Binance clients don’t appear to be significantly affected by the Securities and Alternate Fee’s (SEC) lawsuit in opposition to the world’s largest crypto alternate by buying and selling quantity.

In accordance with knowledge shared by Ki Younger Ju, the CEO says that Binance did undergo outflows of 10,000 Bitcoin (BTC), the biggest withdrawal whole of 2023.

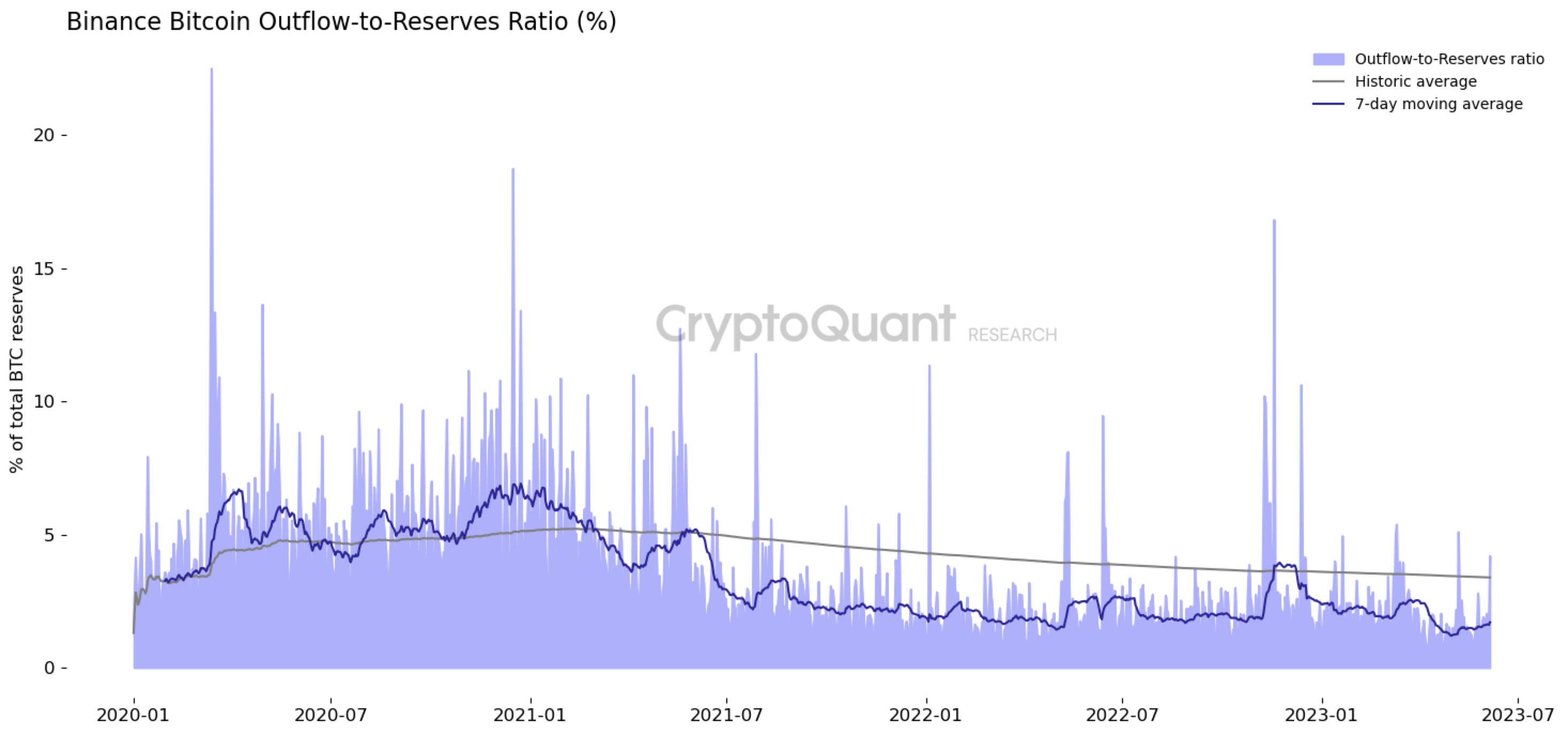

However that outflow seems to be much less statistically vital when taking a look at a zoomed-out time chart, in accordance with Ki Younger Ju.

The impression of 10k $BTC outflows on Binance.https://t.co/1TXeqp1lnZ

— Ki Younger Ju (@ki_young_ju) June 5, 2023

Julio Moreno, head of analysis at CryptoQuant, additionally notes that Binance’s Bitcoin Outflows-to-Reserves Ratio stays low.

Crypto costs crashed throughout the board on Monday after information broke that the SEC launched a lawsuit in opposition to Binance and its CEO Changpeng Zhao. The regulator alleges the alternate violated investor safety and securities legal guidelines.

The criticism additionally zeroes in on BNB, Binance’s native token, and BUSD, the alternate’s stablecoin, which was already focused by regulators earlier this 12 months. In accordance with the SEC, Binance unlawfully engaged in unregistered provides and gross sales of “crypto asset securities.”

The SEC then continued its regulatory crackdown on Tuesday with an announcement that it’s suing high US crypto alternate Coinbase. The regulator alleges the corporate operated as an unregistered securities alternate, dealer, and clearing company.

Regardless of the second lawsuit, digital asset costs jumped on Tuesday, with the general crypto market cap witnessing a 4.2% enhance prior to now 24 hours at time of writing.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney