David Puell, an on-chain researcher at Ark Make investments, right now shared his insights in an in depth report, providing a nuanced perspective on Bitcoin’s present standing and future prospects. The report, titled “The Bitcoin Month-to-month: July 2023,” addresses a number of key subjects which are central to understanding the present state of Bitcoin.

These subjects embody a complete market abstract, an evaluation of Bitcoin’s low volatility and whether or not it signifies a possible breakdown or breakout, in addition to a dialogue on the affect of the Federal Reserve’s tightening coverage as a number one indicator of worth deflation.

Ark Make investments’s Close to-Time period Bitcoin Worth Prediction

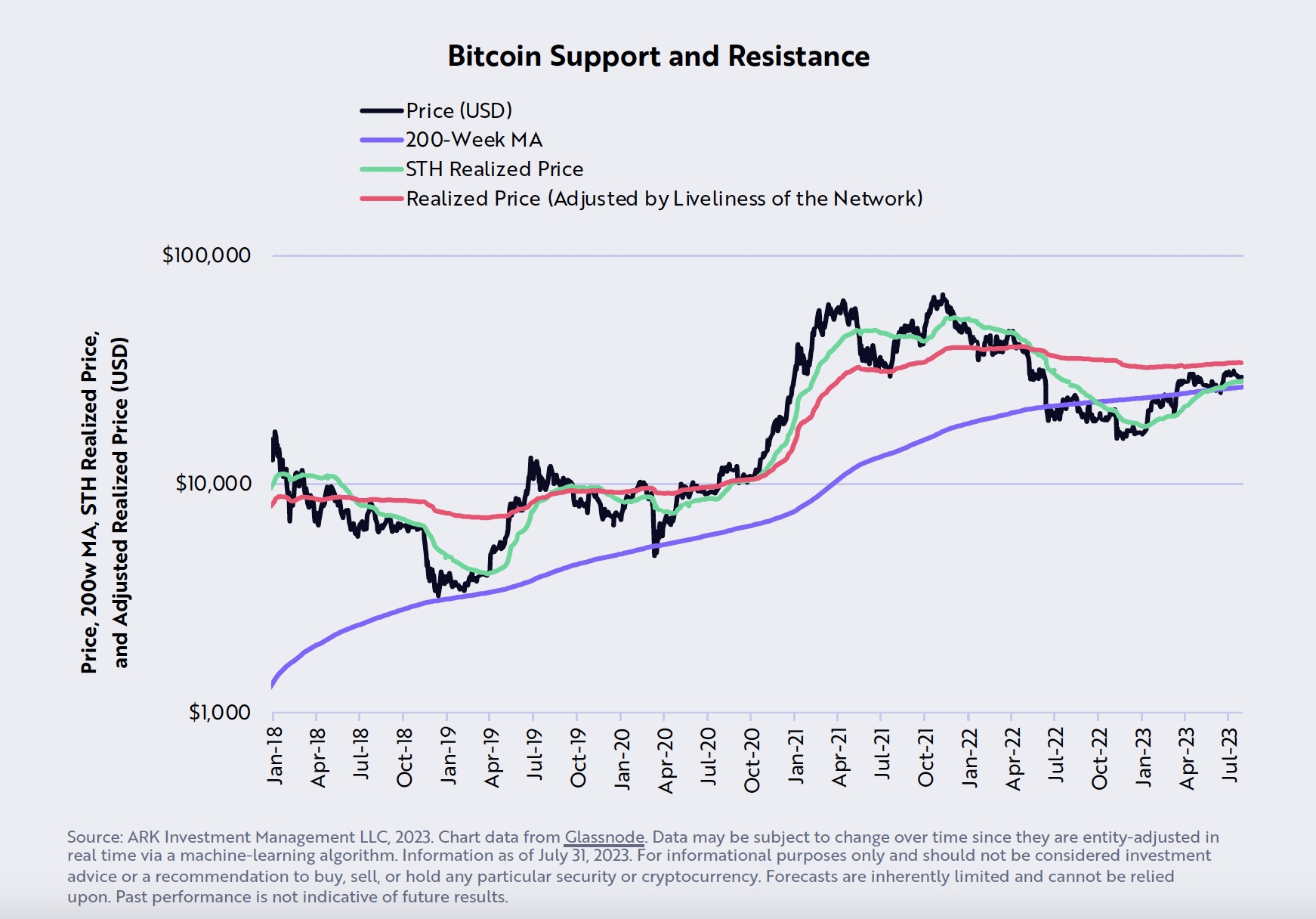

Puell’s evaluation reveals a blended, however primarily bullish outlook for Bitcoin, with the cryptocurrency ending July at $29,230, above its 200-week transferring common and its short-term-holder (STH) value foundation of $28,328. This implies a powerful help stage for Bitcoin, indicating a possible upward pattern, notes Puell.

Nevertheless, Bitcoin’s 90-day volatility, which dropped to 36% in July, a stage not seen since January 2017, presents a impartial outlook. Puell explains, “Primarily based on its low stage of volatility, we consider the Bitcoin worth might be setting as much as transfer dramatically in a single path or the opposite through the subsequent few months.” This might imply a major worth motion, however the path – up or down – is unsure.

