A transfer by Binance.US to amass property belonging to the bankrupt crypto lending agency Voyager Digital has been favored by 97% of Voyager’s prospects.

A Feb. 28 courtroom filing exhibits an awesome majority of Voyager Digital account holders are in favor of the buyout from the United States-based arm of the crypto change Binance.

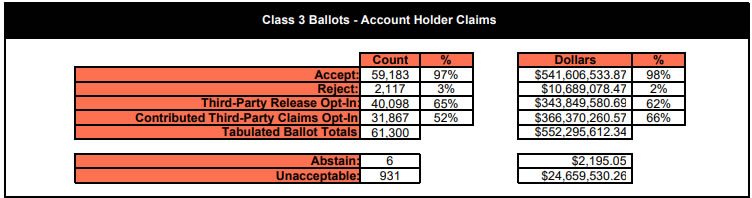

Chapter administration agency Stretto carried out the balloting of Voyager prospects, polling 61,300 account holders with claims in opposition to the embattled crypto lender.

Of that complete, 59,183 voted in favor of the Binance.US restructuring plan, with simply 3%, or 2,117 voters, rejecting it.

The voters have been divided into 4 courses, together with account holder claims and three classes of these with “normal unsecured claims.” The latter teams additionally voted in favor of the proposal.

In December, Binance.US disclosed an settlement to purchase Voyager’s property for $1.02 billion. In line with the press launch on the time, the Binance.US bid “goals to return crypto to prospects in form, in accordance with court-approved disbursements and platform capabilities.”

Nonetheless, there was plenty of pushback and quite a few objections to the proposal by the American division of the world’s largest crypto change.

The Texas State Securities Board and the state’s Division of Banking objected, claiming the restructuring plan incorporates “insufficient” disclosures. A few of these included not informing unsecured collectors that they could solely get 24% to 26% restoration somewhat than the 51% they’d obtain underneath Chapter 7 chapter.

Associated: Voyager is promoting crypto property by Coinbase, suggests on-chain knowledge

The U.S. Securities and Change Fee additionally objected to the transfer in a Feb. 22 courtroom submitting, claiming that the Binance.US acquisition of Voyager property might breach securities regulation.

On that very same day, the Federal Commerce Fee began an investigation into Voyager Digital for its “misleading and unfair advertising of cryptocurrency to the general public.”