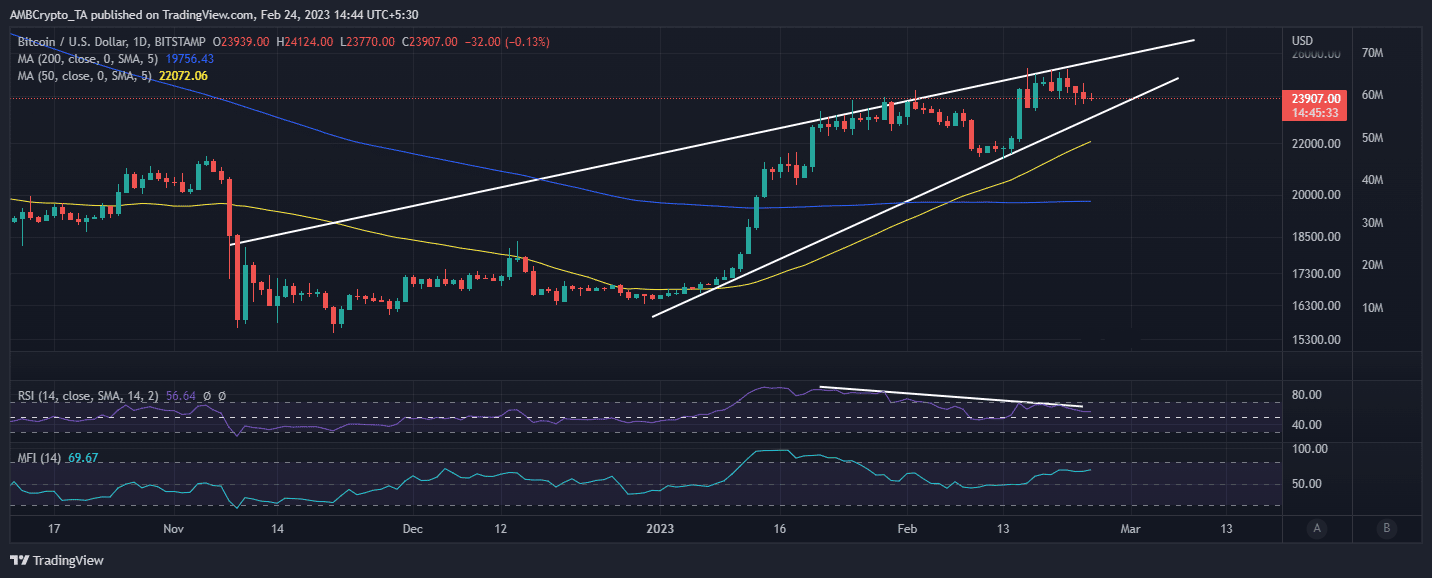

A couple of days in the past, it turned obvious that Bitcoin [BTC] was in a price-RSI divergence sample. This was a sign of relative pattern weak spot for the bears, and one that will give method to a retracement. Quick ahead to the current, and that retracement is right here, however the bears, too, at the moment are displaying some weak spot.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Bitcoin’s $23,909 press time worth represented a 5.4% drop from its current excessive, which was additionally its present 2023 excessive. This may not be a lot within the grand scheme of retracements, but it surely is a sign of low promote stress. This isn’t stunning contemplating the bullish expectations available in the market.

Supply: TradingView

If Bitcoin maintained its press time sample, then the following purchase wall could possibly be anticipated close to the $23,500 worth stage. This was the identical worth vary the place the value bounced again on 16 February and the identical stage beforehand acted as a resistance vary. There have been some key observations that completely summed up BTC’s efficiency.

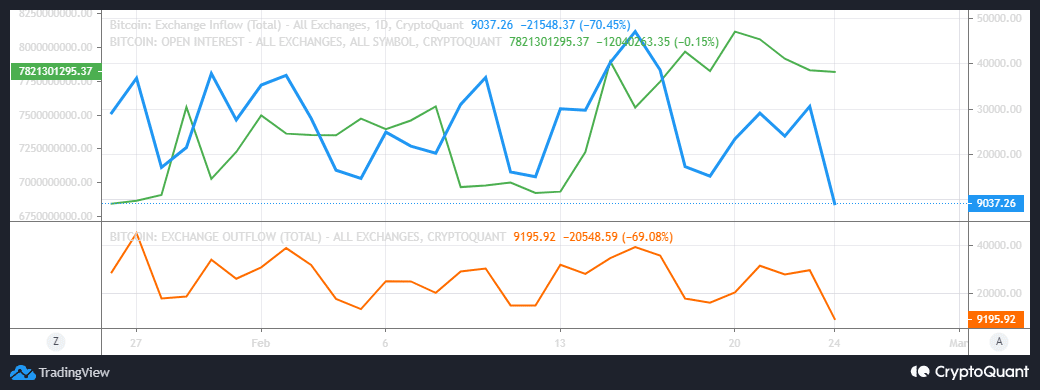

Alternate circulate traits reveal this about Bitcoin

Bitcoin trade flows have been leaning in favor of the bears for the previous couple of days. Nonetheless, the promote stress has declined considerably every day. The newest Glassnode alerts conserving observe of every day on-chain flows reveals that Bitcoin’s internet flows for twenty-four February added as much as -$29.5 million.

