Monax Labs, a studio that builds instruments to handle authorized gaps related to NFTs, has waded into the milieu of corporations with options to the development of diminishing NFT creator royalty charges—with a collection of merchandise it says can assist creators implement funds.

Its new membership platform, Aspen, supplies challenge creators a spread of instruments to handle royalties, minting, subscriptions, and utility entry. Aspen is accessible to the general public in the present day after a six-month tender launch interval, with instruments presently appropriate with Ethereum NFTs in addition to these on Ethereum scaling networks Polygon and Palm.

Although Monax concedes that it’s virtually technically not possible to implement a royalty cost on-chain, these new merchandise intention to provide challenge creators management over who can entry added perks and utility tied to NFTs based mostly on whether or not secondary market patrons paid creator royalty charges.

Aspen 🤝 Royalties

There’s a platform the place you can provide members of your group the flexibility to simply pay their royalties — irrespective of the place they acquire your NFT?https://t.co/yGDvL2ybjD pic.twitter.com/hiF3pNtzCW— Aspen | Web3 Membership Platform (@aspenft) August 17, 2023

Royalties have been as soon as touted as one of many golden eggs in NFT know-how, as creators noticed the potential for ongoing remuneration from gross sales of their work. However whereas these funds—usually a 2.5% to 10% payment on the secondary sale worth—have been thought of a social norm amongst NFT collectors, they might finally be circumvented.

Many marketplaces are not imposing royalties. Final month, main market OpenSea made paying creator charges non-obligatory—the most recent transfer in what some have referred to as a “race to the underside” to draw clients. It adopted selections by marketplaces like Blur and Magic Eden during the last yr to not firmly implement royalty charges.

OpenSea Will Make Creator Royalties Non-compulsory for NFT Trades

The way in which Aspen tackles this drawback is by treating royalties as one of many eligibility necessities to entry an NFT’s utility—like a membership program.

It really works by giving creators the instruments to trace these funds, and prohibit entry to NFT holders who haven’t paid a royalty on a secondary market buy. But it surely additionally lets NFT holders pay as much as regain entry in the event that they initially skipped paying the royalty payment when shopping for from a market.

Christina Giannakou, chief artistic officer at Monax Labs, likens it to a Spotify or Netflix subscription mannequin, though it places the onus on the artist or NFT creator to verify they’re offering worth in return. Aspen makes cash from the device by charging a fee when creators earn money.

