Binance Good Chain (BSC) has demonstrated notable development in key metrics through the fourth quarter (This autumn) of 2023, as highlighted in a complete report by Messari.

Because the third-largest Layer-1 protocol by market capitalization, BSC skilled constructive progress throughout its monetary indicators, signaling a productive quarter for the blockchain ecosystem.

Binance Good Chain Document-Breaking Transactions

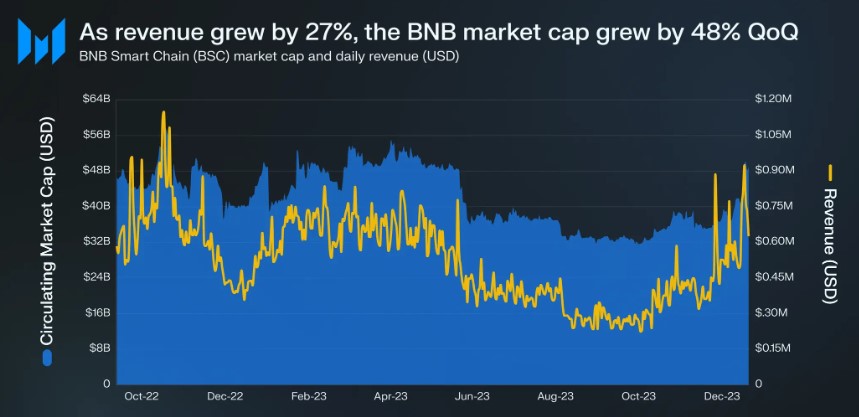

The report reveals that BSC’s market capitalization witnessed a 48% quarter-over-quarter (QoQ) surge. This surge displays renewed curiosity in BNB (Binance Coin), the native asset of BSC, following two consecutive quarters of decline.

Furthermore, BSC’s income measured in USD skilled a big QoQ development of 27%. This income surge, amounting to over $39 million in This autumn, signifies elevated exercise on the protocol and the implementation of varied initiatives all year long.

Associated Studying: Put together For Influence: US Authorities Will Dump $130 Million Price Of Bitcoin

Fuel charges burned in BNB, a metric reflecting community exercise, additionally noticed a notable QoQ enhance of 21%. The rising variety of transactions and good contract interactions contributed to elevated gasoline charges burned, additional reinforcing the Binance Good Chain ecosystem.

Along with monetary metrics, BSC showcased spectacular enhancements in different areas. The variety of lively validators elevated by 25% QoQ, highlighting rising belief and participation in securing the community. BSC’s dedication to decentralization was evident because the protocol skilled a 54% YoY enhance in lively validators.

In accordance with Messari, all through 2023, BSC demonstrated its skill to deal with heightened exercise whereas concurrently lowering prices for customers. Each day transactions on the community witnessed a 35% year-over-year (YoY) enhance and a 30% QoQ surge, averaging round 4.6 million transactions per day in This autumn.

These spikes in transaction quantity had been attributed to inscription-related exercise, with BSC processing a record-breaking 32 million transactions on December 7, 2023.

BSC’s DeFi Ecosystem Reaches $4.6 Billion TVL

Regardless of a decline in day by day common lively addresses and new distinctive addresses, primarily on account of customers exploring various chains like opBNB, BSC’s on-chain exercise remained sturdy.

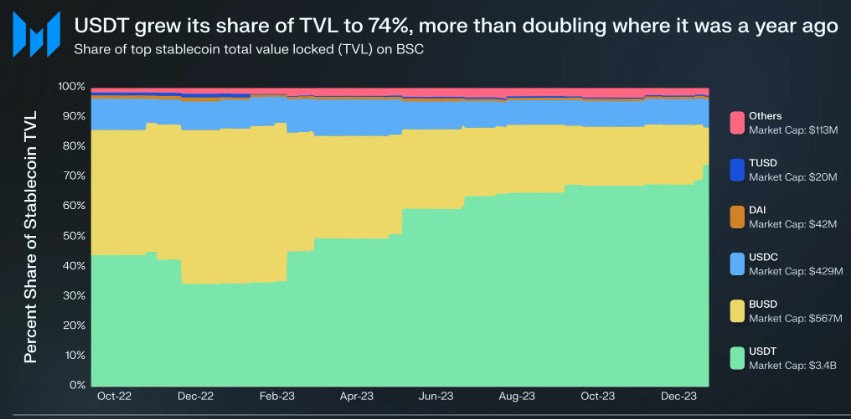

The protocol’s ecosystem of stablecoins, dominated by Tether’s USDT, reached a complete worth locked (TVL) of $4.6 billion in This autumn, showcasing a 33% QoQ enhance in Decentralized Finance (DeFi) TVL.

Associated Studying: Bitcoin Capitulation: Holders Flee BTC As Put up-ETF Disappointment Hits

Whereas Non-Fungible Token (NFT)- associated metrics declined in This autumn, Binance Good Chain and Ethereum (ETH) witnessed a resurgence in exercise towards the top of the quarter, indicating a possible upward pattern within the subsequent market cycle.

Along with BSC’s development, BNB additionally skilled notable value actions. After a pointy drop, BNB surged from $238 to succeed in the $338 stage. Nevertheless, it later retraced to $287 following a correction.

Previously 24 hours, BNB has recorded a development of three.7%, pushing its present buying and selling value above $302.