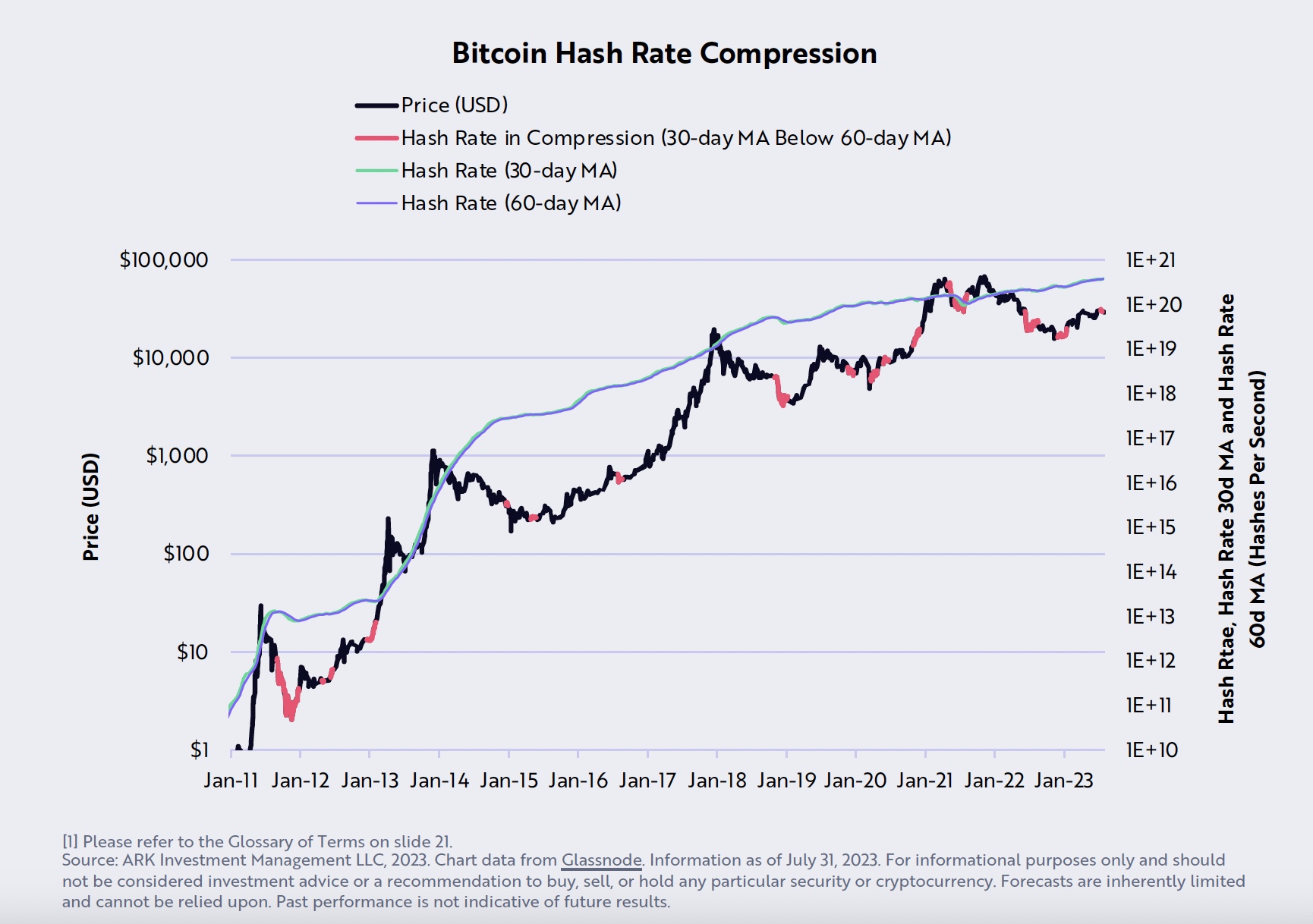

Puell additionally factors to indicators of miner capitulation as a bullish indicator. “Throughout July, the 30-day transferring common of Bitcoin’s hash fee dropped beneath its 60-day transferring common, suggesting that miner exercise had capitulated,” he states. Miner capitulation is usually related to oversold circumstances in BTC worth, hinting at a possible bullish reversal.

The “liveliness” metric, which measures potential promoting stress relative to present holding conduct, additionally suggests a bullish pattern. The analyst notes, “In July, liveliness dropped beneath 60%, suggesting the strongest long-term holding conduct because the final quarter of 2020.” This means that extra holders are retaining their cash reasonably than promoting them, which might drive the value up.

