- As per an analyst, BTC’s LTH SOPR had been trending beneath one since late Might 2022.

- Mining exercise on the BTC community was considerably impacted by the king coin’s value.

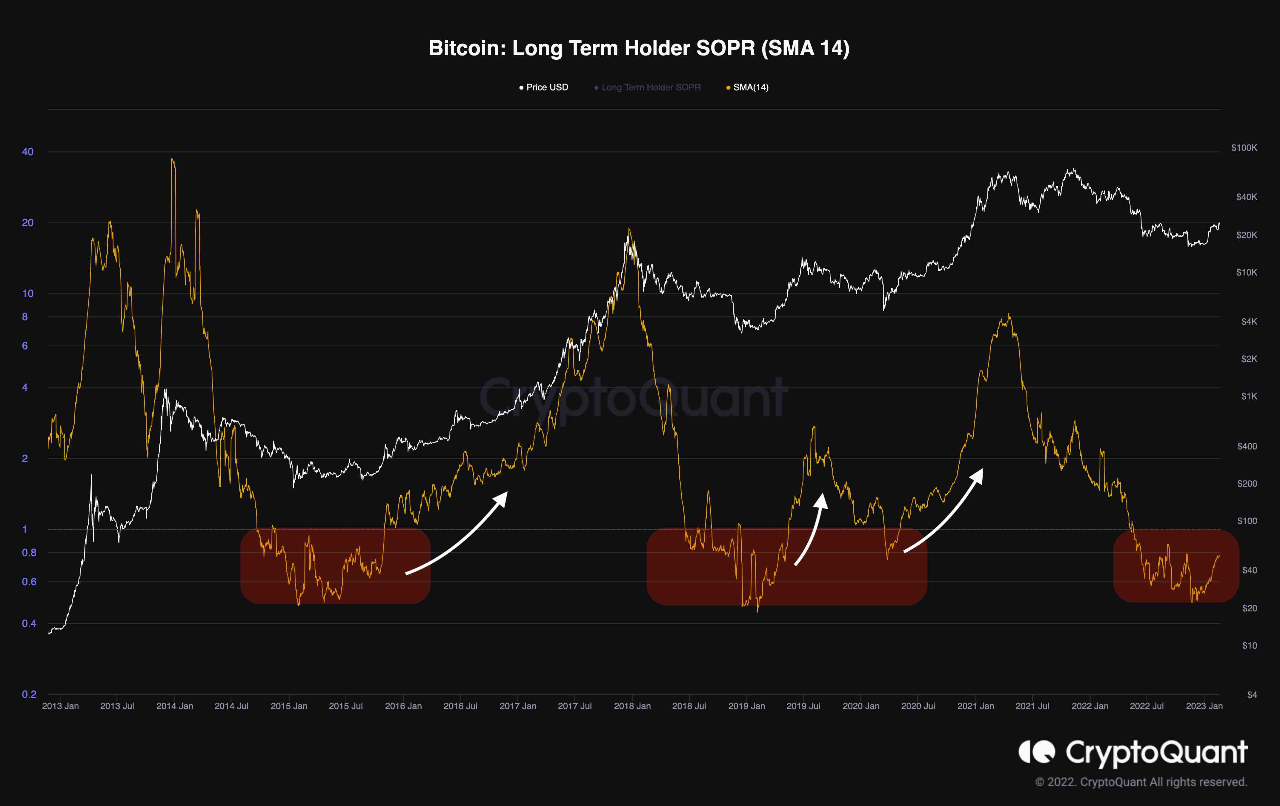

On-chain evaluation of the main coin’s efficiency revealed that the year-to-date (YTD) rally in Bitcoin’s [BTC] value has prompted its long-term spent Output Revenue Ratio (LTH SOPR) metric to develop.

In line with Glassnode Academy, the SOPR metric is used to grasp the general market sentiment and analyze profitability and losses incurred throughout a selected interval for a specific crypto asset.

As well as, the indicator tracks the quantity of revenue realized for all on-chain coin transactions.

Learn BTC’s Value Prediction 2023-2024

So far as BTC is anxious, the LTH SOPR gives insights into the psychology of long-term holders throughout a bear market. When the metric is beneath one, it means that long-term holders are realizing losses and might be motivated to promote.

