- The Arbitrum TVL has outrightly outperformed others within the final month.

- Whales gathered some tokens underneath the chain exhibiting shopping for alternatives.

Layer-two protocol (L2) Arbitrum has been one of many eye-catching revelations of the crypto ecosystem regardless of the turbulence that hit the market in 2022.

Whereas it could have gained the eye of many buyers, the Ethereum [ETH]-scaling answer was virtually at all times at loggerheads with its competitor Optimism [OP].

Nonetheless, Arbitrum appears to be profitable the race because of its place as per Complete Worth Locked (TVL). The TVL merely represents the variety of belongings being staked in a protocol.

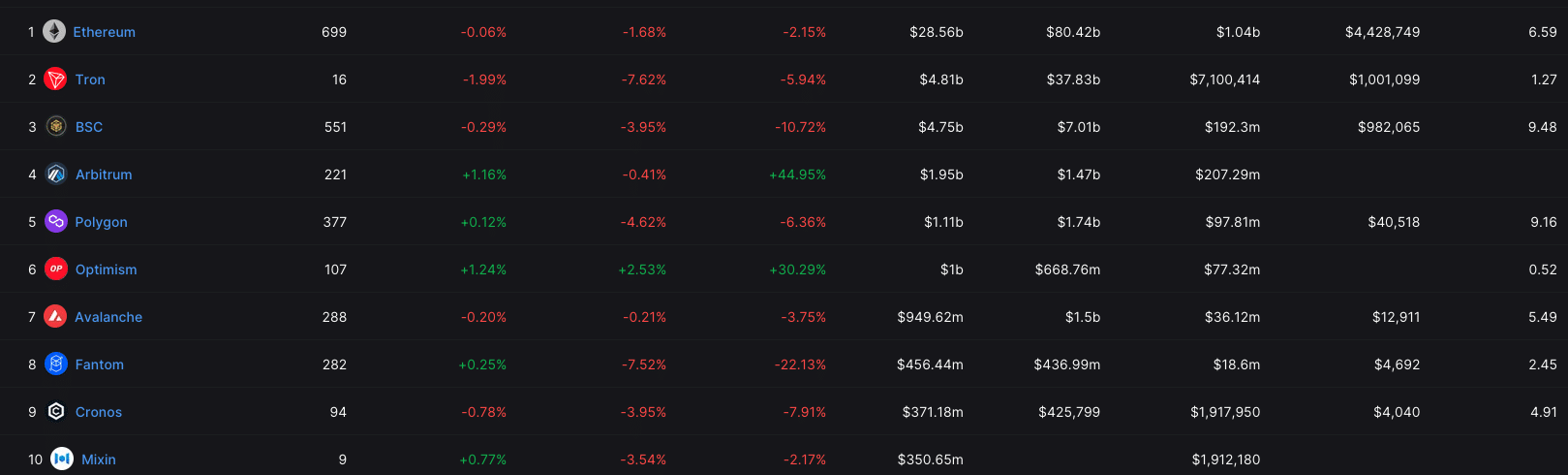

At press time, the Aritbrum TVL was $1.95 billion. This ensured that the protocol was fourth on the checklist behind Ethereum, Tron [TRX], and the Binance Sensible Chain.

Supply: DeFi Llama

Massive bulls eye the chance zone

However a notable stride with the Arbitrum TVL is the way it has outperformed each different chain within the DeFi area. Based on DeFi Llama, the optimistic rollup scaling answer had gained 44.95% within the final 30 days. This implied that there had been extra distinctive deposits into Arbtirum than some other protocol.

This noteworthy enchancment may even have been very important to the reception tokens underneath the Arintrum ecosystem have acquired. And this isn’t simply restricted to retail buyers.

Based on Lookonchain, a whale gathered Positive aspects Community [GNS], and Genaro Community [GNX].

A whale purchased 28,762 $GMX ($1.9M) and 59,064 $GNS ($420K) from #Binance up to now week, then staked $GMX and $GNS.

The whale is bullish on the #Arbitrum ecosystem and bullish on decentralized #derivatives initiatives.https://t.co/m1FxWtrt9y pic.twitter.com/HCMmzQymDV

— Lookonchain (@lookonchain) March 6, 2023

An motion like this means that the whales belief the Arbitrum ecosystem strides to drive the tokens to greens. Additionally, each tokens have considerably decreased in worth over the past month.

Whereas GNX shredded 9.67%, GNS decreased 11.90% within the final seven days. Therefore, the intent may mirror a attainable shopping for alternative.

Crests and troughs however Arbitrum stays the course

Moreover, the contracts created underneath the Arbitrum ecosystem had been 118200 on the time of writing. Cumulatively, the metric stood at 1.7 million.

This metric defines the speed at which readable good contracts are being developed however the information confirmed that the momentum has not been distinctive.

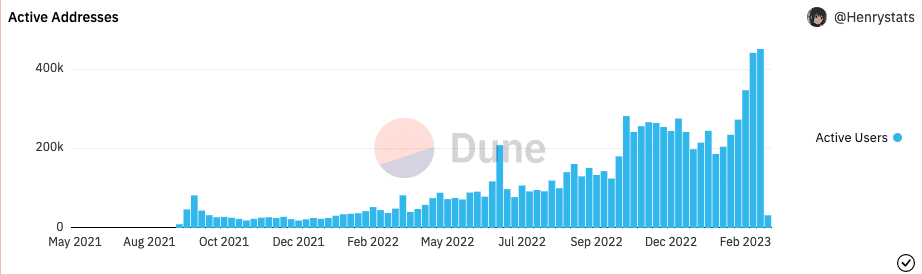

Nonetheless, one half that will have pushed the idea in Arbitrum is the lively addresses. The lively addresses measure the variety of distinctive every day interactions or hypothesis regarding an asset.

At press time, Dune Analytics revealed that the Abritrum lively addresses had been 32090. However the metric has been on an unimaginable rise such that it hit an All-Time Excessive (ATH) in February.

Supply: Dune Analytics

In the meantime, the Arbitrum community has continued its layer-two performance, scaling Ethereum-compatible good contracts and making certain validators course of transactions on the second-layer chain.