $5.07 with a market capitalization of over $1.86 billion.

Nicely, the anticipation of promote stress was additionally revealed by a couple of of the market indicators, which identified that the sellers have been accountable for the market, at press time.

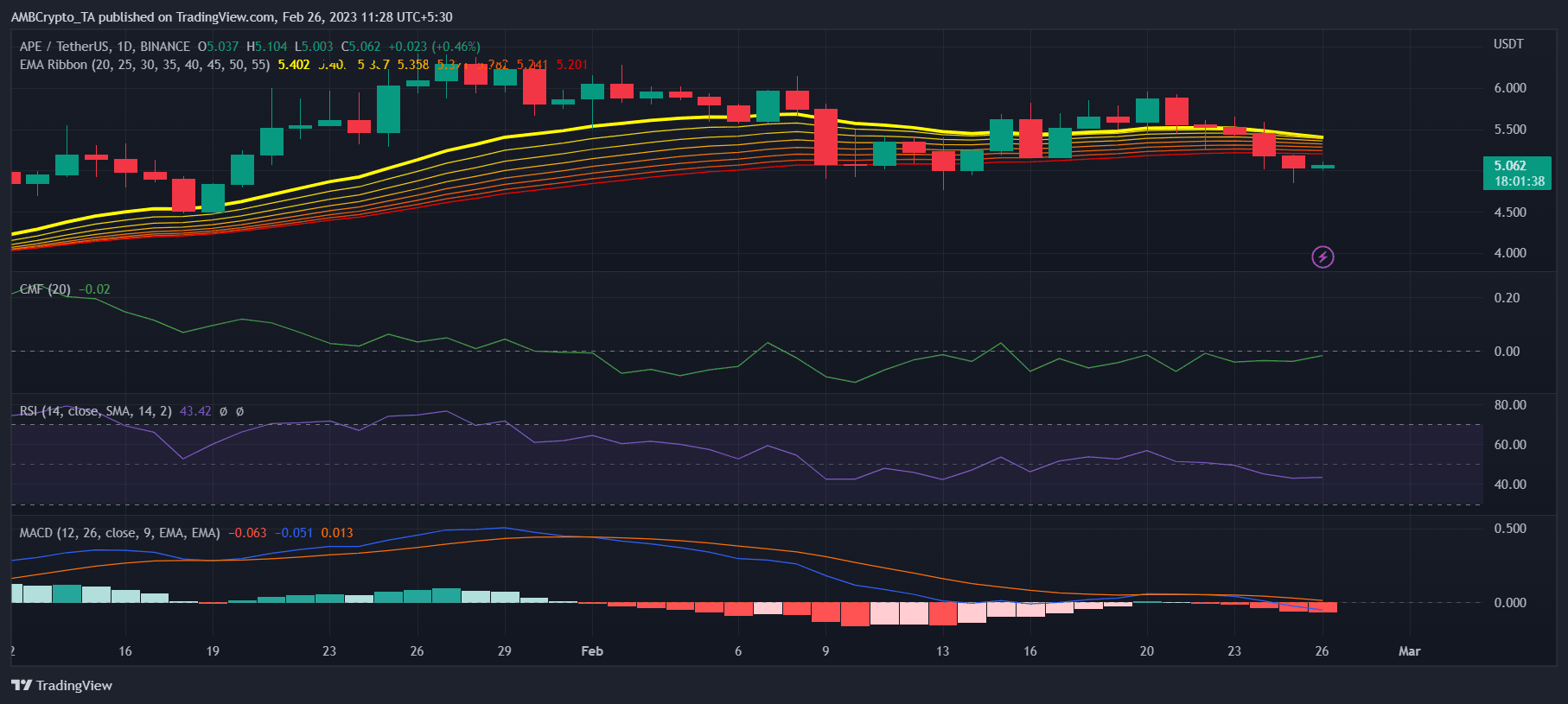

APE’s Relative Energy Index (RSI) went under the impartial mark, which was bearish. Then again, the Exponential Transferring Common (EMA) Ribbon indicated that the bears have been about to take management of the market, as the space between the 20-day EMA and the 55-day EMA shrank.