Conversely, when the metric is above one, long-term holders are realizing earnings and could also be inspired to carry or accumulate extra BTC.

CryptoQuant pseudonymous analyst Greatest Trader famous that the bearishness that plagued the 2022 buying and selling 12 months resulted in vital losses for market individuals, together with long-term traders per the LTH SOPR.

In line with Biggest Dealer, the LTH SOPR had been trending beneath one since late Might 2022, indicating that long-term holders continuously misplaced cash.

Nonetheless, with the overall uptrend within the crypto market because the 12 months started, “the metric began recovering and barely elevated because of the uptrend in Bitcoin’s value,” Biggest Dealer discovered.

Whereas this is perhaps taken as conclusive proof {that a} bull market was underway, Biggest Dealer opined that:

“But, it’s nonetheless too early to call the $15.5K stage the bear market’s backside, because the latest impulsive rally may simply be a bull lure.”

The analyst warned additional that it was pertinent for merchants and traders to intently monitor the SOPR metric within the quick time period to anticipate potential value path and market sentiment.

Supply: CryptoQuant

Maintain your eyes on the miners

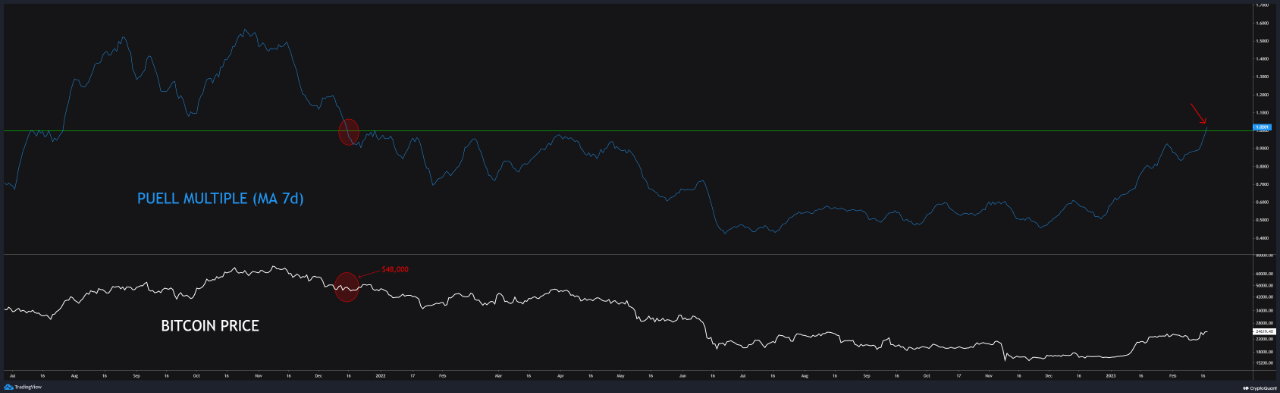

Mining exercise on the BTC community is considerably impacted by the king coin’s value and vice versa. In line with CryptoQuant analyst Gaah, miners are the one entity that requires an ongoing value, resembling operating electrical energy, so their behaviors are at all times tied to BTC’s value.

Subsequently, the examine of metrics resembling Puell A number of, which compares the estimated 365-day common income to miners’ short-term income, turns into essential for figuring out the long run path of BTC’s value because it gives insights into miner habits.

How a lot are 1,10,100 BTC value in the present day?

Gaah discovered that because the final native value fund in November 2022, the common miners’ income has doubled in comparison with the earlier 12 months.

This enhance in common income might cowl the mining prices, lowering the necessity for miners to promote their BTC and, in flip, lowering the promoting strain in the marketplace.

In line with Gaah, within the quick time period, Puell a number of values above 1.00 are important to measuring the doable future habits of miners.

If the common income continues to extend, miners might not have to promote their BTC to cowl their prices. Therefore, it stays a key metric to concentrate to.

Supply: CryptoQuant

![Bitcoin [BTC]: The two metrics that are crucial to your holdings this week](https://nomadabhitravel.com/wp-content/uploads/2023/02/izy4WvKoR_0dffc4d12b5ca3dbf6617983b370ea970bd7b3b3d1bb80a004bddacd3bccfaf0.webp-1024x645.webp)