- BNB will launch Parallel EVM 3.0 in 2023, and also will improve its gasoline restrict.

- The variety of transactions and addresses registered an uptick.

On 14 February, Binance Coin [BNB] posted its tech roadmap for the yr 2023, highlighting its plans for the yr and initiatives within the pipeline. Curiously, on 24 February, Messari shared a report on the identical, mentioning essentially the most notable factors of the roadmap.

Reasonable or not, right here’s BNB market cap in BTC’s phrases

A glimpse of the tech roadmap

The roadmap’s first mission was the launch of a brand new storage community named BNB Greenfield, which went dwell not too long ago. Inside the bigger BNB Chain ecosystem, BNB Greenfield is a decentralized storage infrastructure the place customers and dApps can create, retailer, and trade knowledge.

As per the roadmap, this yr Binance will even give attention to its multichain resolution by introducing a number of ZKP rollup-based L2s for functions with large customers and pre-defined logic. BNB already launched its Parallel EVM v1 and v2 in 2022, and in 2023, it plans to introduce Parallel EVM 3.0.

One other main replace was that BNB will improve the community’s gasoline restrict from 140 million to 300 million in 2023. This variation in gasoline restrict will permit BNB Chain to course of over 5,000 transactions per second. The brand new gasoline restrict and elevated transaction pace may also help BNB acquire extra customers.

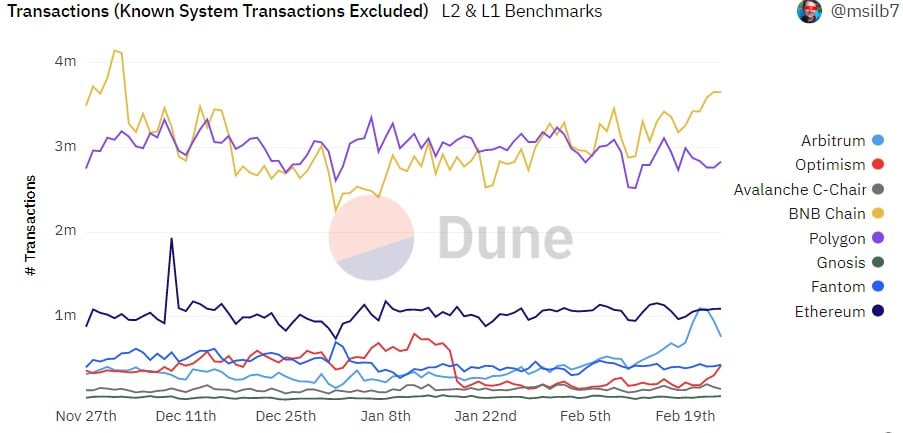

By the way, Dune’s data revealed that the variety of transactions on BNB Chain has been rising for the reason that starting of this yr, outperforming the remaining. Furthermore, the variety of transacting addresses additionally elevated significantly. Each developments mirrored the elevated utilization and adoption of BNB.

Supply: Dune

BNB’s efficiency in 2023

Whereas these updates appeared optimistic for the chain, its efficiency on the metrics entrance fluctuated over the past 30 days. For example, BNB’s weighted sentiments remained on the damaging aspect over the previous few weeks. The token’s growth exercise additionally declined after registering a spike on 9 February, indicating fewer efforts by the builders.

Moreover, demand from the derivatives market additionally took a blow, as BNB’s Binance funding charge remained comparatively low.

How a lot are 1,10,100 BNBs price at present?

After a snug begin to the yr, BNB’s MVRV Ratio declined significantly over the previous few days, which could possibly be attributed to the bearish market pattern.

Supply: Santiment

Nonetheless, BNB accumulation witnessed a rise over the previous month as its provide held by high addresses registered an uptick. At press time, BNB’s worth had declined by over 4.5% within the final seven days and was trading at $302.09 at press time.