Non-fungible tokens have come a good distance, within the view of Anjali Younger, the co-founder and COO of Abridged. In a BeInCrypto interview, Younger pointed to the June 15 public sale of “The Goose” NFT at Sotheby’s as a bullish signal. Whereas the effective artwork NFT market faces myriad challenges, inaccurate valuation not least amongst them, Younger sees blockchain transparency as a bonus.

2019 was the ultimate stretch earlier than a pandemic. For Web3 and crypto, it was additionally the 12 months that launched the mass public to non-fungible tokens (NFTs). One of many first to catch on was NBA’s High Shot. After an explosion in reputation in early 2021, NBA High Shot surpassed CryptoKitties and Decantraland to change into the world’s largest NFT market.

Sotheby’s Public sale a Bullish Signal

By 2021, the market had matured considerably. Legendary auctioneer Sotheby’s was promoting NFTs for $17 million as denizens of the artwork world turned as much as watch.

By the tip of the 12 months, the legendary public sale home had remodeled $100 million simply by promoting digital collectibles, in keeping with their very own figures. On the time, their endorsement signaled the transition of NFTs from a passing fad to prestigious digital paintings.

In October of that 12 months, Sotheby’s even launched its personal market—Sotheby’s Metaverse.

Nonetheless, that was earlier than the bear market. But, whilst curiosity in NFTs has fallen by 95% from its January 2022 peak, in keeping with Google Tendencies, the artwork and style worlds are two cliques which have continued to take them critically.

Generative artist Dmitri Cherniak’s Ringers “The Goose” NFT offered for a hammer worth of $5.4 million at Sotheby’s final month, the second highest ever for a digital collectible.

Younger views current Sotheby’s public sale figures as an indication of the NFT market’s robustness. The gross sales deliver constructive consideration from exterior, she stated.

“Main as much as the public sale, Sotheby’s estimated that ‘The Goose’ would fetch a worth between $2-3 million. By closing at $6.2 million and blowing its unique 2021 sale worth out of the water, ‘The Goose’ exceeded all expectations,” Younger continued.

“Having a majority of these wins throughout a bear market is a validation for the endurance of this distinctive artwork kind, in a approach that many high-valuation gross sales made throughout yesteryear’s peak NFT mania didn’t absolutely seize,” she added.

NFTs Have Their Personal Tradition, Says Anjali Younger

In August 2021, 3AC co-founders Su Zhu and Kyle Davies purchased “The Goose” for about 1,800 ETH. A determine price roughly $5.8 million on the time. Within the current Sotheby’s public sale, it went to a pseudonymous NFT collector known as 6529.

“The truth that ‘The Goose’ has been reabsorbed into the NFT group from a now-defunct hedge fund exhibits the fervour and conviction of the artists and collectors within the house,” noticed Younger.

“Thus far, the client has expressed his perception that necessary crypto-cultural markets ought to keep natively in decentralized areas. This is the reason ‘The Goose’ was collectively bought through an on-chain museum, and this current public sale exhibits that crypto has its personal tradition. One which must be celebrated and shared even exterior of our slender borders.”

However the current Sotheby’s public sale is one-half of two tales. As a result of whatever the thrilling subculture of NFTs, or the occasional public sale story that bursts into the mainstream press, NFTs are outdated information. A minimum of for most individuals.

