- One other ATH of Bitcoin’s hashrate might result in BTC’s value fall.

- The king coin has not too long ago indifferent from the S&P 500 development.

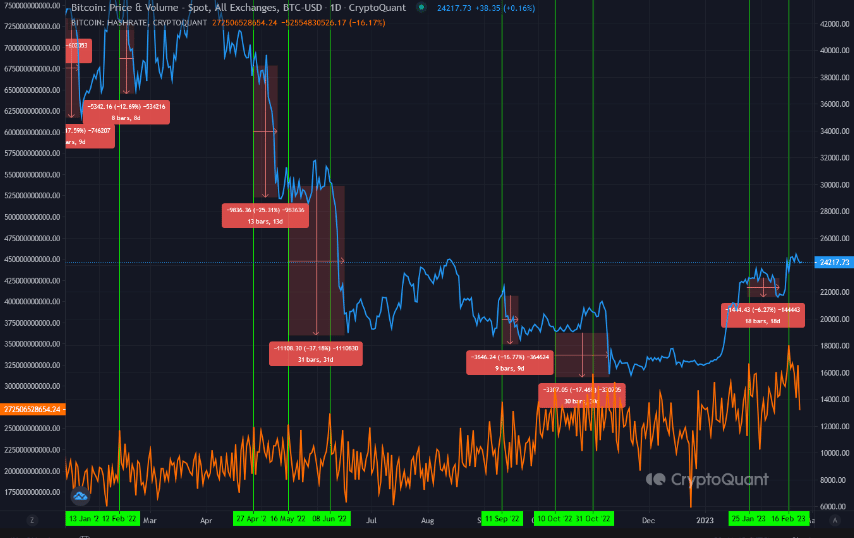

A big drop in Bitcoin’s [BTC] value may very well be imminent if the hashrate reaches one other All-Time Excessive (ATH), a CryptoQuant analyst revealed on 23 February. Analyst Gigisulivan, who can be a macroeconomic specialist, opined that the 16 February ATH solely gave a warning signal. Furthermore, a repeat of the prevalence might trigger a catastrophic final result for BTC.

Learn Bitcoin’s [BTC] Worth Prediction 2023-2024

Earlier happenings are proof

Bitcoin’s hashrate is the computational energy used to mine and course of BTC transactions on the Proof-of-Work (PoW) blockchain. On 26 January, Gigisulivan had put out a publication explaining the hashrate’s impact on the coin’s value.

He had initially defined that investor anticipation in direction of bullishness within the case of an hashrate ATH was a sham. Sustaining his stance, the analyst gave examples of events the place the metric hike resulted within the king coin’s worth decline.

Supply: CryptoQuant

As per the present state, Gigisulivan identified that BTC was in a important state for the reason that ATH recorded seven days in the past. The on-chain analyst talked about the state of the 200-weekly Transferring Common (MA), and Bitcoin’s correlation with the inventory market as the reason why a value fall might occur. He famous,

“New Hashrate ATH from sixteenth of Feb, comes at a important junction for Bitcoin, coming off 200 Weekly MA and its first weekly deathcross, with inventory market weakening this all provides as much as a bearish sentiment gaining power.”

