NFT

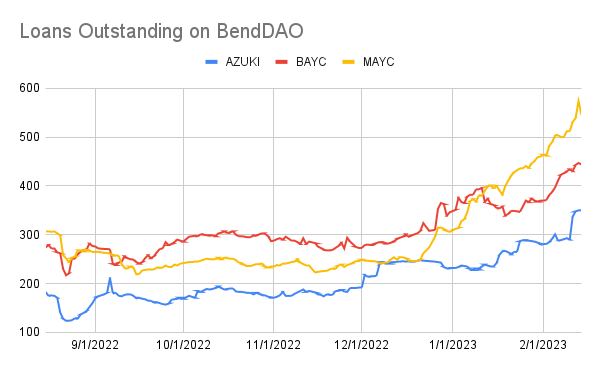

BendDAO, the most important NFT lending platform by market cap, hit new all-time highs final month on the backs of 4,399 particular person loans, lots of them Azukis, Mutants and BAYC.

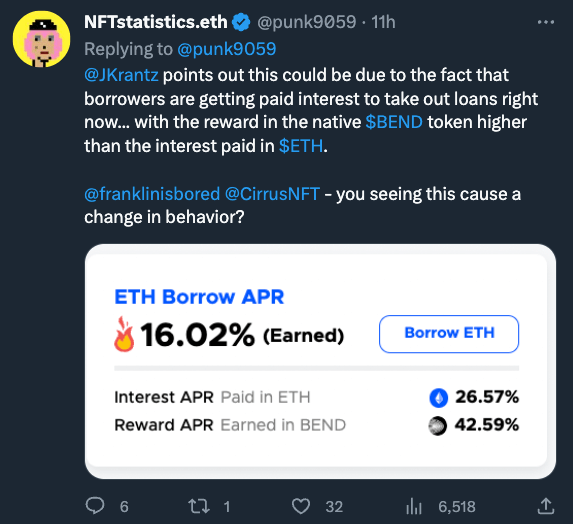

Twitter consumer @JKrantz speculated that the sudden all-time excessive is likely to be as a result of debtors are getting paid a better curiosity to take out loans on their NFTs with the native BEND token, which has seen a spike in progress during the last month.

Within the final 30 days, BEND has been up 377.5%, which some say is the rationale why loans are flocking to the platform, as debtors can yield a a lot excessive fee of return on their property in the event that they settle for the native BEDN token over ETH.

BendDAO is taken into account a “peer-to-pool” lending protocol. Although extra not too long ago, newer NFT lending websites comparable to pwn.xyz have sprung up. In contrast to BendDAO, pwn.xyz doesn’t have pricing oracles and seeks to as an alternative facilitate the borrower and the lender to set the phrases of the mortgage themselves. In its present model, it additionally doesn’t cost any charges (BendDAO presently expenses a payment equal to 30% of the entire curiosity revenue collected on NFT loans).

