- U.S. government-seized Bitcoin holdings began to maneuver, inflicting FUD

- Quick-term holders declined whereas long-term holders stayed put

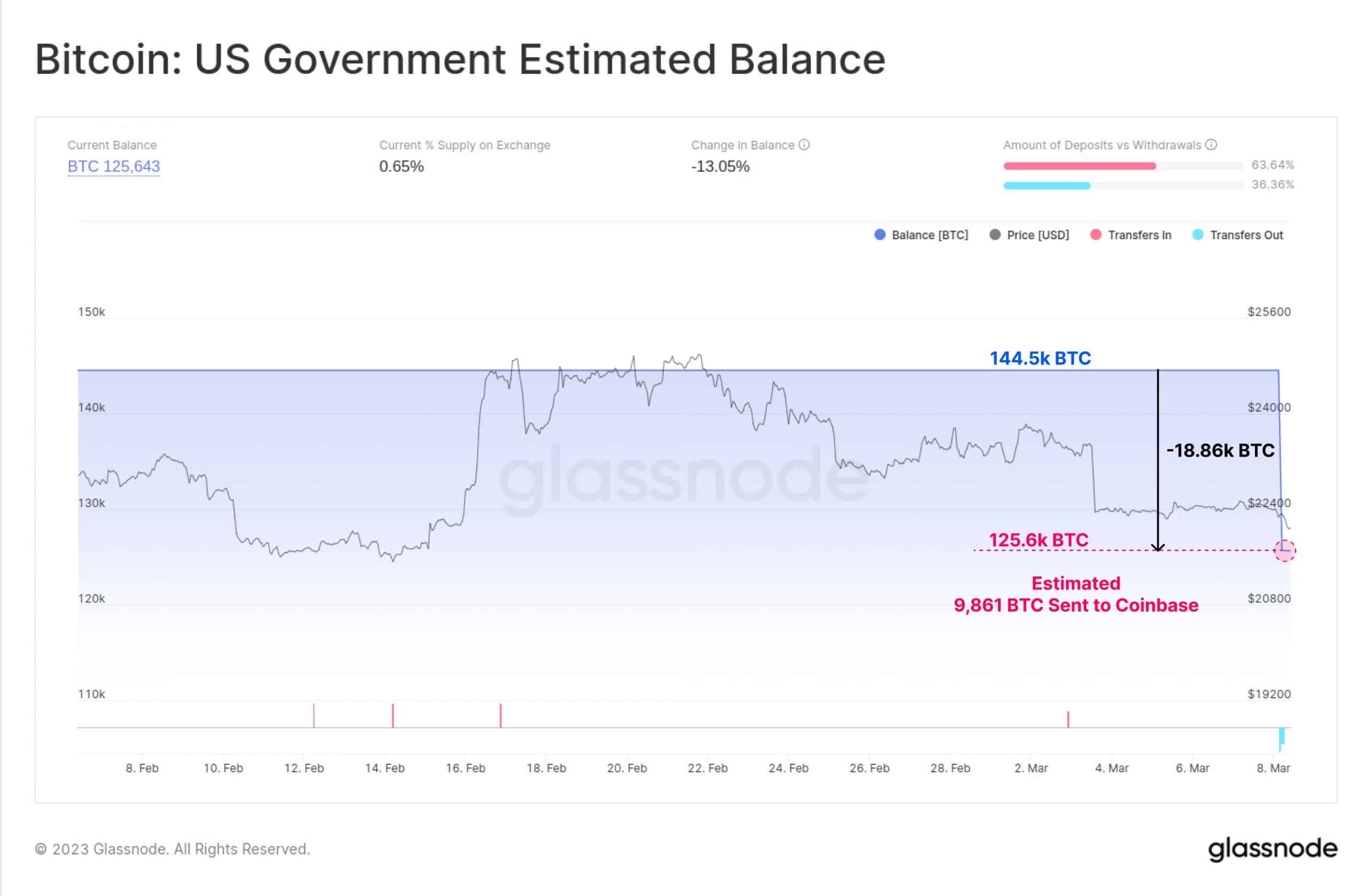

Over the previous couple of years, the U.S. authorities has amassed huge quantities of BTC for legislation enforcement functions. This BTC, for essentially the most half, has remained dormant all through the time it was being held by the usgovernment. Nevertheless, based on new knowledge supplied by Glassnode, this BTC has now began to maneuver.

Learn Bitcoin’s Value Prediction 2023-2024

The quantity of Bitcoin which is on the transfer is estimated to be round 40k BTC. Out of the aforementioned quantity, 9,861 BTCs have been seized from the Silk Highway hacker and have been despatched to a Coinbase cluster.

Supply: glassnode

The FUD begins

This habits of the U.S. authorities has led many members of the crypto-community to invest on what this might imply for Bitcoin. Many customers are beneath the assumption that the U.S. authorities might be promoting these BTC holdings, negatively affecting the worth of the cryptocurrency within the course of.