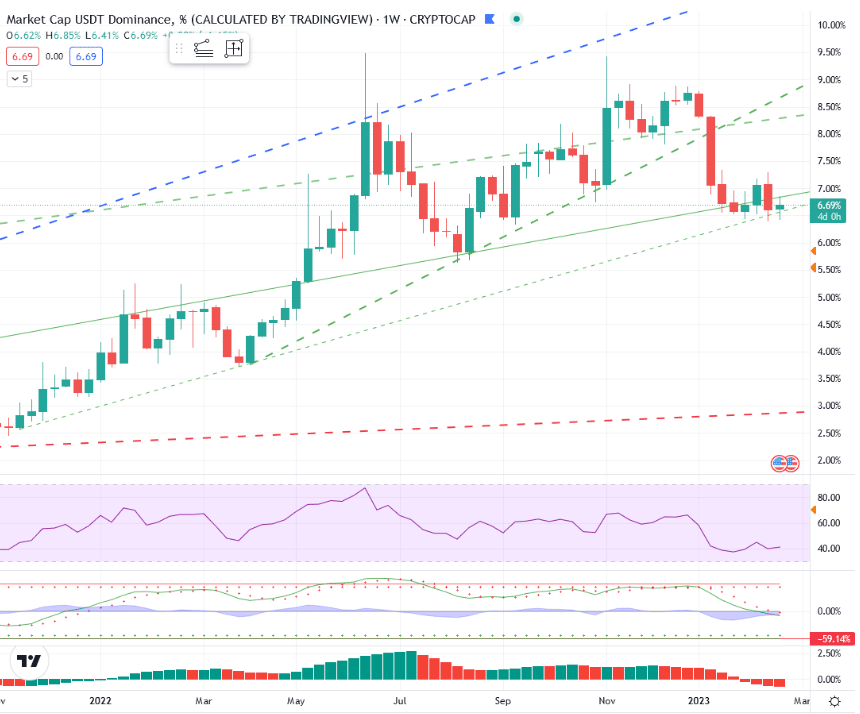

In addition to that, Tether’s [USDT] huge dominance over the previous few days made an extra case for bears. Recall that the proscription of Binance USD [BUSD] and USDC’s possible probe had propelled many traders to decide on USDT as their most well-liked stablecoin.

For Gigisulivan, this supremacy might drive BTC all the way down to $21,500. This was as a result of the coin appeared overvalued in comparison with the inventory market.

Supply: TradingView

BTC: Sliding away from the custom

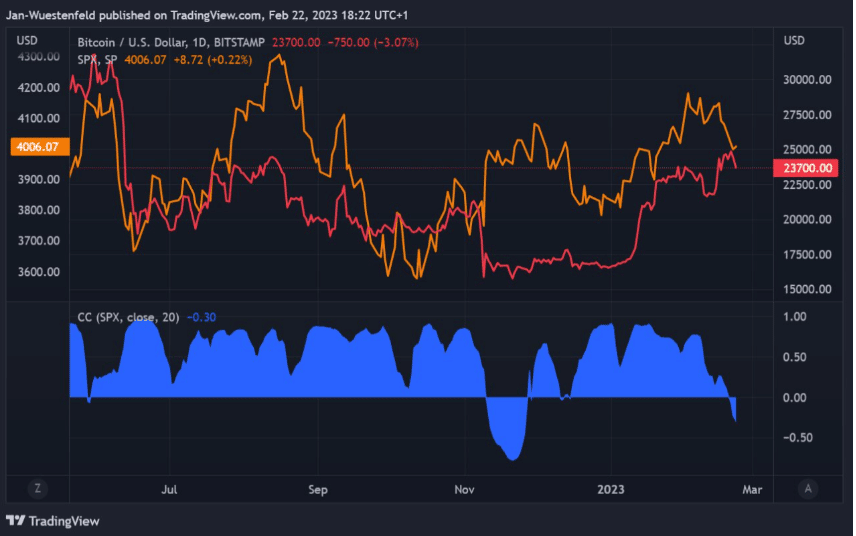

Bitcoin has typically correlated with the inventory market. However one other CryptoQuant publication by Quantum Economics analyst Jan Wüstenfeld opposed Gigisulivan’s perception. In keeping with Wüstenfeld, BTC had indifferent its correlation from the S&P 500 Index (SPX) over the past 20 days.

Apparently, the coin had additionally modified its response in direction of information, just like the FOMC final result. So, might it’s that Bitcoin was starting to solely reply to solely the crypto market actions?

How a lot are 1,10,100 BTCs value in the present day?

Properly, Wüstenfeld talked about that it was not the primary time such a factor had occurred, as there was an identical prevalence in the course of the FTX collapse. Whereas BTC had misplaced maintain of the $25,000 area, the SPX adopted an uptrend.

Supply: CryptoQuant

It was not sure how lengthy the conflicting state would final. Nevertheless, Wüstenfeld acknowledged that it might be attention-grabbing to see, as some elements of the crypto neighborhood have even yearned for the disconnect.

![Bitcoin [BTC]: Why a hashrate hike will favor the bears](https://nomadabhitravel.com/wp-content/uploads/2023/02/Screenshot-2023-02-23-at-07.44.25.png)