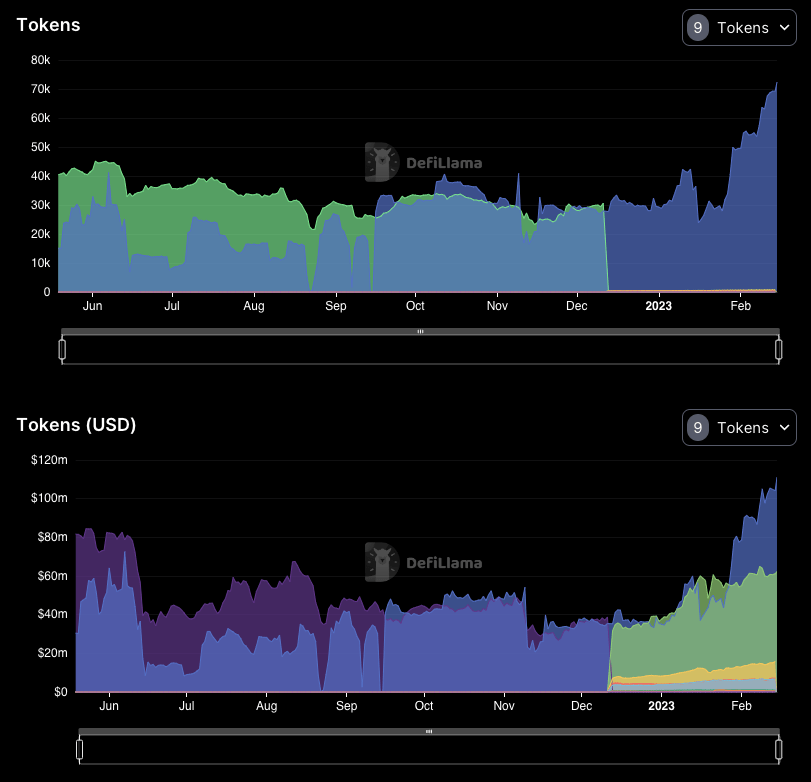

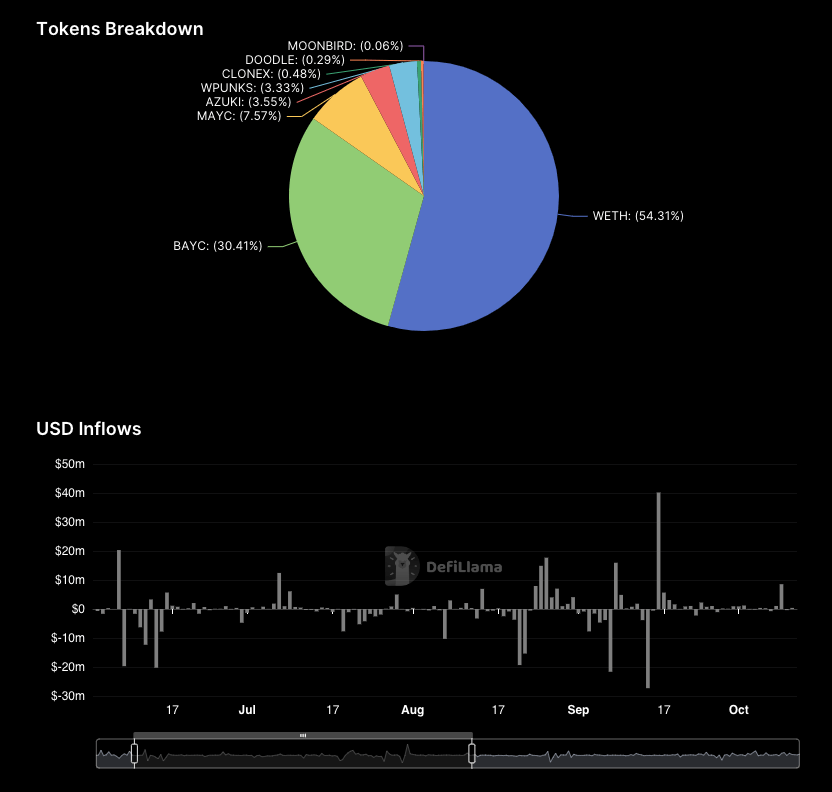

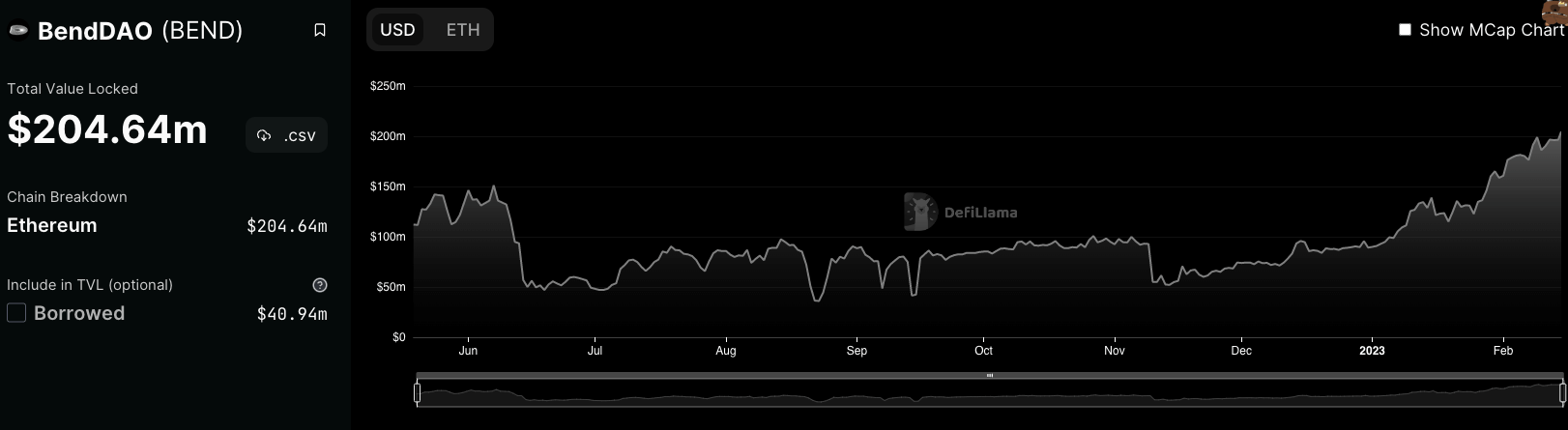

BendDAO is by far the most important NFT lending protocol by market cap. It presently has over $200 million price of property locked up on its platform, greater than 4x of what its rivals have mixed.

BEND is presently buying and selling at $0.0265.

The protocol’s spike in exercise comes on the heels of a document month of loans within the NFT lending trade writ massive.

In Jan., BendDAO noticed an ATH by way of month-to-month mortgage quantity and the variety of loans. A complete of 17.9K ETH, price roughly $28 million, unfold throughout a complete of 4,399 loans.

The nice, the unhealthy and the ugly with NFT lending protocols

In Aug. 2021, BendDAO weathered a financial institution run that noticed 15,000 ETH withdrawn from the contract inside a 48-hour time interval.

Information that might have ended up calamitous for bendDAO, provided that it had many bid-less debt-ridden NFTs listed on its platform, lots of which had extraordinarily distressed ground costs throughout that point as effectively.

Conditions can come up for giant NFT lenders like BendDAO when there’s a broader market downturn and lenders have interaction in competitors to retrieve their funds on NFTs with distressed ground costs.

In such circumstances, restoration of funds could also be inconceivable.

Nonetheless, the reverse can also be attainable. A lender could also be given an asset that turns into price considerably extra throughout the mortgage maturation interval. And within the case of a default, the lender might find yourself with an NFT price much more than for what it was collateralized.

The sector total continues to do effectively.

In January, Crypto reported that NFT lending had total its highest month-to-month quantity all through January 2023. Outdoors of the market chief, BendDAO, different platforms comparable to NFTfi, X2Y2, and Arcade made up an extra $44.8 million that month.