- The Silvergate Financial institution scenario immediately affected EOS’ founding firm.

- Worth motion confirmed that the token short-term projection could possibly be removed from respite.

The native token of the EOS Community [EOS] suffered an incredible loss in worth following the crypto market tumble. Many altcoins skilled the identical destiny. Nevertheless, for EOS, the case was not simply associated to an across-board Bitcoin [BTC] drawdown.

Is your portfolio inexperienced? Test the EOS Revenue Calculator

Typically, escape is the way in which out

Whereas buyers scrambled to make sure that losses had solely informal penalties, Block.One announced that it held a stake at Silvergate Capital. Nevertheless, the corporate which backs the EOS challenge talked about that it was exiting its fairness place.

Though it admitted counting its losses, the remark additionally highlighted that its mother or father firm Bullish was not uncovered. The press assertion learn,

“Whereas we’re disillusioned with this consequence, we stay unwavering that banks and different monetary establishments embracing the digital asset and cryptocurrency sectors are well-positioned to make use of expertise to advance the capabilities of each the normal monetary providers and the brand new burgeoning digital asset economic system to higher serve the wants of the general public.”

The Silvergate uncoerced liquidation has been one of many main components which have decreased the general market capitalization. This excessive growth has additionally unfold concern whereas the market worth dipped under $1 trillion.

Advert interim, EOS exchanged arms at $1.04, shedding 10.34% of its day by day worth within the course of. CoinMarketCap knowledge additionally revealed that the token’s market cap had additionally been affected.

This implied that the potential upside of the token could also be non-existent within the brief time period. However do the technical indicators share an analogous sentiment?

Strains within the pipe

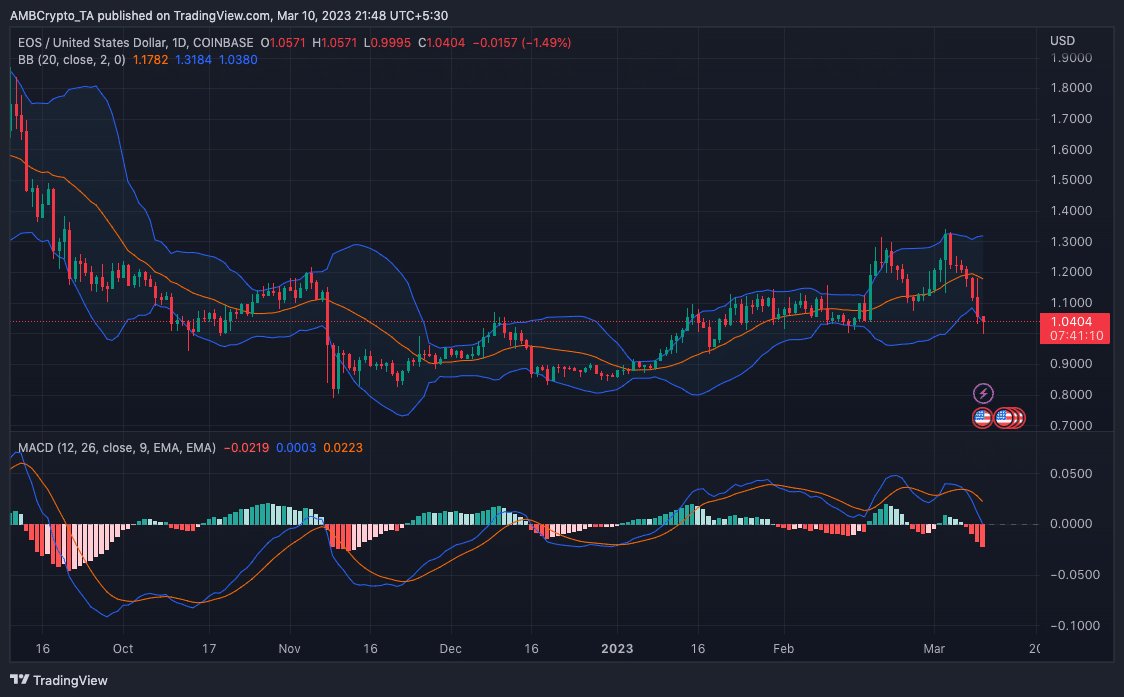

Indications from the day by day chart confirmed that the EOS volatility has been increasing since 16 February. This was the interpretation of the Bollinger Bands (BB) situation. Nevertheless, the BB widening was the one leak from the chart.

It is usually important to say that the EOS value motion had been hitting the decrease and higher bands. As of this writing, the value was positioned across the identical proximity because the decrease band. This implied that the token had adjusted to a volatility swing in help of an oversold situation.

Real looking or not, right here’s EOS’ market cap in BTC’s phrases

Regarding the trend-following momentum, the Shifting Common Convergence Divergence (MACD) confirmed that EOS had a weak sign for any entry.

Supply: TradingView

As well as, the patrons (blue) and sellers (orange) adopted an growing downward pattern. So, this implies a bearish state alongside the falling value.

In conclusion, the Slivergate episode has had deadly results on crypto costs. Therefore, the widespread affect implied that the ecosystem was not solely free from the affect of macroeconomic components.