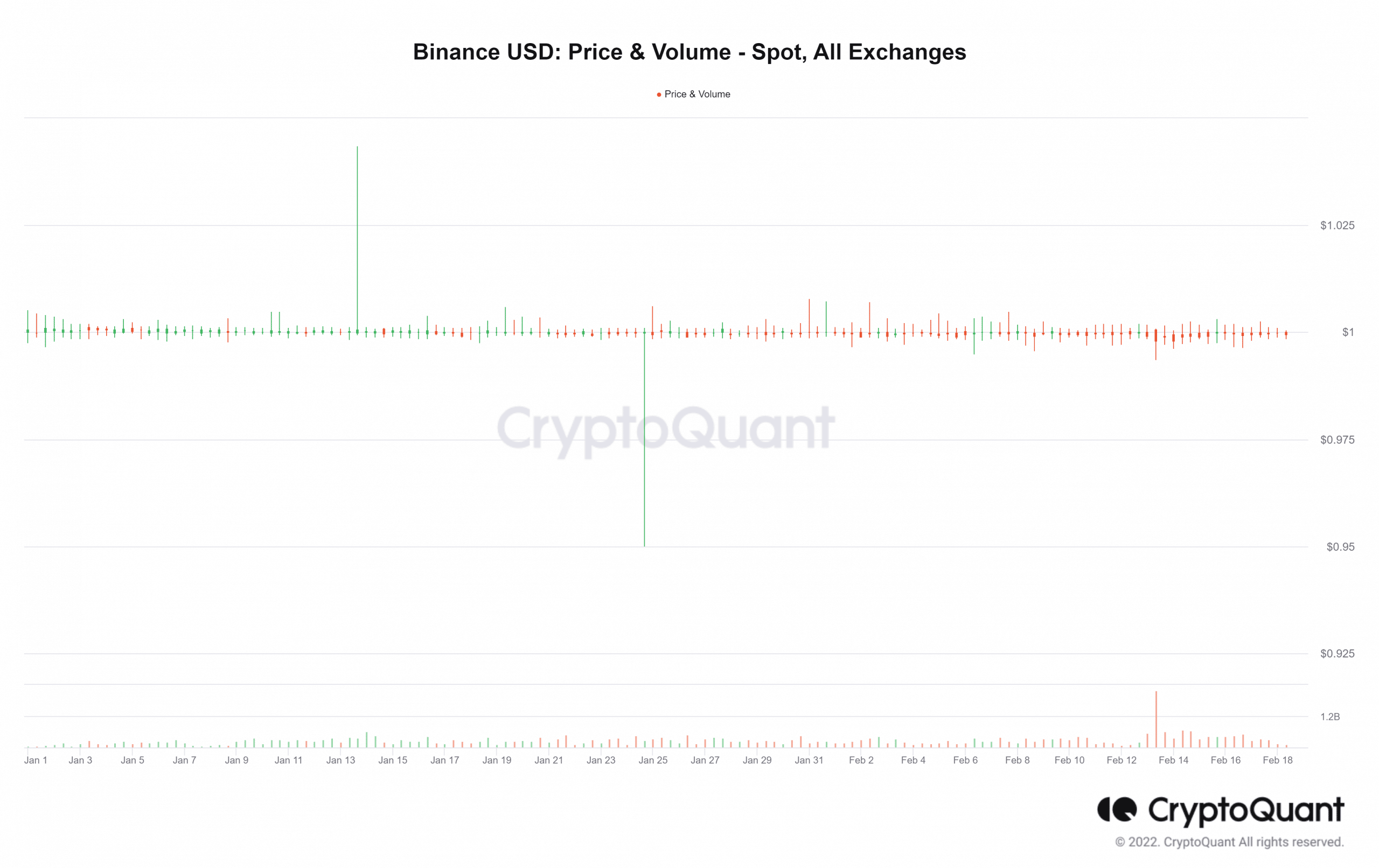

- BUSD has been in a position to preserve the $1 peg regardless of its FUD.