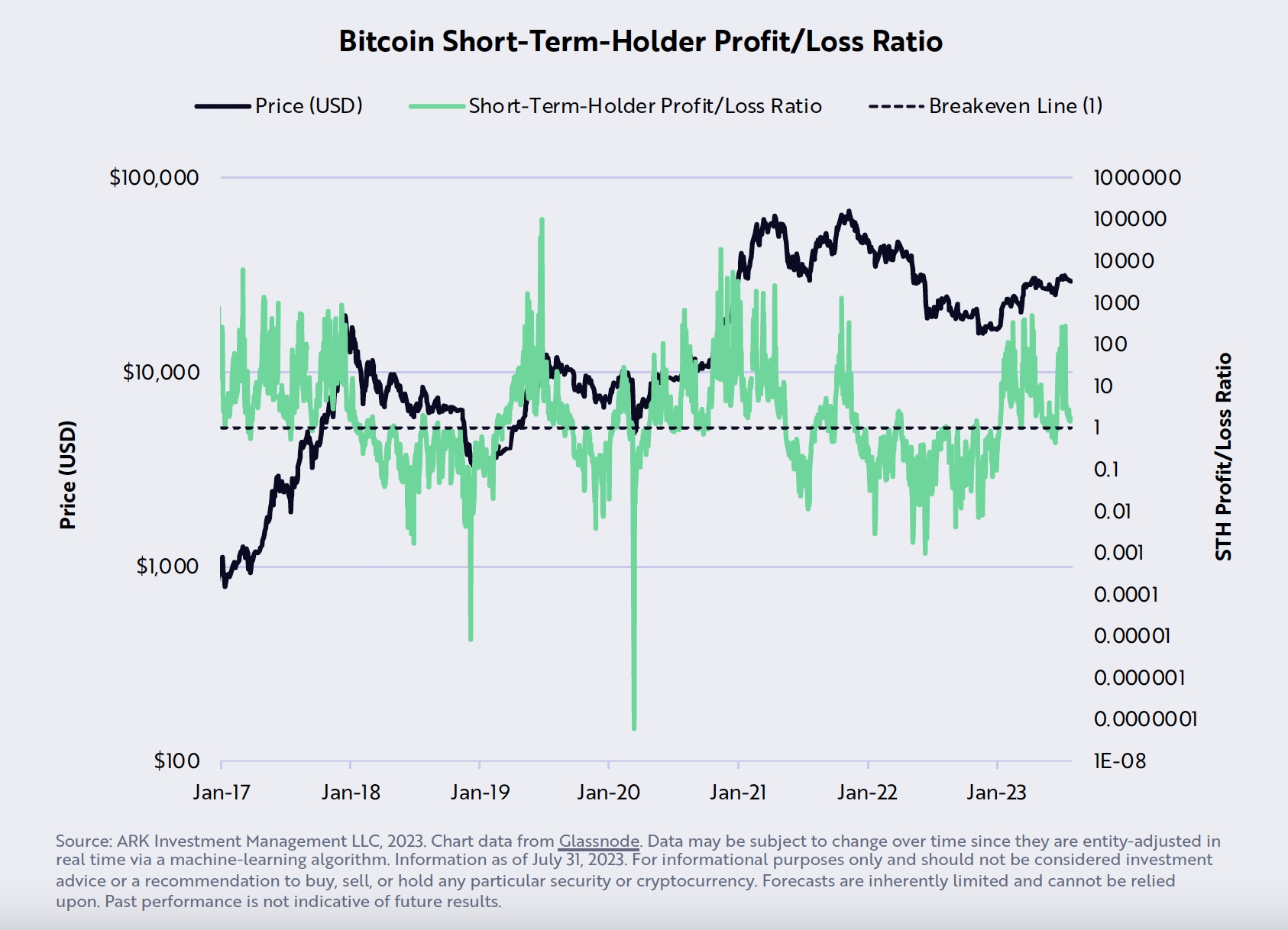

ARK’s personal short-term-holder revenue/loss ratio, which ended July at ~1, can also be seen as a bullish signal. Puell explains, “This breakeven stage correlates each with native bottoms throughout major bull markets and with native tops throughout bear market environments.”

Nevertheless, the way forward for Binance’s BNB token, which is going through elevated regulatory stress, appears to be like bearish based on Puell. He warns, “As regulatory stress will increase on crypto alternate Binance, its native token, BNB, might be on the edge of serious turbulence.” If BNB breaks down, it might probably affect the general stability of the crypto market, together with BTC.

Macro Outlook

On the macroeconomic entrance, Puell discusses the potential affect of the Fed’s 22-fold improve in rates of interest, which he views as bearish for Bitcoin and the broader financial system. He states, “In response to famend economist Milton Friedman, financial coverage works with ‘lengthy and variable lags’ that final 12-18 months, suggesting that the complete affect of the Fed’s 22-fold improve in rates of interest has but to hit.”

The Zillow Lease Index, which leads the House owners’ Equal Lease (OER) by roughly 9 months, means that Shopper Worth Index (CPI) inflation might decelerate considerably beneath 2% by year-end. Puell views this as a bullish signal for Bitcoin, because it might probably improve the attractiveness of non-inflationary property like Bitcoin.

Lastly, Ark Make investments takes a impartial stance on the falling US import costs from China, regardless of the yuan’s depreciation by ~12% since February 2022. He notes, “All else equal, China exporters ought to have elevated costs to offset the depreciation of the yuan. As an alternative, they’ve reduce costs, harming their profitability.”

In conclusion, Puell’s report presents a posh image for Bitcoin. Whereas there are a variety of indicators for a possible bullish pattern, there are additionally vital dangers and uncertainties that might result in bearish outcomes.

