Within the ever-shifting terrain of the monetary sector, a nuanced battle is unfolding as conventional banks and blockchain expertise corporations vie for supremacy in deposit acquisition.

Established monetary establishments, stalwarts of the business, discover themselves at a crossroads as they grapple with altering buyer preferences and the disruptive pressure of evolving applied sciences. The wrestle to amass deposits, a linchpin for these establishments, has develop into more and more intense within the face of the disruptive improvements emanating from the blockchain expertise sector.

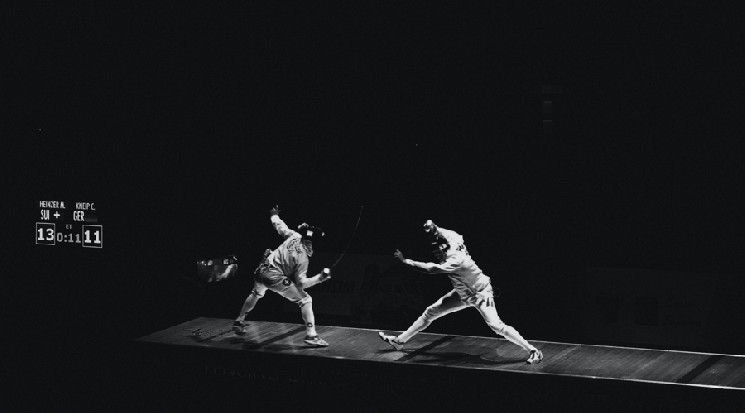

A Conflict of Ideologies

On one entrance, conventional banks, leveraging their time-honored popularity, regulatory adherence, and expansive buyer base, are steadfastly asserting their relevance on this digital period. Concurrently, the rise of blockchain expertise introduces a brand new participant into this monetary enviornment – one characterised by agility, decentralization, and a resolute dedication to reshaping the panorama of monetary transactions.

Latest strategic initiatives, exemplified by Polygon Labs’ substantial $85 million grant program, underscore the assertive strikes made by blockchain expertise corporations to entice builders into their burgeoning ecosystems. The dedication demonstrated by Polygon Labs alerts a dedication to fostering innovation inside its community, incentivizing builders and content material creators to contribute to the expansion of its blockchain ecosystem.

The dichotomy turns into evident as blockchain expertise corporations endeavor not solely to compete for deposits however to essentially redefine the standard banking mannequin.

Their focus lies in offering decentralized monetary options, decentralized functions (DApps), and a extra inclusive and environment friendly monetary infrastructure, difficult the very essence of standard banking practices.

On this evolving narrative, content material and functions play a pivotal function. Blockchain expertise corporations are vigorously working to draw builders and builders who can craft compelling content material and functions inside their ecosystems.

This aggressive panorama extends past mere monetary transactions; it revolves round delivering a complete and user-friendly expertise that surpasses the choices of conventional banks.

The Polygon Labs grant program acts as a microcosm of this broader development, the place blockchain expertise corporations actively put money into and incentivize the creation of modern content material and functions. This strategy represents a transparent departure from the traditional banking mannequin, the place innovation usually encounters impediments resulting from regulatory constraints and entrenched legacy methods.

Blockchain initiatives like MATIC or Loopring (LRC) embody not solely the attraction of builders but in addition the creation of ecosystems conducive to collaboration and creativity. The purpose extends past diverting deposits from conventional banks; it’s about providing a dynamic and responsive monetary ecosystem that aligns with the evolving wants of customers.

In response, conventional banks are awakening to the need of adaptation.

Some have initiated explorations into blockchain expertise, aiming to combine its advantages whereas leveraging their established strengths. Nonetheless, the problem stays substantial, as these monetary establishments grapple with legacy methods, regulatory complexities, and ingrained practices which will impede the swift adoption of decentralized applied sciences.

The battle for deposits, due to this fact, transcends the quick competitors for funds. It embodies a conflict of ideologies and approaches to finance. Conventional banks, fortified by their historic standing and the belief they’ve cultivated, are defending their territory. Conversely, blockchain expertise corporations are difficult the established norms, advocating for a decentralized and community-driven monetary future.

Conclusion

The dichotomy between banks and blockchain expertise corporations within the battle for deposits sheds mild on the seismic shifts underway within the monetary business. Initiatives like Polygon Labs sign that the competitors shouldn’t be merely about fund accumulation however in regards to the content material and functions that outline the person expertise. The monetary panorama is present process a profound evolution, and the victors on this battle will likely be these adept at navigating the intricate interaction of expertise, innovation, and user-centric options.