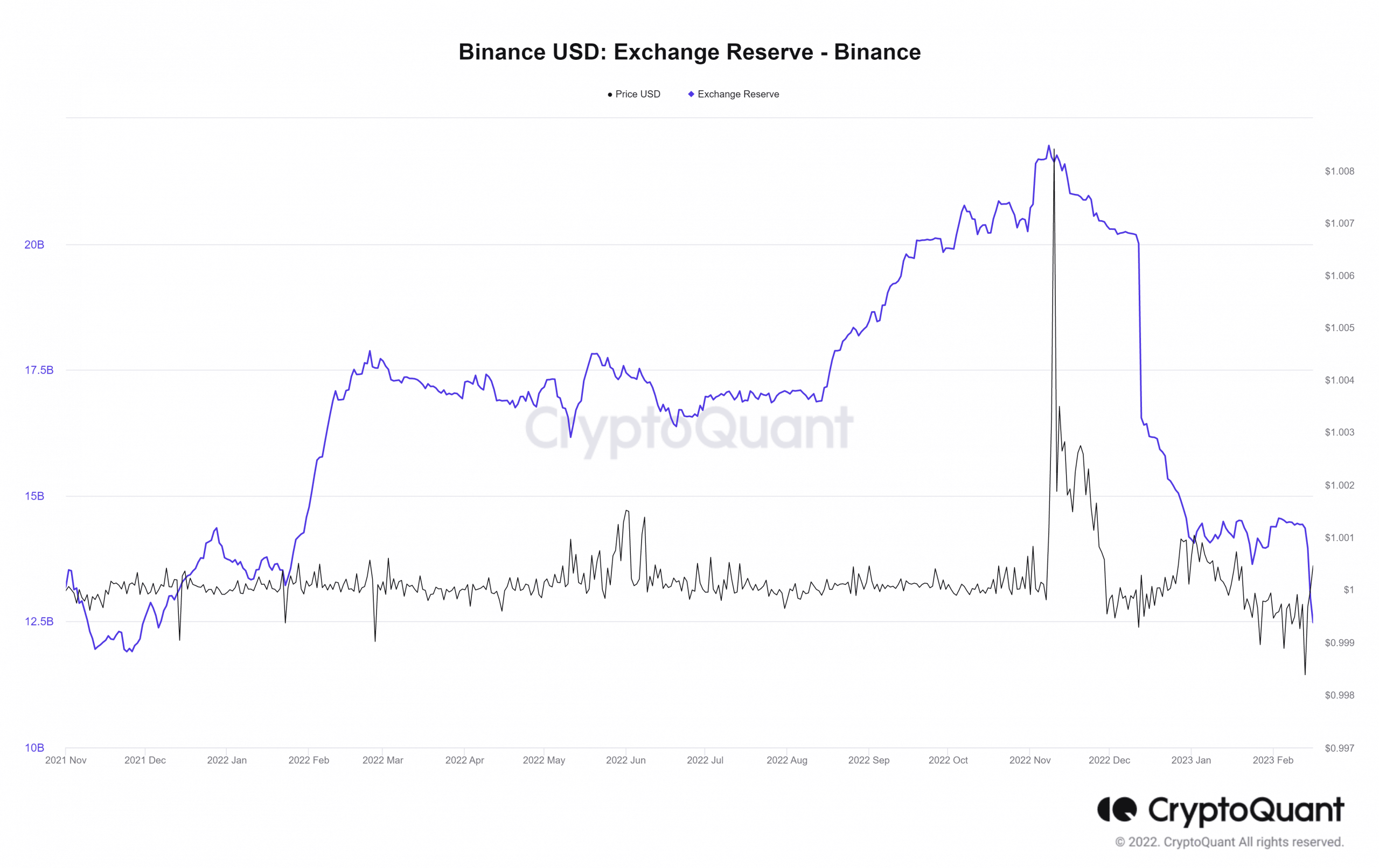

- Binance’s BUSD reserve has declined to round 12.4 billion.

The regulatory hammer hung above Binance for a while earlier than touchdown on Binance USD (BUSD). Regardless of the FUD that has gripped the stablecoin, one metric has turned out to be optimistic for it to this point.

BUSD maintains its peg

Because of the Wells discover issued by the Safety and Change Fee (SEC) to Paxos, the Binance USD (BUSD) has been put by way of a rigorous stress check.

Consequently, stablecoin buyers have been compelled to promote their holdings. It was estimated that as of 17 February, there had been near $500 million price of trades seen to the general public.

Regardless of the excessive quantity of transactions, BUSD has stored its worth fastened at one greenback, as per Crypto Quant. As of this writing, the quantity had already exceeded 200 million whereas remaining steady at its present stage. Regardless of the asset’s obvious fall, that is excellent news.