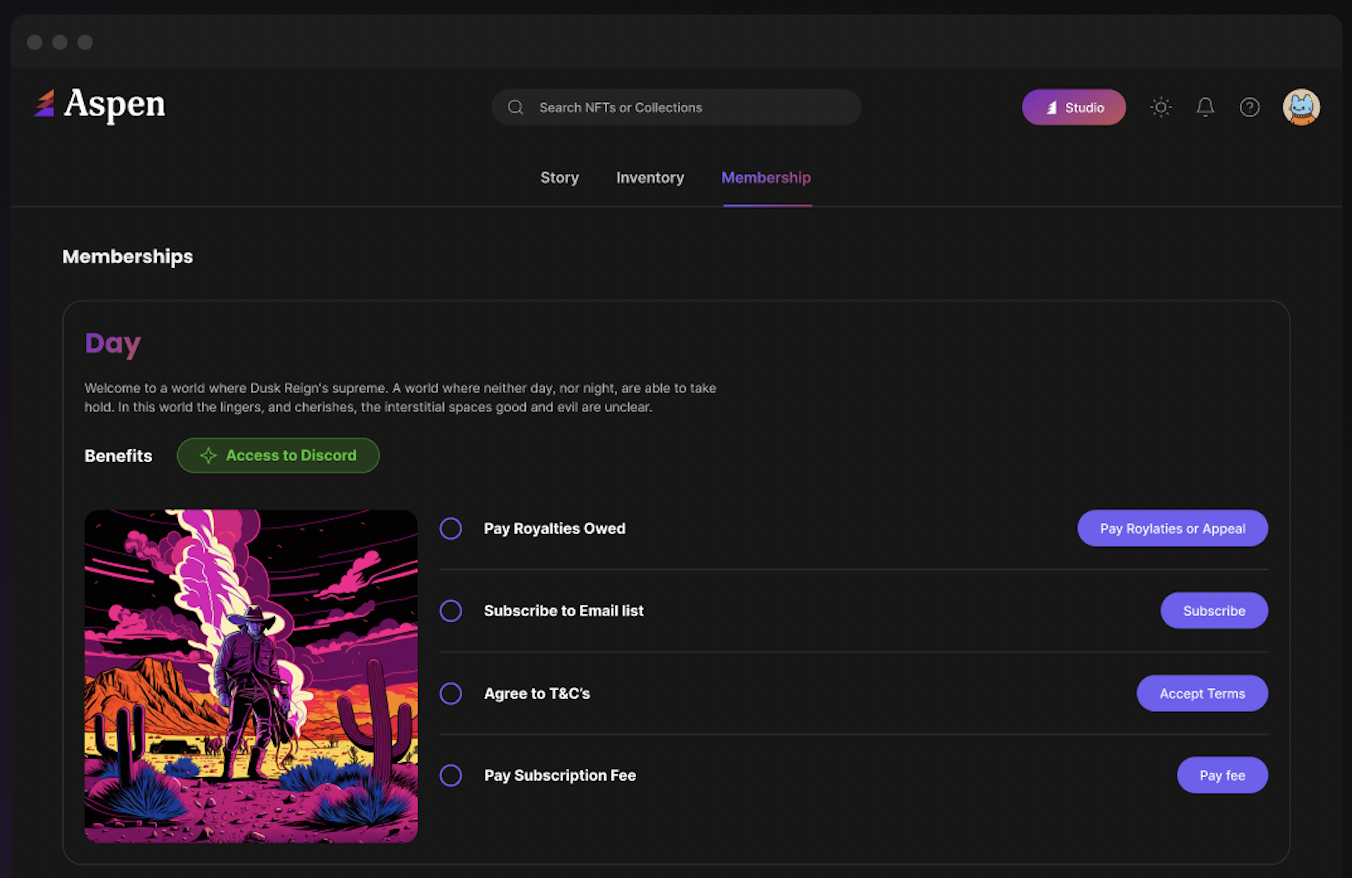

An instance of the Aspen membership portal. Picture: Monax Labs

“We’re capable of see [who has paid], and we mainly compile an inventory of people who both paid royalties on one other platform—or got here on to Aspen after which paid royalties—so as to get entry to membership and utility,” mentioned Giannakou.

Monax holds up its work with Consortium Key as considered one of Aspen’s success tales throughout the tender launch section. Consortium Key makes use of Ethereum NFTs to unlock instruments to maximise crypto market buying and selling effectivity—and units its creator royalty payment at 7.5% of every secondary sale worth. The NFTs presently begin at a worth of 1.5 ETH (about $2,450) on OpenSea.

When the businesses began working collectively, Monax Labs claims that Consortium Key income was down 95% as a consequence of fading NFT royalty enforcement. Throughout the first month of implementing the brand new program, Consortium Key reached its preliminary income aim, greater than doubling the quantity of subscriptions. Monax mentioned that 90% of Consortium Key’s holders have now paid their set creator royalties, up from 10% as of April.

Whereas Aspen’s mannequin places the utility first relatively than the artwork, Giannakou argues that this shouldn’t cease artists from interested by what different ongoing utility they might present to their holders. Such advantages can provide patrons incentive to carry onto their NFTs—or alternatively, for would-be holders to think about shopping for on the secondary market.

“Any challenge can create ongoing utility, actually,” she mentioned. “Is there one thing which you can cost a small quantity for on an ongoing foundation to create income? I believe that finally comes all the way down to the challenge, the person artist, and their model.”

“The creators are the innovators,” Giannakou added, “and I believe if the innovators don’t get paid to innovate, then the entire Web3 ecosystem is in hassle basically.”