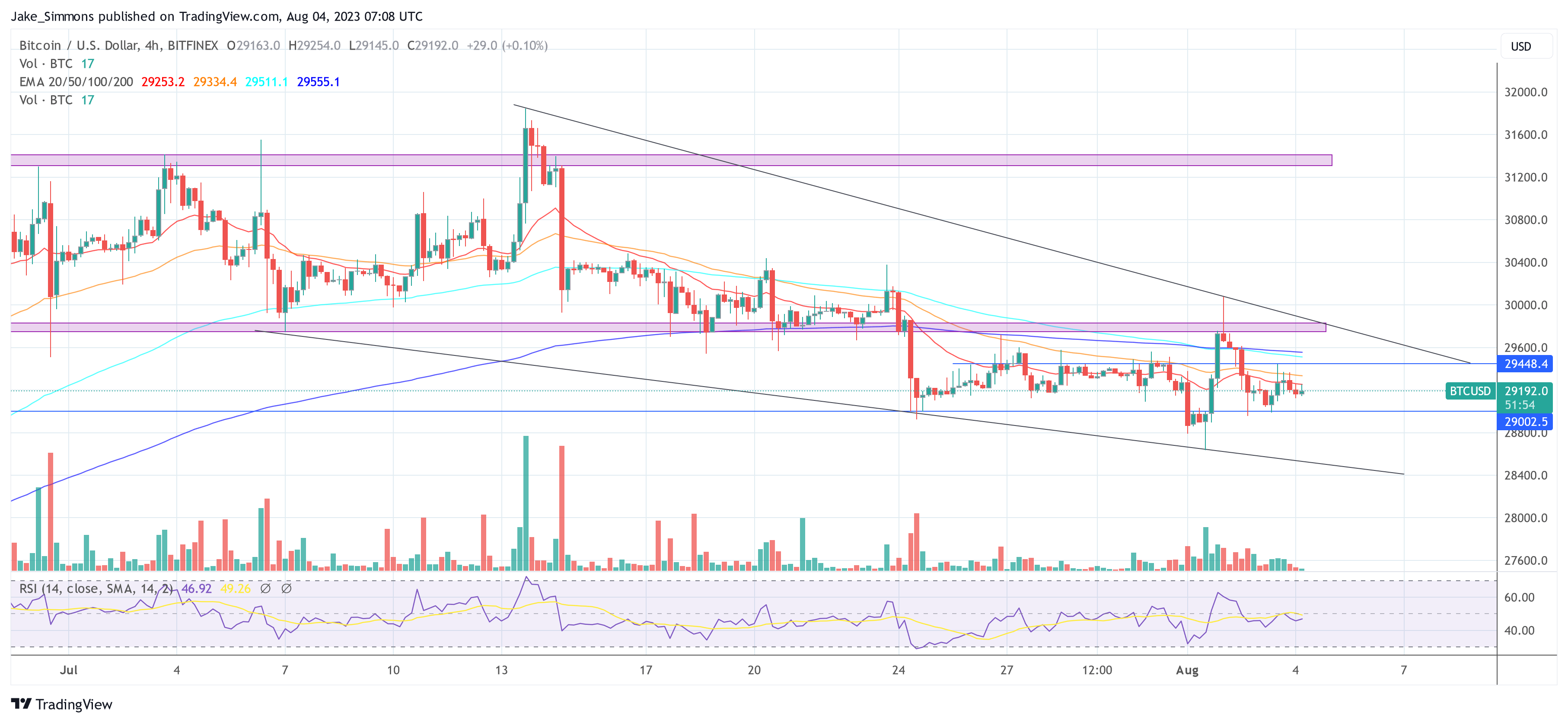

At press time, the BTC worth was at $29.152. Essentially the most essential resistance for the time being lies at $29.450. If BTC can overcome this resistance, a breakout from the multi-week downtrend is perhaps attainable.

Featured picture from Kanchanara / Unsplash, chart from TradingView.com