Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion

- AXS’s market construction has been strongly bearish

- Improvement exercise elevated, however energetic addresses declined

Axie Infinity’s [AXS] worth motion has weakened over the previous few weeks. Since January 23, the gaming token has depreciated by 40%, with the crypto buying and selling beneath $10. On the time of writing, AXS’s worth was $8.3 and it might retest key help ranges if macroeconomic headwinds persist.

Learn Axie Infinity’s [AXS] Worth Prediction 2023-24

Is a patterned breakout probably?

Supply: AXS/USDT on TradingView

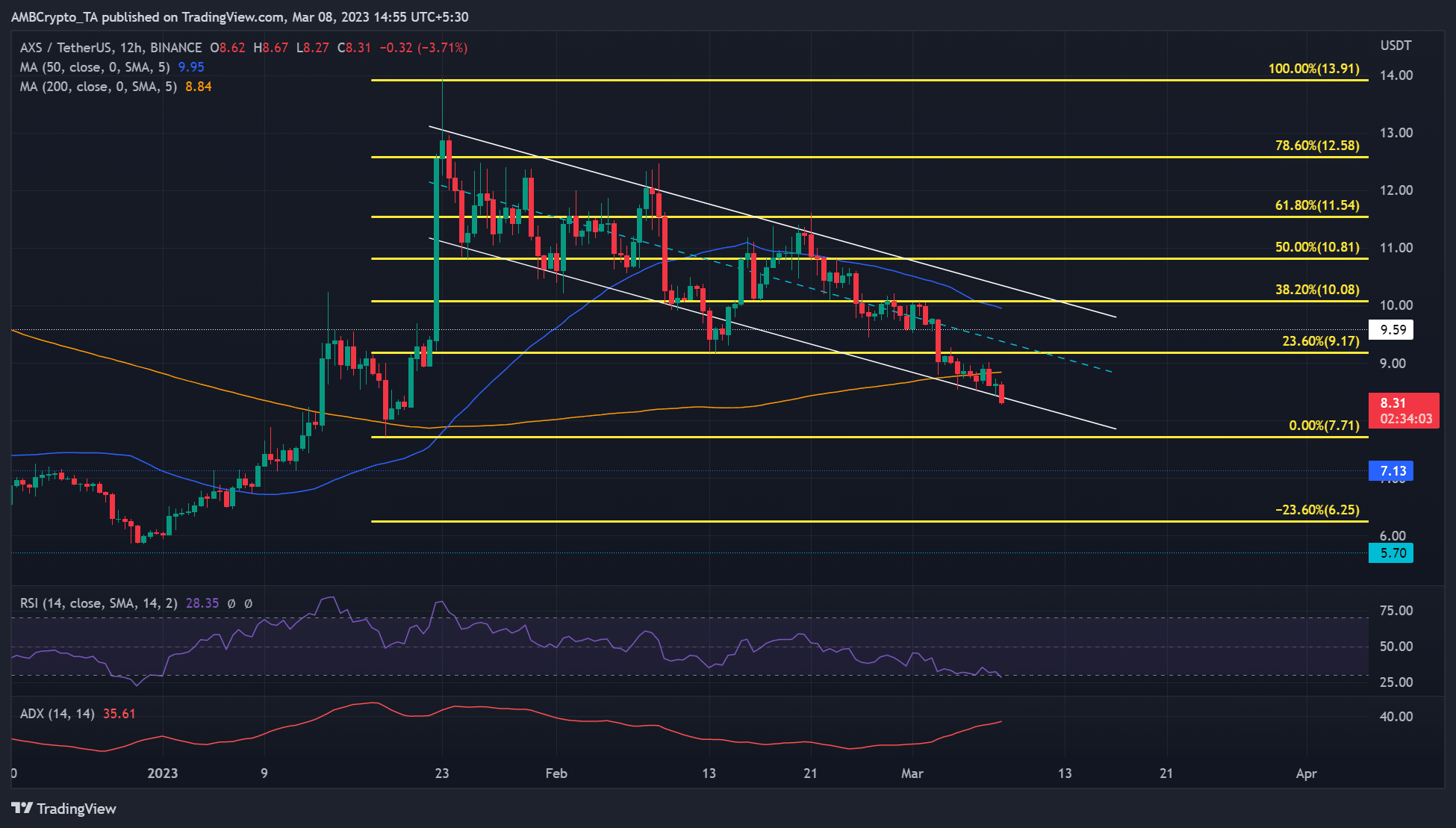

AXS has dropped from $12 to $8 as bears dominate the market. The prevailing inflation might additional exert promoting strain and supply bears extra leverage within the subsequent few days/weeks. Consequently, bears might sink AXS beneath the descending channel’s boundary of $8.40 and retest the $7.71 help. A particularly bearish state of affairs might see AXS drop to $6.65 or $5.70.

