A high crypto analyst says that Bitcoin (BTC) will see yet one more main dip earlier than it has the possibility of coming into a brand new bull cycle.

In a brand new video replace, analyst Benjamin Cowen tells his 787,000 YouTube subscribers that the highest crypto asset by market cap is due for one more leg down earlier than the following bull market begins.

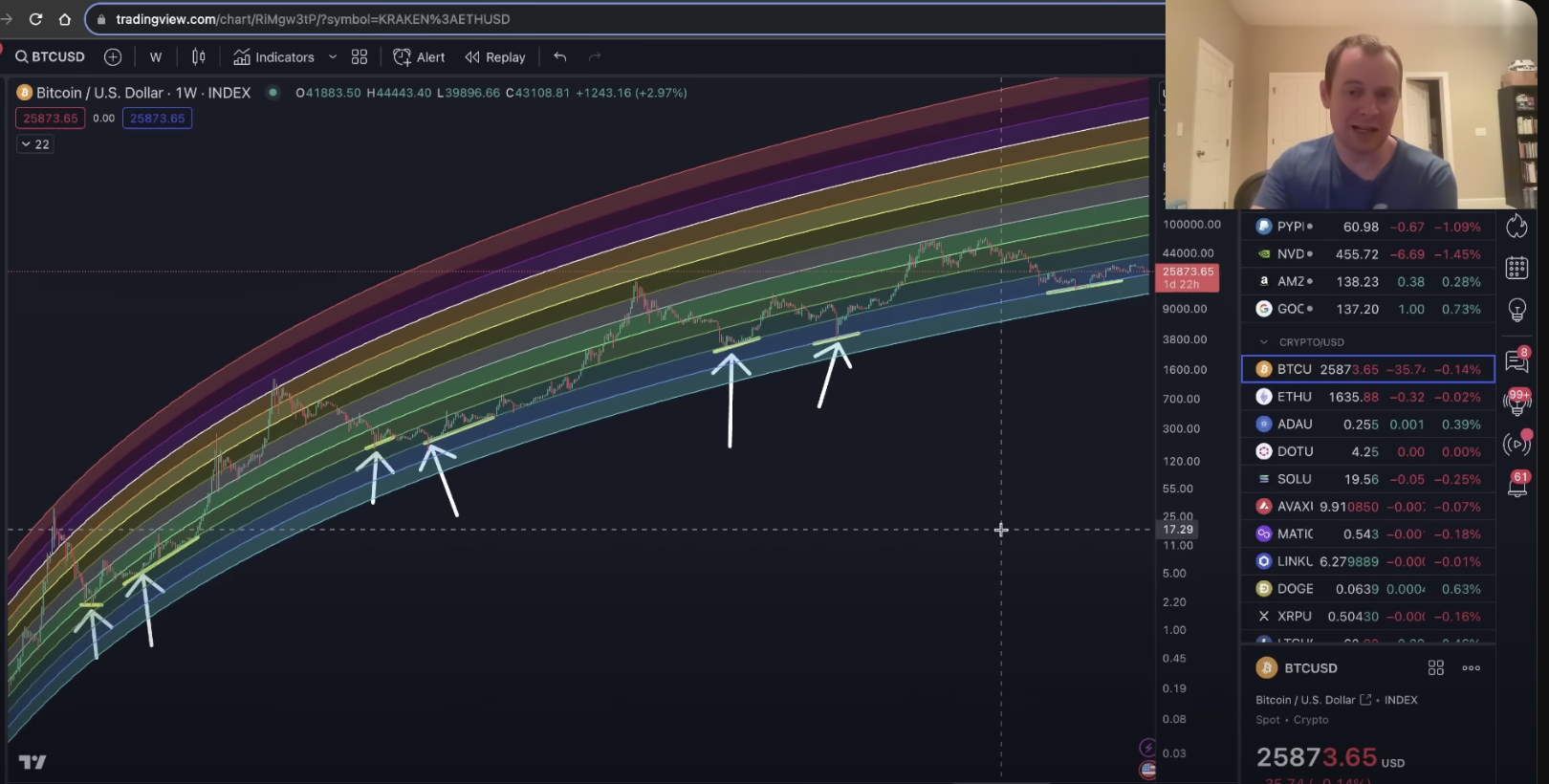

logarithmic progressions, Cowen says that relying on the timing, the dip might both type a double backside sample, a decrease low, or a better low.

“I think that earlier than we now have sufficient juice to get an actual bull market going and never one among these faux pathetic ones that everybody loses their thoughts over throughout the pre-halving yr, I feel that we’ll go to [the lowest] regression band.

I feel there’s a superb likelihood, and relying on when that happens would dictate whether or not it’s a decrease low, a double backside, or a better low. If you wish to say a double backside then that might imply occurring no later than February of 2024.

So if it happens by February 2024 or if it doesn’t happen till February 2024, then it might correspond to a double backside. If it happens earlier than, then it might correspond to a decrease low. If it happens after that then it might correspond to a better low. All of it is determined by when it occurs.”

Logarithmic bands observe try and forecast the worth of an asset over time by rooting themselves in earlier highs or lows. with totally different coloured bands representing every value vary. In response to Cowen, throughout each bear market, BTC’s value tends to backside out one band decrease than the earlier cycle.

“Logarithmic development assumes that extra exponential good points happen earlier in that asset’s historical past. The sooner the asset is, the extra seemingly it could possibly expertise these exponential good points. The additional you get out, it’s more durable and more durable to maneuver the worth as a result of the market cap is a lot higher.

So you might have a low, which is kind of set at one regression band, after which you might have a better low, however [on] a decrease regression band. Now preserve that in thoughts since you’re going to see this sample emerge each single time.”

Bitcoin is buying and selling for $25,868 at time of writing, a fractional enhance over the last 24 hours.

I

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet online affiliate marketing.

Featured Picture: Shutterstock/Nsit/NextMarsMedia