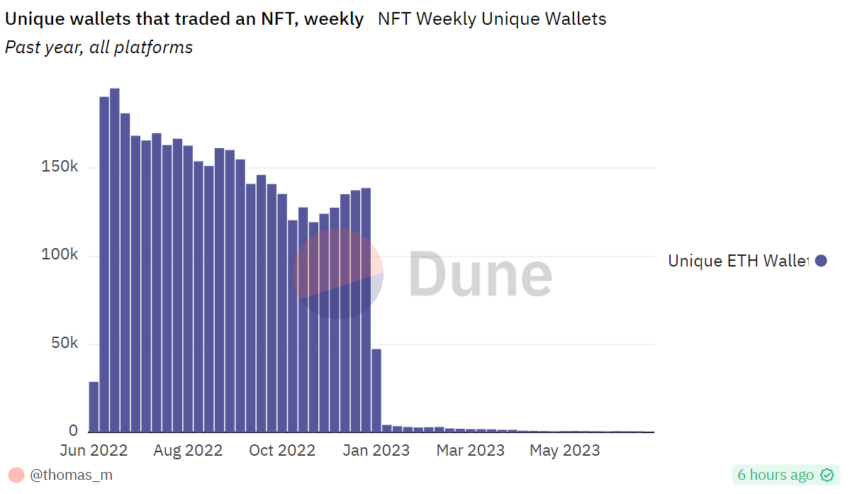

In keeping with knowledge from Dune, the weekly numbers of wallets buying and selling Ethereum NFTs collapsed in January 2023, and has by no means recovered. NFT buying and selling is firmly a minority pursuit—at the least for now.

Supply: Dune

Trend Has Caught Round

Nonetheless, in keeping with Younger, the current Sotheby’s occasion didn’t focus solely on resale worth. So maybe these fixating on record-breaking costs are lacking the purpose?

“Conversations largely revolved across the sheer magnificence and impression of what it means to be at this particular intersection of artwork, tech, and group. Not a lot the fixed discuss of ground costs some would possibly anticipate after studying media protection of the public sale,” she stated.

Younger additionally sees potential for the sector as style manufacturers have entered (after which stayed) within the house. Demonstrating that, at the least within the eyes of some, NFTs aren’t any passing fad.

“Throughout [my recent] go to to Europe, I observed a rising pleasure round manufacturers and NFTs exterior the US,” Younger stated. “We’re starting to see luxurious style manufacturers like Gucci, Louis Vuitton, and Lacoste embrace NFTs, and there are various extra ready within the sidelines studying and keen to hitch when the time is correct for them.”

Study extra about distinctive digital collectibles and their potential: NFTs Defined: What Are Non-fungible Tokens and How Do They Work?

On the similar time, Younger additionally sees appreciable obstacles to NFTs’ wider adoption. Considered one of them being schooling.

Does the Common Joe absolutely perceive what they’re, past costly JPEGs of monkeys? She stays skeptical.

“I wouldn’t say the fundamental idea of NFTs is as broadly understood because it might be. Cultural and academic obstacles to their adoption definitely exist everywhere in the world. These are areas we have to concentrate on as we try to make NFTs extra mainstream.”

A Extra Clear Market

One of many gnawing issues about NFTs and the market surrounding them is worth accuracy. How do buyers know what they’re shopping for is a “high quality” NFT? How have you learnt you’re not shopping for into an over-hyped assortment that may quickly be eclipsed by the subsequent taste of the month?

For comparability, high-end artwork is broadly acknowledged to be one of the vital manipulated markets on this planet. And one which favors preserving the worth of established artists (whose paintings is already within the collections of the uber-wealthy) at very excessive ranges.

How is the NFT market any completely different after we don’t even know the id of the pseudonymous dealer 6529?

“Inaccuracies exist in all types of valuations, from actual property to company shares,” conceded Younger. “There’s no absolute measure of reality in any of those domains. The benefit with NFTs and different crypto belongings, nonetheless, is that each one transactions are overtly seen on the blockchain.”

Younger sees the extent of transparency that comes into play right here as with out precedent.

“Whereas it’s true that there’s no foolproof methodology to find out worth, this stage of transparency locations us on a extra advantageous trajectory in comparison with many different markets.”

NFTs Are Extra Than Artwork

“The worth of artwork will at all times be financially subjective and societally priceless,” Younger stated.

As 6529 aptly put it, long-form on-chain generative artwork is magical within the sense that, “in contrast to nearly some other artwork kind, neither the artist nor the preliminary collector know what the piece shall be in the intervening time it’s collected.”

Though, the main target shouldn’t at all times be on NFTs as artwork or speculative belongings, stated Younger. A part of the schooling deficit with NFTs is the lack of know-how about how they’re a lot extra.

“They’re already being utilized in quite a lot of methods,” stated Younger. “From serving as memberships to on-line golf equipment, to being built-in into gaming, to offering entry to unique real-life occasions. They’re additionally used as proof of participation and attendance, loyalty factors, and whilst components of digital id.”