NFT

Debtors might make the most of the protocol to borrow for over 300,000 NFTs with specified phrases. With none domain-specific experience, liquidity suppliers might now get hold of best-in-class yield on their ETH.

We’re excited to announce the launch of https://t.co/h44ltfyfZ6 immediately.

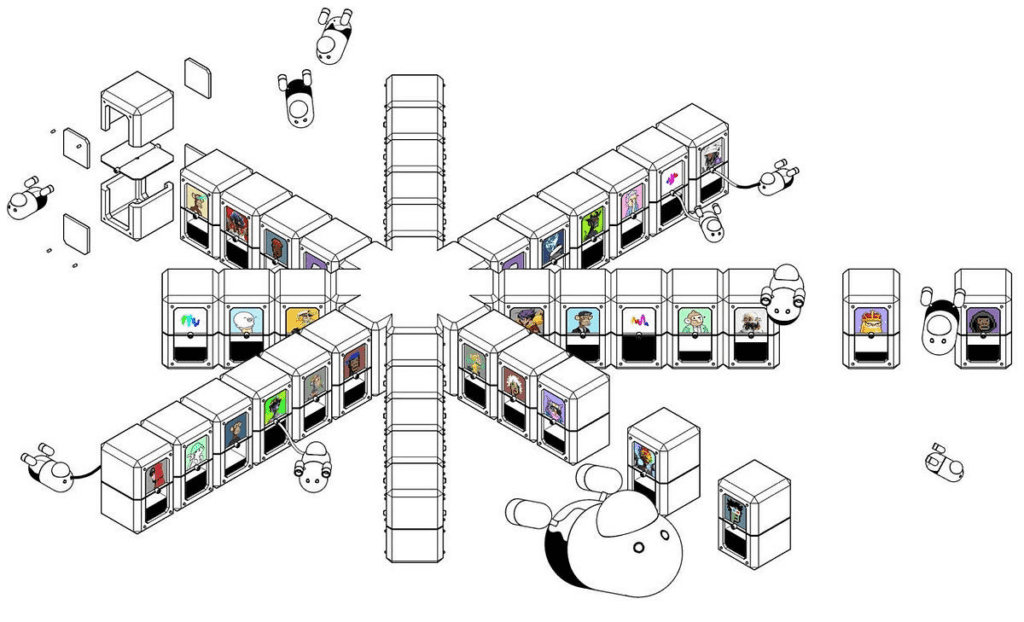

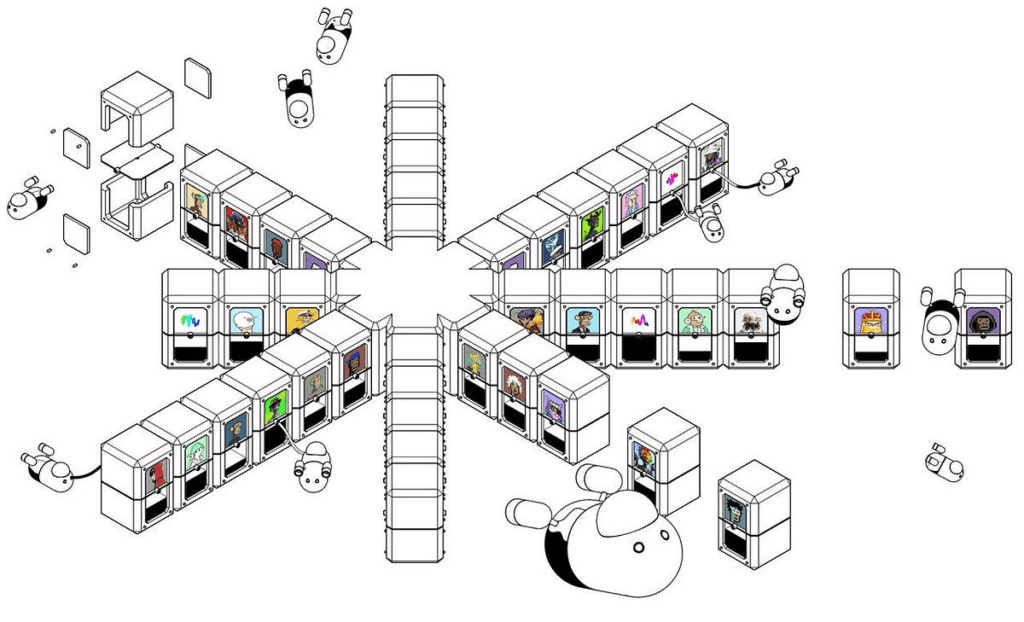

Astaria is a novel NFT-backed lending protocol pic.twitter.com/PFK5OcZuiP

— Astaria (@AstariaXYZ) Could 25, 2023

The platform, which was co-founded by former SushiSwap CTO Joseph Delong, allows NFT holders to lease their belongings to merchants who might not have the ability to purchase a blue-chip NFT in a single transaction.

Astaria’s platform distinguishes itself by its distinctive three-actor paradigm, which incorporates Strategists, Debtors, and Liquidity Suppliers. This idea is meant to divorce the necessity for specialist NFT experience from monetary funding, making the method extra accessible to people with much less area information. Liquidity suppliers provide funds and earn earnings, whereas Strategists, who’re NFT specialists, decide mortgage situations.

Following months in beta, the NFT lending platform has seen the highs and lows of its rivals within the business and intends to extend NFT market liquidity whereas preserving lenders’ and debtors’ pursuits.

The general public beta represents a rise in entry for all debtors and liquidity suppliers. Debtors with evaluated NFTs might now discover the quite a few lending decisions provided on Astaria’s web site. This enhanced entry is a crucial milestone within the platform’s progress and demonstrates Astaria’s dedication to offering accessible, modern monetary options to a various spectrum of NFT homeowners.

Co-founder and CEO Justin Bram acknowledged:

“The graduation of our public beta is a serious milestone in our journey to re-envision NFT lending. We’re grateful for the continued help from our group and early adopters and stay up for additional refining our platform.”

Astaria is launching a pre-funded vault that Upshot will help in overseeing to be able to handle threat and reward alternate options between debtors and lenders to be able to handle cash movement contained in the protocol.

DISCLAIMER: The data on this web site is offered as normal market commentary and doesn’t represent funding recommendation. We encourage you to do your individual analysis earlier than investing.