- On-chain information revealed that BTC’s ongoing efficiency is hinting at an imminent bear market finish

- Whereas many BTC holders stay in revenue, the extent of profitability has began to say no

In its newest report, on-chain analytics firm Glassnode analyzed Bitcoin’s [BTC] on-chain efficiency. In doing so, it noticed that the prevailing value actions resemble earlier bear market bottoms.

Based on the information supplier, final week’s value decline to a low of $22,199 occurred alongside essential value ranges. These are associated to older holders from the earlier cycle and whale entities which were lively for the reason that 2018 cycle, making it extremely essential.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Better revenue, entry of latest cash, and the whole lot good

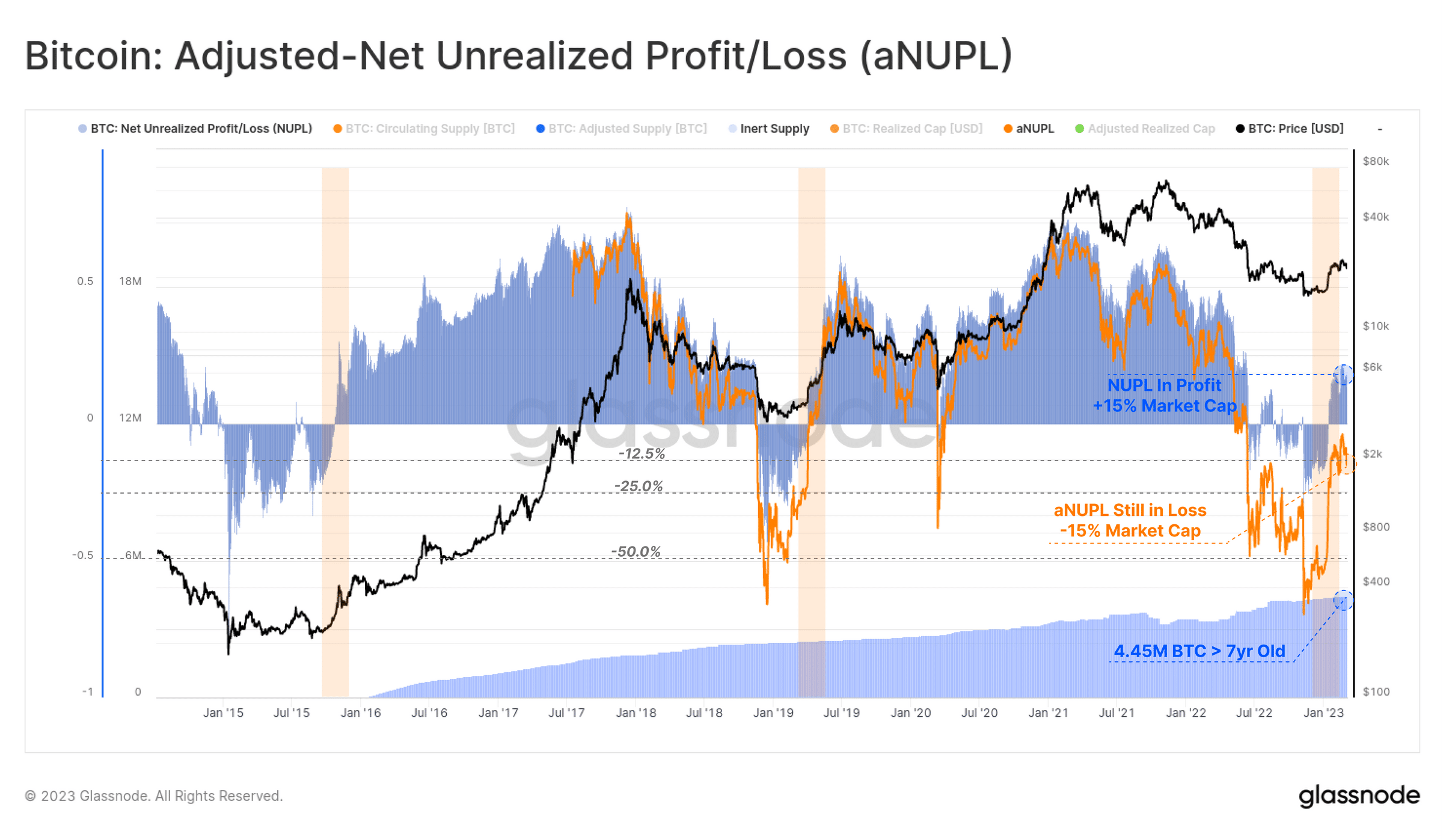

Glassnode assessed BTC’s Web Unrealized Revenue/Loss metric (NUPL) and famous that “the present state of the market might be moderately described as resembling a Transitional Part,” which is widespread “within the later levels of a bear market.”

The NUPL metric determines whether or not BTC holders are presently experiencing unrealized positive aspects or losses. It compares the typical buy value of all BTCs held by buyers to the present market value. If the market value is greater, there’s a web unrealized revenue, whereas if the market value is decrease, there’s a web unrealized loss.

Based on Glassnode, the weekly common of NUPL has modified from a state of web unrealized loss to a optimistic situation since mid-January. This can be a signal that the standard BTC holder now holds a web unrealized revenue of roughly 15% of the market cap, resembling transition phases in earlier bear markets.

Nonetheless, Glassnode warned that the adjusted model of NUPL, which accounts for misplaced cash, confirmed that the market is simply barely under the break-even level. Merely put, this might nonetheless be thought to be being in a bear market territory.

Supply: Glassnode

Aside from the NUPL metric, one other indication of the “Transitional Part” is the entry of latest cash into the market.

Glassnode thought-about the BTC’s Switch Quantity metric and located that the coin’s month-to-month Switch Quantity is up by 79% to $9.5 billion per day since early January. In reality, the report described this as a optimistic signal of progress.

Learn Bitcoin [BTC] Worth Prediction 2023-24

It, nonetheless, added a caveat that that is nonetheless properly under the yearly common, which has been closely influenced by a big quantity of FTX/Alameda-related wash volumes. Nonetheless, it stays an excellent indicator that the tip of the bear market could be underway.

Supply: Glassnode

Moreover, BTC’s Adjusted Spent Output Revenue Ratio (aSOPR) revealed the “first sustained burst of profit-taking since March 2022.” Nonetheless, Glassnode warned that the coin’s Realized Revenue/Loss ratio revealed that profitability “has shifted again in direction of a transition section.”

Which means that BTC won’t be as worthwhile because it was in January when the worth skilled a growth. Therefore, warning is suggested.

Supply: Glassnode

![Bitcoin [BTC]: As market hits ‘transition phase,’ here are the things to look out for](https://nomadabhitravel.com/wp-content/uploads/2023/03/woc-10-03-1--1536x894.png)