Due to this fact, cautious bears might await a pullback to retest the decrease channel’s boundary to verify an additional downtrend earlier than making strikes.

A candlestick shut above the channel’s decrease boundary ($8.4) will invalidate the aforementioned bearish thesis. Such a transfer might supply bulls a restoration probability, particularly if Bitcoin [BTC] defends the $22K psychological stage. The goal for bulls could be the channel’s higher boundary or the 38.2% Fib stage ($10.2). Nonetheless, bulls should clear the hurdles at 23.6% Fib stage ($9.17) and 50-period MA ($9.95).

The RSI (Relative Energy Index) declined to the oversold territory, reinforcing bears’ leverage. As well as, the Common Directional Index (ADX) was above 25 and the slope turned north, confirming a powerful downtrend. Nonetheless, the rising divergence between the ADX and worth might additionally point out a slowing downtrend.

AXS’s Funding Charge was damaging and energetic addresses declined

Supply: Santiment

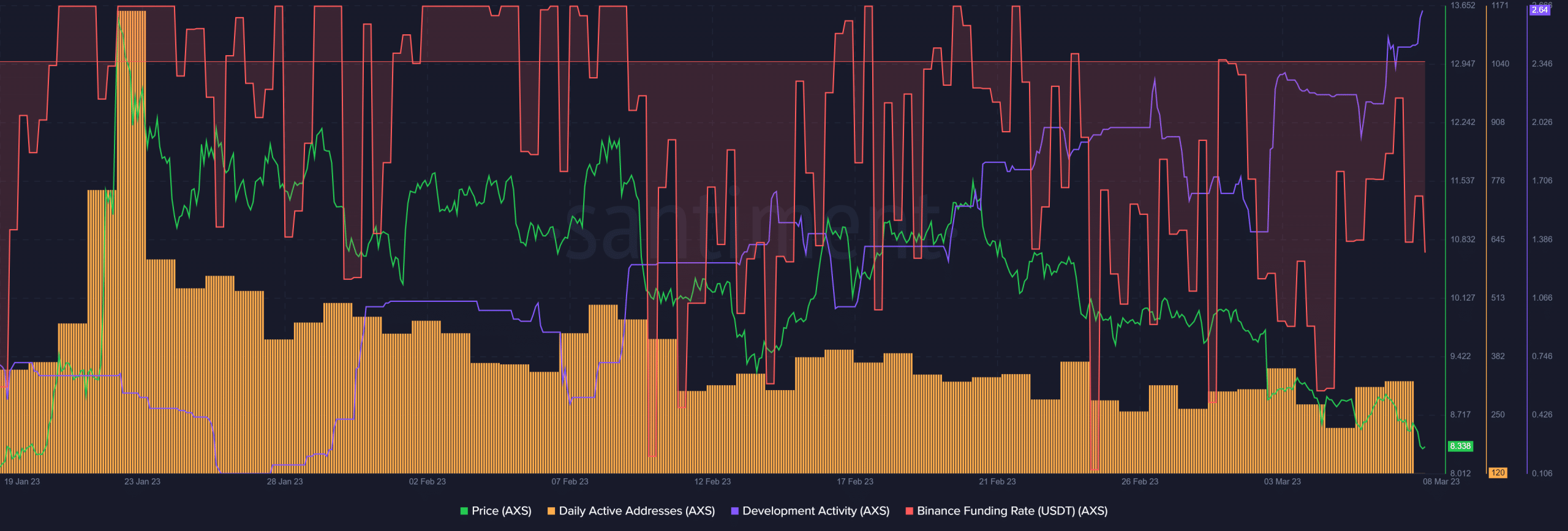

The Funding Charge for AXS/USDT pair remained disturbingly damaging over the previous few weeks, indicating restricted demand and largely bearish sentiment within the derivatives market. Equally, the quantity of each day energetic addresses declined considerably over the identical interval, displaying that fewer addresses traded the token, limiting buying and selling volumes.

Is your portfolio inexperienced? Verify the AXS Revenue Calculator

Nonetheless, the community saved constructing, as proven by the uptick in improvement exercise. Such an enormous hike might increase the token’s worth in the long term. Nonetheless, prevailing macroeconomic headwinds might undermine a powerful rebound, particularly if BTC breaks beneath $22K.

![Axie Infinity [AXS] is close to a patterned breakout – Can shorting yield gains?](https://nomadabhitravel.com/wp-content/uploads/2023/03/pasted-image-0-49-1536x874.png)