Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- The decrease timeframe market construction was bearish.

- The futures merchants additionally anticipated extra losses for BNB.

Binance Coin noticed a pointy northward transfer after 14 February and reached the $325 mark on 16 February. Since then the worth has sunk downward as soon as once more, wiping out many of the beneficial properties from the transfer.

Learn Binance Coin’s [BNB] Worth Prediction 2023-24

Bitcoin has additionally seen losses in current days, however it had some assist on the $22.5k stage, and additional south at $21.6k. Over the subsequent week, can Binance Coin bulls pressure the short-term downtrend to finish?

Can bulls anticipate a retest of the $290 order block to provide robust beneficial properties over the subsequent two weeks?

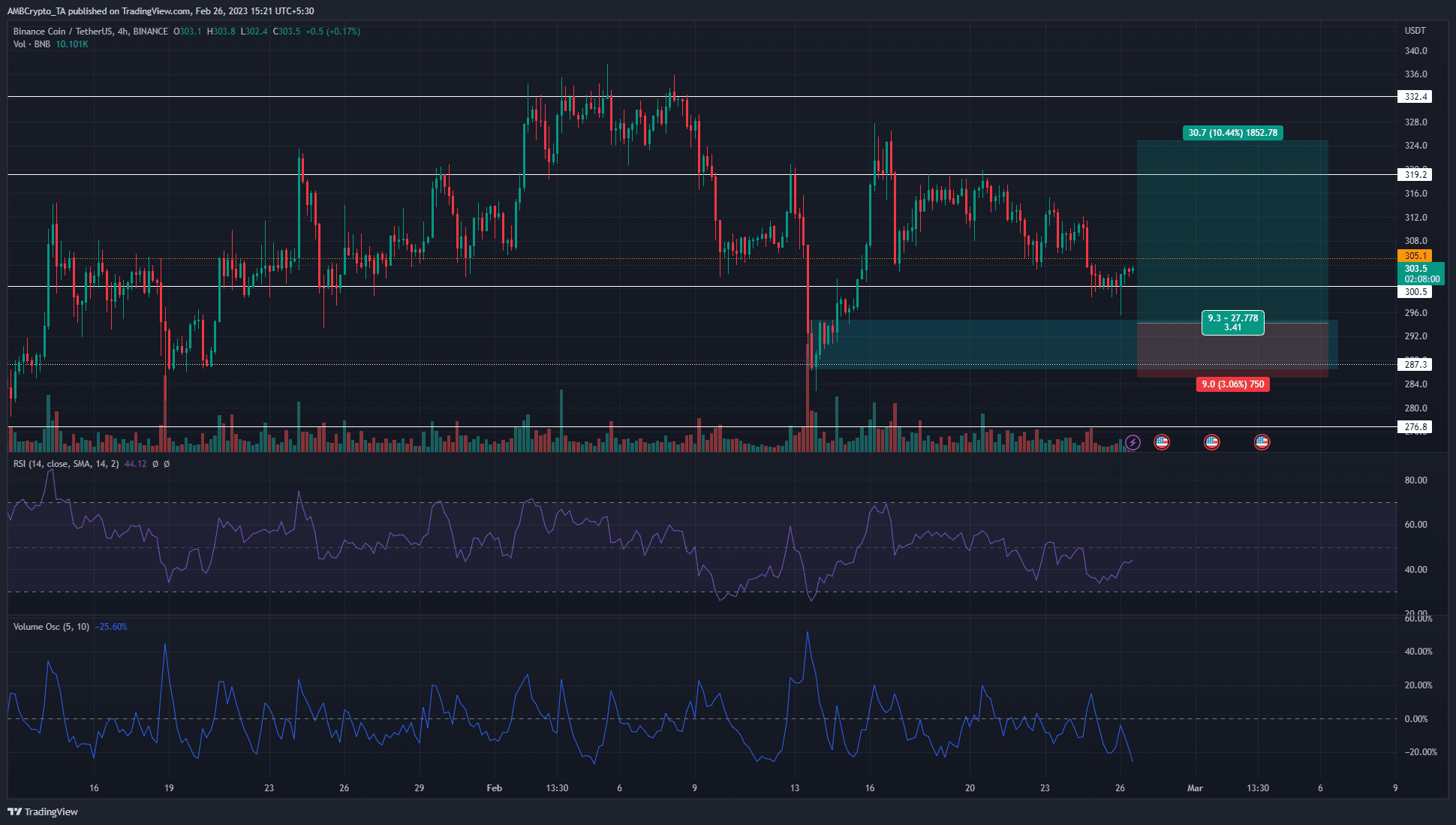

Supply: BNB/USDT on TradingView

A quick pump adopted by a slower retracement can imply that, as soon as the retracement was accomplished, the worth can start to ascend and break previous the earlier resistance as soon as extra.

The robust rally on 14 February set a bullish order block on the $286-$294 space. Highlighted in cyan, this H4 order block may current a shopping for alternative within the coming days.