Supply: CryptoQuant

Outflow continues as reserve declines

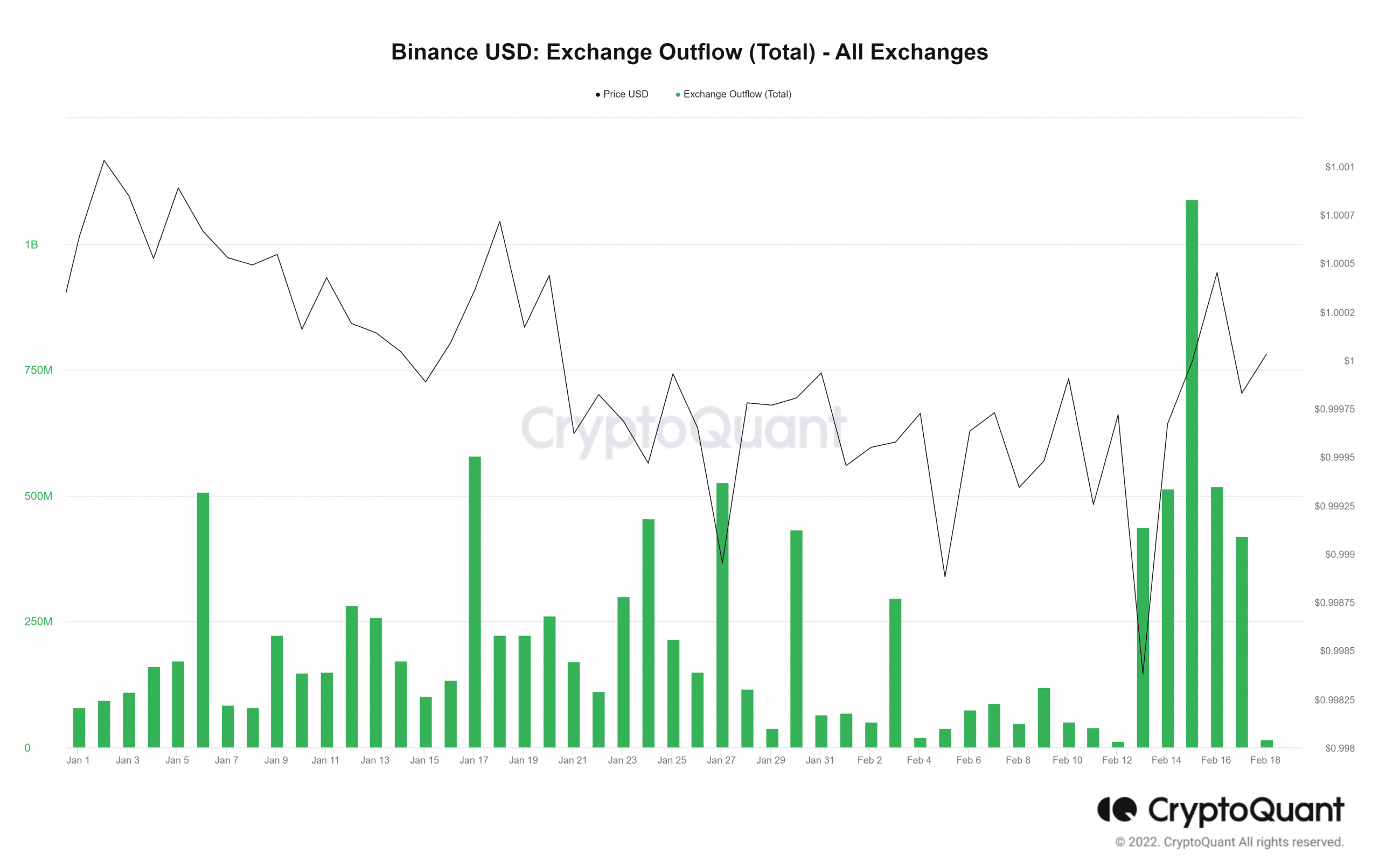

All indicators level to BUSD holders being in a rush to promote their property as a result of they’re not sure of what would possibly occur subsequent.

Analyzing the influx and outflow statistics for all exchanges revealed that though the influx had lowered, the outflow was nonetheless at a big stage.

The latest figures indicated that the outflow was almost 500 million. Holders could also be switching to fiat or different stablecoins, as seen by the rising outflow.

Supply: CryptoQuant

Moreover, Binance’s BUSD reserve has been diminishing with the big quantity of BUSD buying and selling.

A verify of Binance’s trade reserve measure revealed that the reserve had dropped to roughly $12.48 billion as of this writing. It began the 12 months with a reserve of almost $14 billion and stored it till the decline started.

Supply: CryptoQuant

The Aave freeze

It’s vital to notice {that a} proposal to discontinue buying and selling in BUSD on Aave was offered on 13 February and can be voted on till 19 February.

The proposal states that dropping the flexibility to mint extra BUSD may hurt peg arbitrage and asset peg. Moreover, it was famous that freezing this reserve and inspiring customers emigrate to a different stablecoin was essential. As of this writing, the proposal had gathered 99.96% votes.

How Paxo’s dispute with the SEC over Binance USD (BUSD) can be resolved continues to be largely unknown. Nonetheless, the true state of BUSD can be revealed within the following weeks or months as occasions play out and paint a whole image.

![Binance USD [BUSD] maintains its peg even as outflow increases](https://nomadabhitravel.com/wp-content/uploads/2023/02/Binance-USD-Price-Volume-Spot-All-Exchanges-1536x967.png)