Moreover, this transfer by the federal government can hurt the sentiment round BTC and trigger extra FUD.

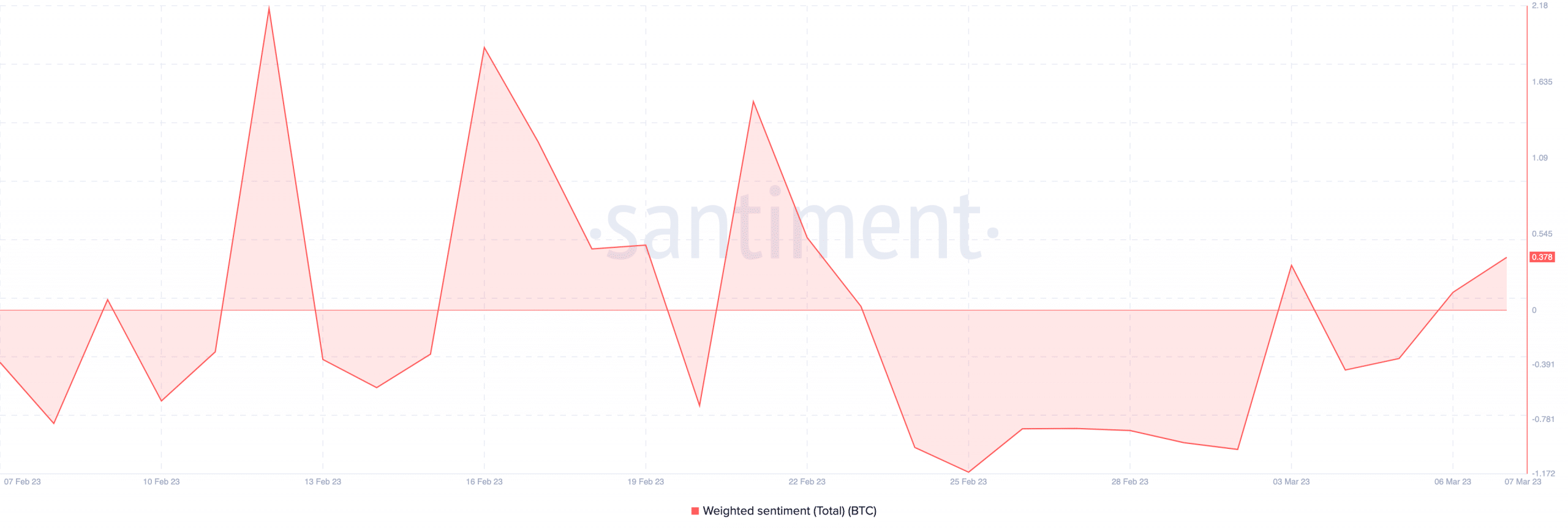

At press time, the general weighted sentiment round Bitcoin was barely optimistic. Nevertheless, if the FUD continues to unfold, issues may take a flip for the more severe and the promoting strain on BTC holders would find yourself rising.

Supply: Santiment

Regardless that the FUD round Bitcoin has been on the rise, long-term holders are much less prone to be affected. Based mostly on the declining lengthy/quick ratio, it may be noticed that short-term holders of BTC have began to exit their positions. The MVRV ratio for the remaining long-term holders is destructive, implying that they wouldn’t be capable to promote their holdings for a revenue throughout this era.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

Due to this fact, it’s extra possible that these long-term holders will proceed to carry on to their property till promoting their holdings is worthwhile. The declining velocity can also be an indication {that a} majority of BTC addresses have been HODLing.

Supply: Santiment

Any optimistic, hopeful indicators?

Nevertheless, one of many the reason why addresses may very well be optimistic about Bitcoin’s future can be its efficiency in opposition to different real-world property. In keeping with analysts, for example, Bitcoin has managed to outperform property similar to gold, silver, U.S equities, and the usDollar index.

All of the hysteria with the markets pricing in 50 bps for March.

A terminal Price of 5.6% in October, increased for longer calls.

Triple-digit inversion, and most inverted since 1980. Whereas an ongoing Grayscale case with the SEC. #Gold and #Silver are getting crushed. #Bitcoin is… https://t.co/n9muCqdh86 pic.twitter.com/Jc1m417Ym4— James V. Straten (@jimmyvs24) March 7, 2023

It stays to be seen whether or not Bitcoin continues its trajectory of outperforming numerous asset courses and whether or not BTC holders are impacted by the FUD.

![Bitcoin [BTC] FUD takes centre stage as Uncle Sam makes a move](https://nomadabhitravel.com/wp-content/uploads/2023/03/FqpxoJhaAAEXmPH-scaled-1536x1004.jpeg)