APE’s MACD additional established sellers’ benefit because it displayed a bearish crossover. Nonetheless, although the Chaikin Cash Circulate (CMF) was under the impartial mark, it registered a slight uptick, which was a optimistic sign for APE.

Supply: TradingView

Practical or not, right here’s APE market cap in BTC’s phrases

The difficulty is actual

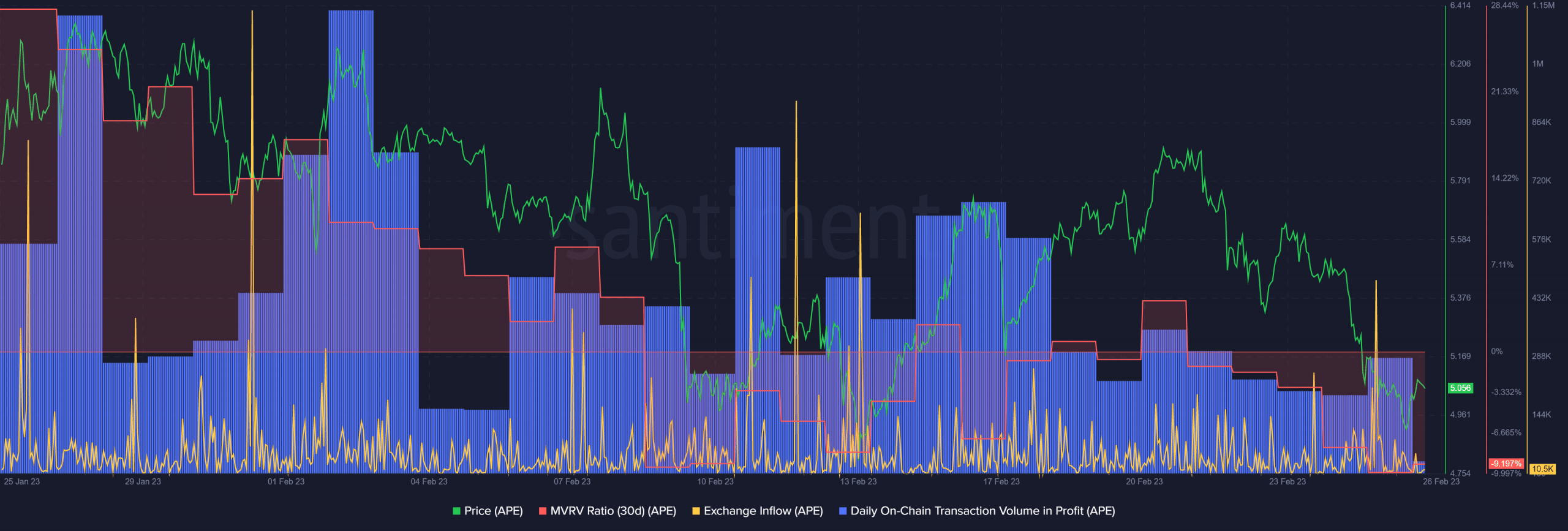

In the meantime, APE’s alternate influx spiked fairly a couple of instances over the previous few days, which additionally signified elevated promoting stress.

As APE’s value went down during the last week, its MVRV Ratio additionally fell. Thus, indicating a smaller diploma of unrealized revenue was within the system.

The alt’s on-chain transaction quantity in revenue additionally fell due to the worth decline. Due to this fact, contemplating all of the datasets, APE may need to endure elevated promoting stress within the days to return.

Supply: Santiment

![ApeCoin [APE]: This latest development can trigger selling pressure](https://nomadabhitravel.com/wp-content/uploads/2023/02/APEUSDT_2023-02-26_11-28-23-1536x690.png)