📊 Every day On-Chain Alternate Circulate#Bitcoin $BTC

➡️ $687.8M in

⬅️ $717.3M out

📉 Internet circulate: -$29.5M#Ethereum $ETH

➡️ $363.8M in

⬅️ $341.2M out

📈 Internet circulate: +$22.6M#Tether (ERC20) $USDT

➡️ $587.7M in

⬅️ $659.8M out

📉 Internet circulate: -$72.0Mhttps://t.co/dk2HbGwhVw— glassnode alerts (@glassnodealerts) February 24, 2023

The identical tracker revealed that Bitcoin had a internet circulate of -$40.1 in the day gone by and +$52.9 million the day earlier than. This confirmed a return of general promote stress, but it surely slowed down at press time. This was confirmed by the trade influx metric, however trade outflows additionally demonstrated an identical consequence.

Supply: Glassnode

The newest trade circulate information reveals that trade outflows have been barely greater than inflows. Additionally, Open Curiosity has been declining for the previous couple of days, but it surely levelled out on the time of writing. A possible pivot in derivatives demand is likely to be on the playing cards.

What number of are 1,10,100 BTCs price at the moment?

Are bulls able to take over?

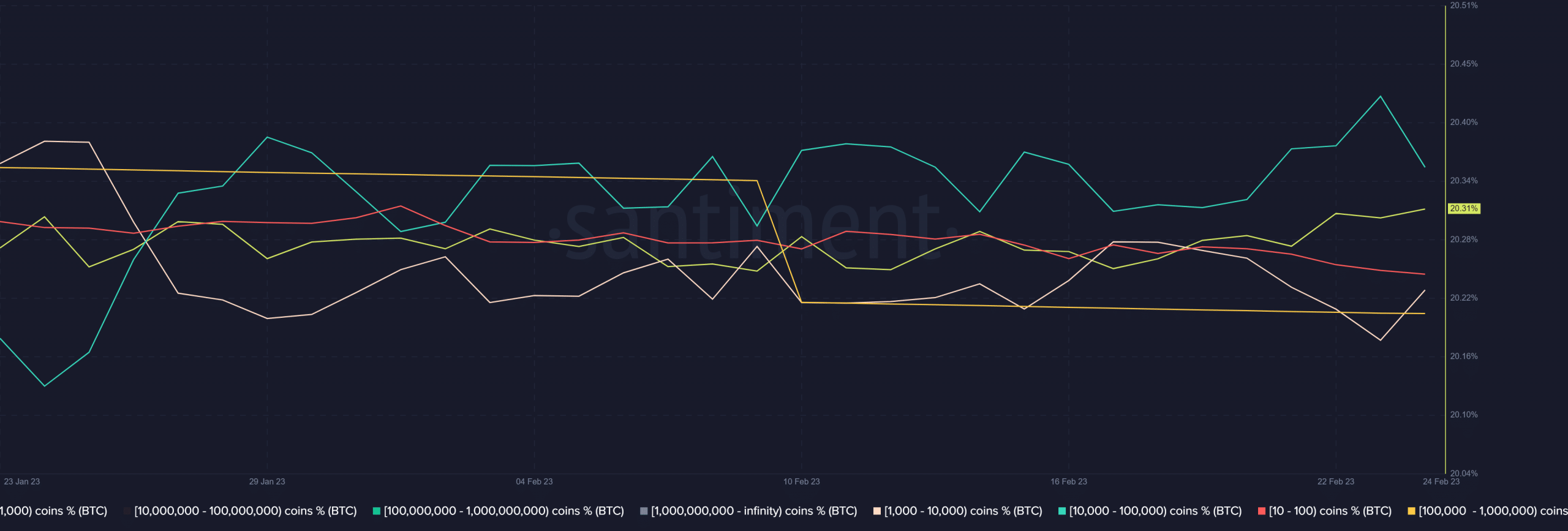

Maybe a have a look at the place most buying energy comes from might supply some helpful insights. Bitcoin’s provide distribution reveals that addresses holding between 1,000 – 10,000 BTC pivoted throughout yesterday’s buying and selling session and have been accumulating at press time.

Supply: Santiment

This commentary was essential as a result of the identical tackle class managed the most important provide of BTC in circulation. The explanation why a bullish transfer has not commenced regardless of this commentary is that addresses holding over 10,000 BTC have been doing the alternative, thus contributing to promote stress.

![Bitcoin [BTC] bears show signs of weakness as this metric slows down](https://nomadabhitravel.com/wp-content/uploads/2023/02/BTCUSD_2023-02-24_12-14-28-1024x413.png)