The RSI was beneath impartial 50 to point out robust bearish momentum behind Binance Coin. The quantity oscillator didn’t present a big spike in buying and selling quantity. As a substitute, the amount has been low, which was anticipated over the weekend.

Is your portfolio inexperienced? Test the Binance Coin Revenue Calculator

Monday’s excessive and low may set up vital ranges to be careful for the subsequent week. Bulls can anticipate a transfer into the aforementioned order block and a bullish market construction break on decrease timeframes equivalent to 1-hour to search for shopping for alternatives.

A descent beneath the $283 mark would invalidate this bullish concept.

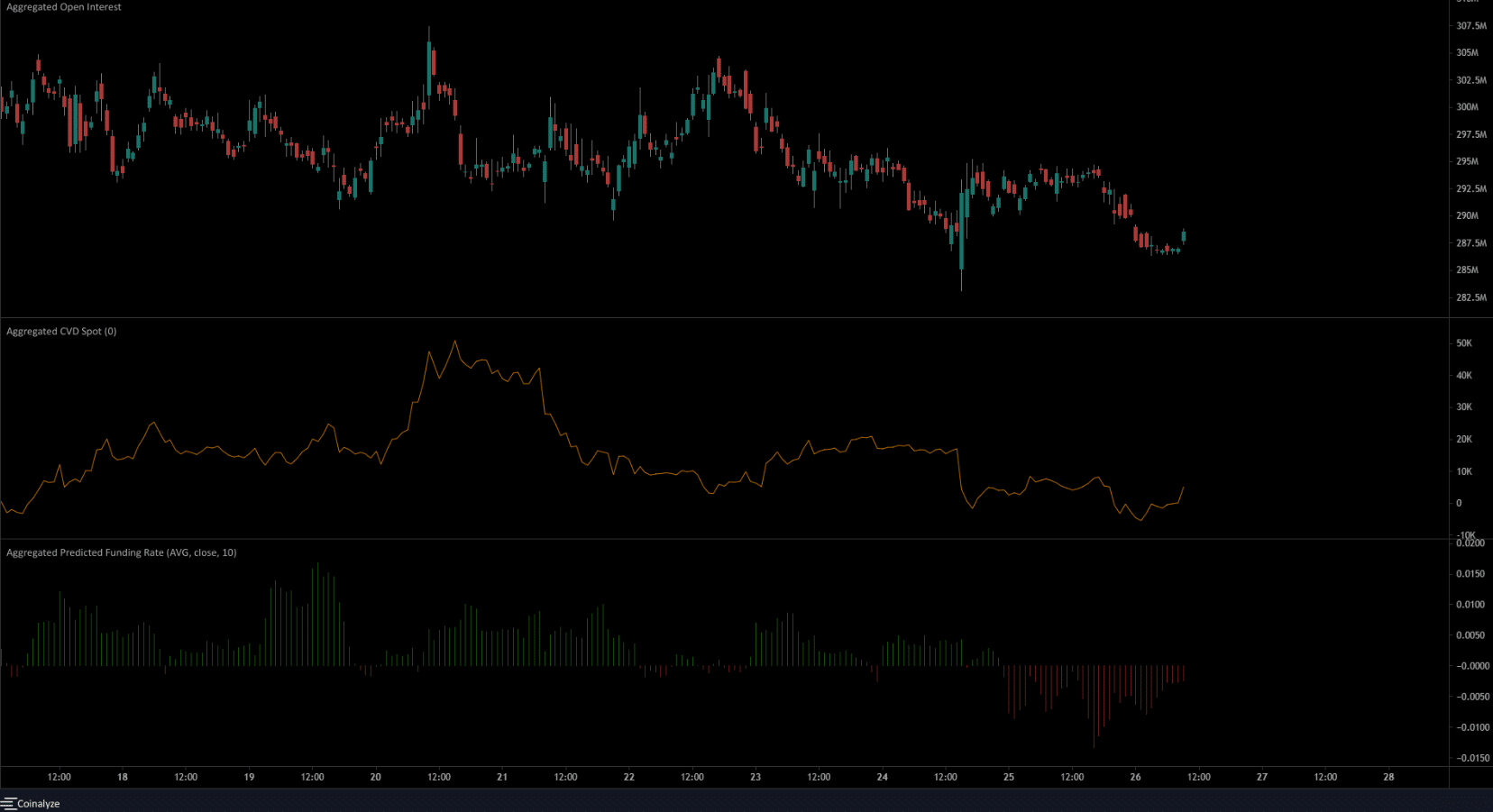

The autumn in Open Curiosity advised bearish sentiment remained dominant

Supply: Coinalyze

The futures market didn’t encourage bullish sentiment. Alongside the sinking costs, the Open Curiosity has additionally declined. This meant that lengthy positions have been discouraged, and the sentiment was bearish. The expected funding fee was additionally in detrimental territory to point out brief positions have been dominant.

The spot CVD was additionally in a downtrend, though it did see an uptick in current hours. This might not be enough to shift the development. Merchants can anticipate a surge in OI for a sign that sentiment was notably robust in a single path.